Trending Assets

Top investors this month

Trending Assets

Top investors this month

Starbucks Announce Dividend $0.49 per share

Starbucks $SBUX announce a dividend per share of $0.49, payable on May 27th, for those owning the stock from May 13th.

I suspect that the quarter after this coming quarter will be a dividend increase from $SBUX as they tend to do it once every 4-quarters.

I have recently been buying up a lot of $SBUX in the $80 to $90 range, almost tripling the position size. So this dividend is going to be good!

Some context from an older Commonstock post:

"Starbucks (SBUX): The company is undergoing some tension from a recent unionisation effort. After the successful unionisation of two NY stores in December (and a third store in Memphis more recently), and the dismissal of 7 Memphis employees (for organising), this sparked a nationwide outcry, followed by over 110 stores now signing up with the intent to follow the same course of action as Buffalo. Starbucks' Q1 earnings showed that demand was strong, but that near-term margins are suffering at the hands of inflationary pressure, increased training costs, and good old supply chain disruption.

Unionisation only looks set to further dampen EBIT margins in the future but was not discussed during the call. However, management has committed to reinvestment in China, and the payment of dividends. Whilst the union possesses a threat to the LT margins of the business, and general partner morale, I do not believe it takes away from the company's status as an attractive dividend growth prospect, with attractive reinvestment capabilities to further grow their operations. At a dividend yield of 2.05%, and a rich history of dividend increases, I see this as an attractive prospect.

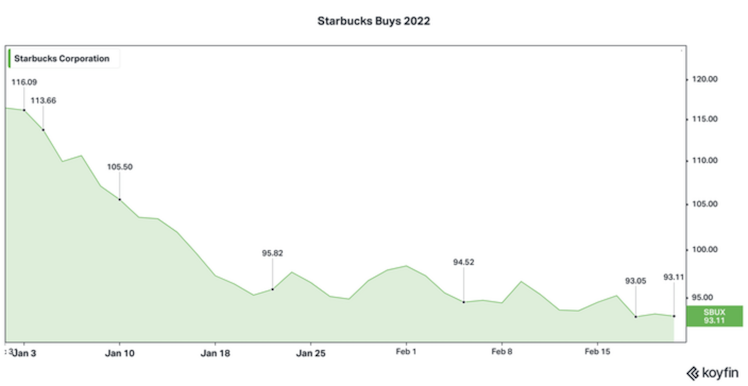

I have been pretty active buying up $SBUX stock this year. So far, I have bought shares on seven separate days in 2022 for an average price of $100 per share. I believe that the stock now trades at a fair valuation at around 17x 2023 EBIT, with a bountiful amount of share repurchases scheduled for the next three years, and plenty of FCF to increase dividends.

Although near-term margins look to be suffering (primarily as a result of the inflationary environment) and the China business is still lagging behind (the result of covid mobility restrictions), I think this company is priced at a reasonable valuation and is a great fixture in a DGI portfolio. I plan to continue buying in the $80-$90 range all year round."

I have since bought more at $85.28, $81.55, and $87.65 per share in March.

Already have an account?