Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Unfolding Story of Teako Minerals

Updated version as of January 31st, 2024:

On January 18th, 2024, Teako announced that following a recent Norwegian parliament meeting and the various developments in mineral exploration in Fennoscandia in recent years, the Company has decided to pause exploration efforts in British Columbia, to primarily concentrate on Norway, while also maintaining a minor focus on Finland. The majority of the Company’s projects in British Columbia are in good standing for 2-3 years, allowing the Company the strategic flexibility to explore various alternatives, including the potential of partnering with other parties or selling the projects, as part of its ongoing commitment to maximizing shareholder value. Investors will be regularly informed of developments, ensuring transparency and continuous engagement with our valued stakeholders.

Following this decision, I felt it was best to step down from my role as an Advisor with Teako, as my knowledge base relates to the Americas rather than the Nordic countries, and I no longer felt I could effectively serve the company. I wish them all the best as they continue to move forward with their exciting plans for growth in Finland & Norway.

My previous post on Teako's story:

As a Director at Teako, it’s been a tough decision as to whether I should write anything about the company here on CommonStock. Of course I am a fan of the story, or I would not have accepted a position with them, but writing about them could appear to be an act of “promotion” and though marketing is necessary for every company, every junior mining investor knows the downside that comes with that, should a company choose the wrong channel. However, over the past month my Twitter DM’s have been full of questions about the company given what Teako has proposed since its inception – to be a disrupter and do things differently, hopefully setting an example for the sector on many fronts. In an effort to keep those promises, particularly those related to transparency and communication, I will stick to facts in this article and refrain from using any platitudes or promotional jargon. I am solely aiming to answer questions that have been posed to me and if you have any that you would like addressed in addition to this, Teako’s CEO, Sven Gollan, and I would be more than happy to answer them.

A special thank you to our incredibly talented IR Manager, Mark Steeltoft (@mk1invest on Twitter). It pays to hire a hard-working Millennial who knows his way around the latest tech. Mark has made our website & presentation look so amazing that someone recently asked if we are a graphic design company – I’m assuming there was a touch of sarcasm there (?) but yes – Mark is just that good!

As relevant material is released over the coming weeks, Mark will continue to update and improve our website and he is planning to include videos, articles, and other items of interest for our shareholders and interested parties.

I would be remiss if I didn’t mention this gentleman as well - someone everyone would want on their team, not only for the positive vibes and good humour that he brings, but the breathtaking graphics he creates. Have a look at his Twitter banner & profile picture (@jamesiebabie1) and you will see what I mean, I am often awestruck by his talent:

Link to the latest $TMIN.CN Corporate Presentation:

How it all started:

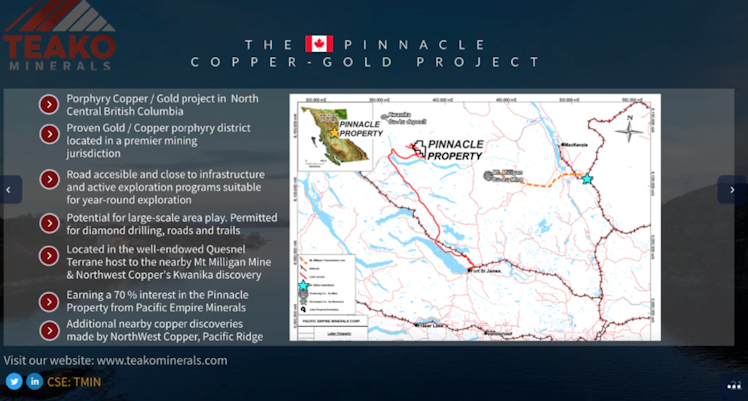

Teako’s story began on August 18, 2021 with the CSE listing of 1111 Exploration Corp., a junior exploration company focused on creating shareholder value through acquisition, exploration and development of mineral projects.

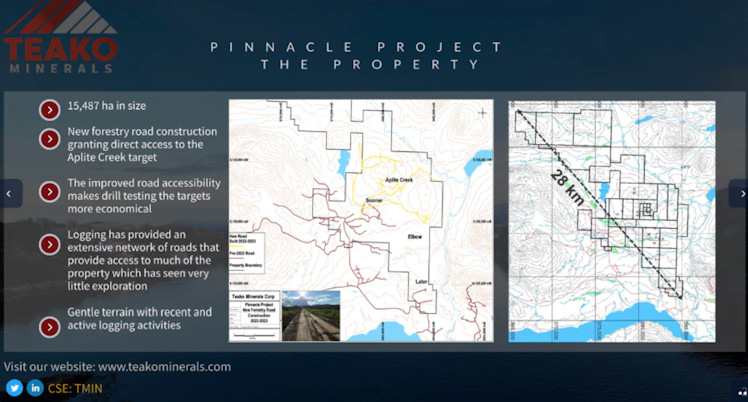

Four days later, “Eleven” announced they were initiating a field program on their

15,487-hectare copper & gold project, Pinnacle, in central BC.

“Eleven is earning a 70% interest in the Pinnacle Project from Pacific Empire Minerals Corp. (“PEMC”). Under the terms of the Agreement, Eleven can earn a 70% interest by completing $5,700,000 in exploration expenditures on the Project, paying PEMC an aggregate of $375,000 in cash payments and issuing 3,500,000 common shares to PEMC by the fourth anniversary of the agreement. Following the exercise of the Option, PEMC will retain a 30% free-carried interest in the Project up until the date that Eleven publishes a NI 43-101 compliant Pre-Feasibility Study ("PFS") on the Project. Following completion of the PFS, PEMC and Eleven will form a joint venture with Eleven holding a 70% initial interest and PEMC holding a 30% initial interest.”

At this point in our story, I would like to introduce some of the Teako team members beyond Mark, Owen, and myself - those who were present in the earliest days of the company:

On April 25, 2023, Michael Sweatman resigned from Teako’s board to pursue other interests. My appointment to the board and his resignation shared the same press release:

https://teakominerals.com/wp-content/uploads/TMIN-NR-2023.04.25-Teako-Finland-and-Board-Change.pdf

On March 10, 2022, Eleven announced it had identified drill targets at the Pinnacle project and that fall, Eleven amended the option terms for the project and planned their upcoming field program.

This 2021 sampling, combined with previous soil sampling, induced polarization surveys and the current magnetic survey, identified a northwesterly trending area of elevated copper and gold soil geochemistry coincident with magnetic highs and high chargeability over an area of four (4) km by 1.2 km. The geology comprises dykes and stocks of syenite and monzonite within andesite volcanics. Alteration is dominantly widespread propylitic with localized potassic alteration near and within intrusive rocks. This large area has seen only minor drilling in 1974 and 1990. A second parallel zone to the northeast, of similar scale, is yet to be fully delineated.

_

The Company is currently planning a follow-up sampling program to expand the target outlined in 2021. This work will include additional soil sampling and expansion of the

magnetic survey both northwest and southeast of the core Aplite Creek area. This work

will be greatly aided by a newly constructed logging access road completed in the

winter of 2022._

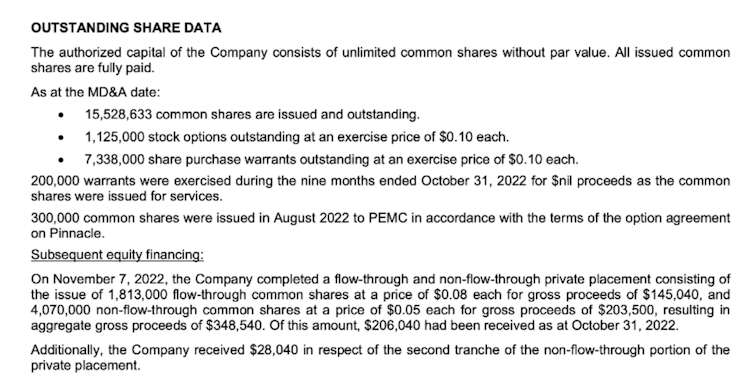

A snapshot from the October 31, 2022 MD&A release to give you an idea where the

company sat at that point:

http://teakominerals.com/wp-content/uploads/NR-2022-11-09_ELVN_ Close_PPranche .pdf

After closing its first tranche of financing on November 9, 2022, Teako welcomed Jerker Tuominen as an Independent Director a few weeks later and followed shortly with a second and final tranche of financing.

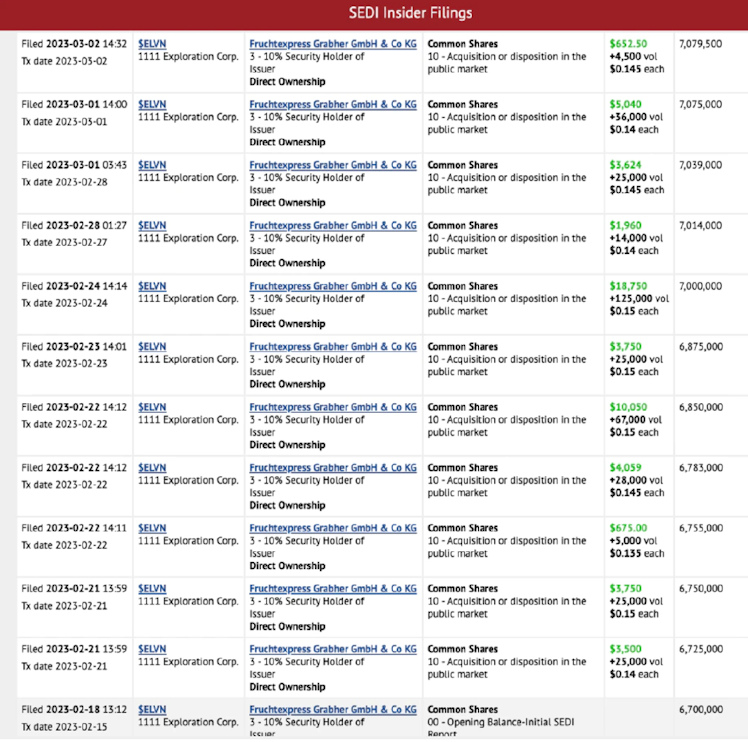

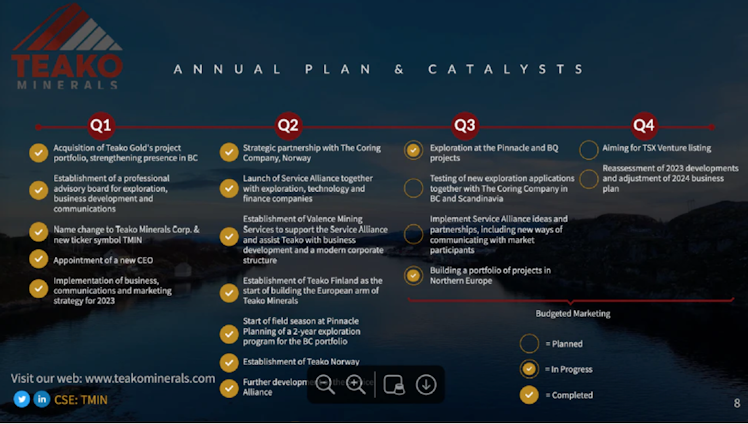

Some might say that Teako’s story really began in February of this year when the name change from “1111 Exploration Corp.” to “Teako Minerals Corp.” was announced but as I have shown above, several team members had been laying some important groundwork prior to that. In addition to our name change (completed March 1st and officially trading under $TMIN.CN on March 3, 2023 https://teakominerals.com/wpcontent/uploads/2023-03-01-NR.pdf), the company concluded agreements to acquire our BQ and Teako Copper-Gold Projects and a key insider entered the scene.

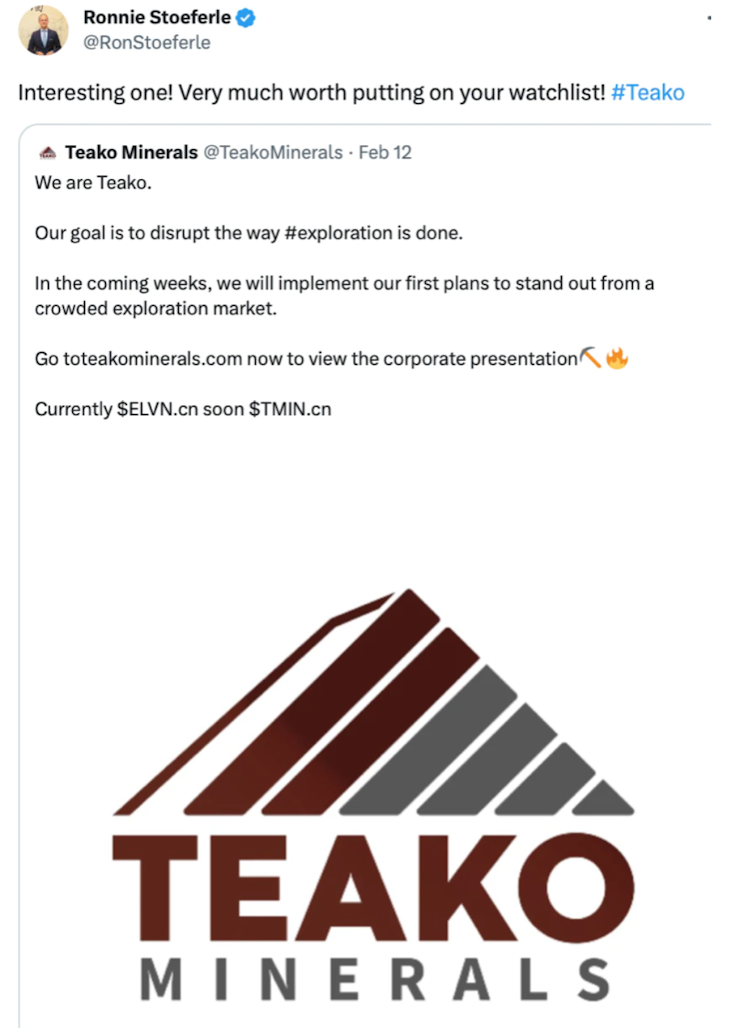

Was this “key insider” the successful Austrian fund manager, Ronnie Stoeferle?

No, not Mr. Stoeferle - and though I hadn’t officially met this insider yet it, it was certainly someone that I was familiar with…

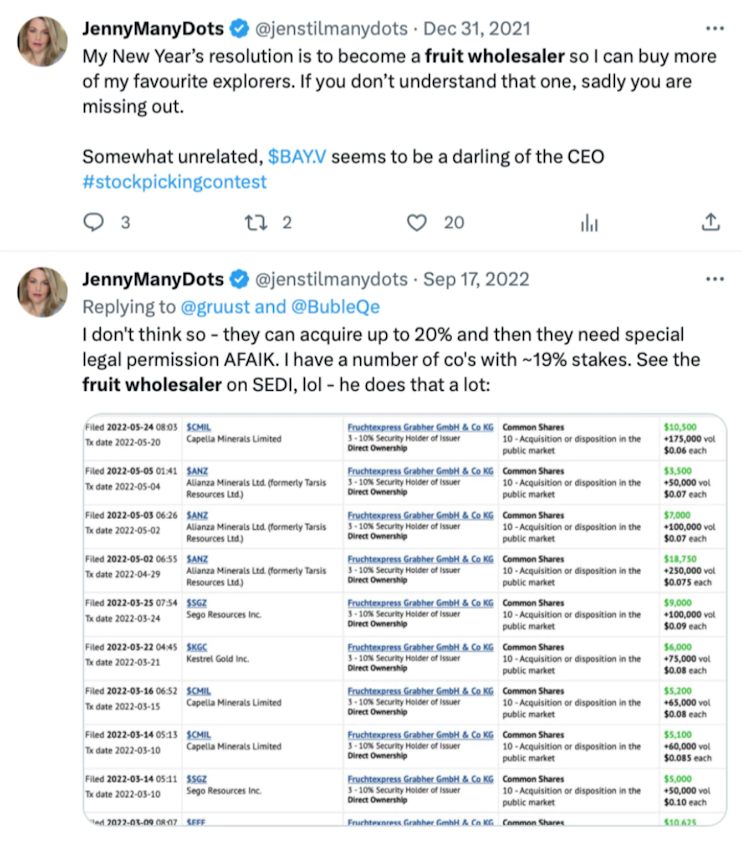

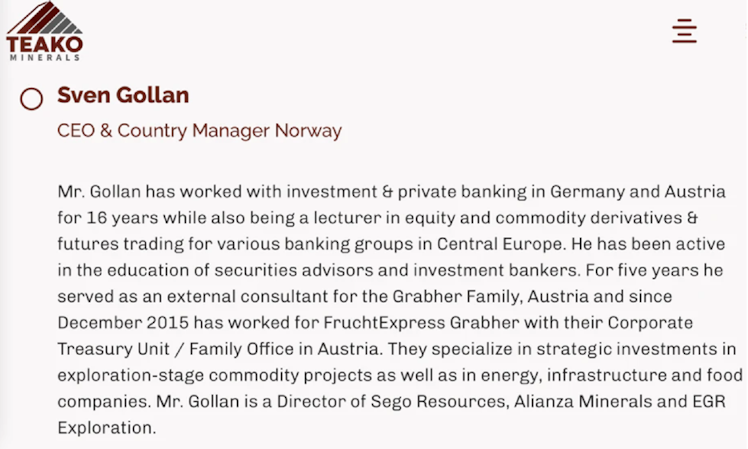

Some may question why the involvement of an Austrian fruit wholesale company (FruchtExpress) and their external consultant, Sven Gollan, would be a key piece in the

developing story of a junior exploration company with gold and copper properties in

British Columbia, but that’s actually one of the questions I received that compelled me

to write this piece.

Allow me to introduce our CEO, Sven (@kilpisjaervi on Twitter):

_Sven Gollan, CEO commented, “When the “Teako” concept was launched over a year

ago, we wanted to create an exploration company with a modern, effective business

structure that would allow a team of geologists to focus exclusively on field work and

making a discovery. I want Teako Minerals to work with similar goal driven exploration companies to create synergies in a wide variety of fields to jointly implement proven strategies as well as new disruptive ideas. I look forward to being part of this journey, announcing future partnerships, and building shareholder value.”_

Sven-Gollan-as-CEO.pdf

(Owen's incredible artistry evident once again in Sven's Twitter bio)

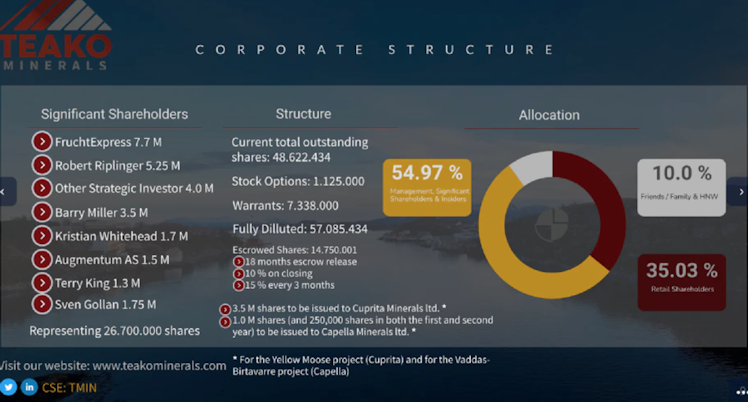

In the short time I have had the privilege of working with Sven, it’s become apparent that he was likely an instrumental part of Fruchtexpress’s phenomenal success story. The man runs full steam ahead, industrious and determined to achieve his goals and create something special – and most definitely not on a small scale. Both FruchtExpress & Sven are significant shareholders of the company and we intend to maintain a tight share structure that benefits all shareholders.

A link to FruchtExpress’ website if you wish to read about their story, which began as a family business in 1932. The company also invests in exploration, energy, infrastructure, and other food businesses, with exploration being a key interest:

When I first spoke with Sven about joining the Teako team, he made it clear that he wanted the people he hired to be the company’s greatest asset – because a team that enjoys working together is more motivated to contribute to a company’s success and if shareholders can’t trust the people involved, then the projects are worthless.

From the FruchtExpress website:

_

More than 100 employees continue to work together every day on the FruchtExpress

success story… This is our greatest asset. The basis of human encounter can be replaced by nothing! That is why, despite technical aids and state-of-the-art technology, there is enough space in our company for creativity of contacts, trust generating conversation and direct communication. This is appreciated by producers, employees, and customers alike._

Headquartered in Austria, FruchtExpress now serves customers in several countries across Europe. In 2018, they became a shareholder in “Service-Bund”, an association of medium-sized food wholesalers. Their success and impressive growth can be strongly attributed to their implementation of strategic supply chain management & supplier development, and through Service-Bund, they were able to offer customers significantly more.

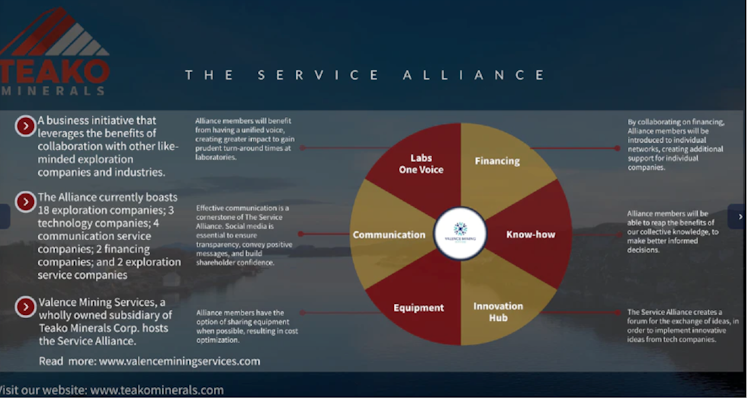

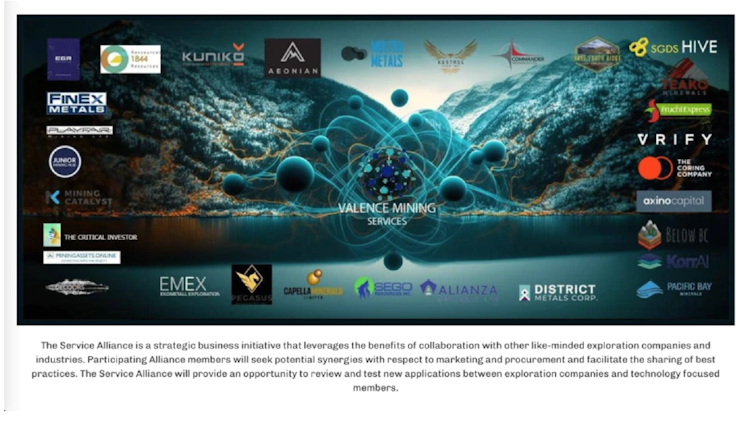

Enter Teako’s Service Alliance, launched on May 1st and a strategic concept that I frequently receive questions about:

Confession: restraining myself from uttering something here about great things not being built overnight. As much as Sven is putting puzzle pieces together at rocket speed, inquiring minds don’t view it as fast enough to paint an entire picture yet.

One question posed to me was “Why build a company first, rather than having a project?”

I discussed this inquiry with Sven, and we both agreed the answer was “Why not both?” Teako does indeed have projects as I’ve outlined above, and we are continuing to add to our portfolio.

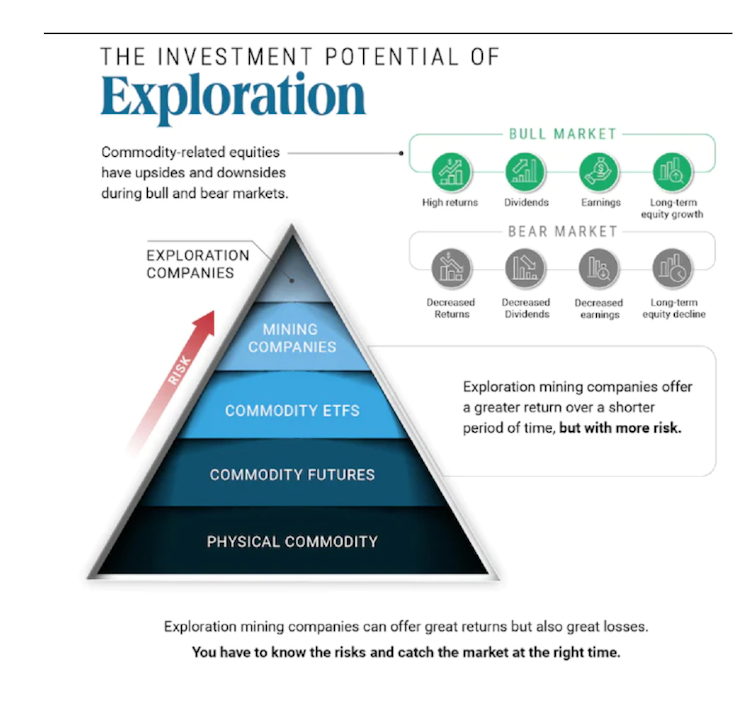

By building a corporate structure alongside initial project development of our BQ and Pinnacle properties (plus our recent acquisitions of Yellow Moose in BC & two projects from Capella Minerals in Norway), Teako has the ability to acquire additional prospective properties in the current market, considered to be rather poor…AKA cheap! Teako intends to grow into its corporate structure and by putting certain pieces in place now, it will allow us to be a ‘fast mover’ when market conditions improve.

We have also had inquiries about choosing to operate in a number of jurisdictions and a focus on both precious and battery metals. Those that have followed me on Twitter & CommonStock are likely familiar with the bull cases I have laid out for the metals sector, particularly for gold and copper. I have also discussed the advantages of having a diversified portfolio and we feel Teako is no different. As Yellow Moose is our most advanced project at present, gold will be our primary metal in BC, while copper, cobalt, and other base metals in Norway & Finland offer tremendous potential in long forgotten brownfield projects, as well as some of the last real greenfield project areas in Europe, a true ‘Wild North’ that is primed for a ‘real’ discovery. In Finland, we are motivated by the great success of AEM and Rupert, and our geos offer special insight into the Nordic’s metal deposits, where gold is often discovered along with copper and

other metals. Based on our extensive network in all target areas, we feel we have a strong basis to expand our business there. History shows the areas we are operating in are considered “safe jurisdictions”, but a key item of note is that our global operations will offer year-round opportunities to have “boots on the ground”, avoiding what is often a seasonal dip in news flow when operating in a single geographical location. With resident country managers appointed for Canada (British Columbia), Norway, and Finland, we are able to avoid language barriers and establish important relationships with local stakeholders, contractors, communities, and government.

https://teakominerals.com/wp-content/uploads/TMIN-NR-2023.04.25-Teako-Finland-and-Board-Change.pdf

On April 25, 2023, Teako announced my appointment as a Director and the establishment of both Teako Finland and Valence Mining Services Ltd (VMS). Valence is a wholly owned subsidiary of Teako Minerals Corp. and will serve to host our growing Service Alliance. By creating a separate entity, Valence can focus on managing and developing the Alliance, allowing Teako to focus on what it does best – exploration.

The Service Alliance Concept:

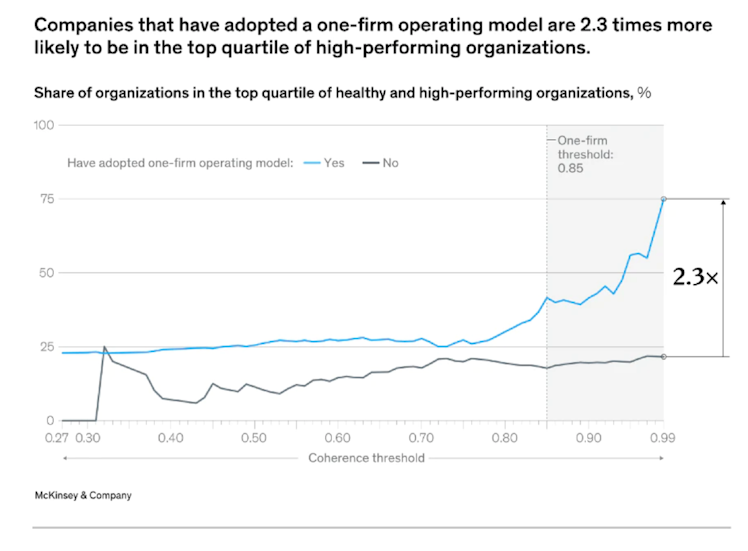

I attempted above to illustrate some parallels between FruchtExpress’ successful corporate model and that of Teako’s growing Service Alliance. We feel it’s well explained in the slide above from our presentation, but perhaps another helpful tool that demonstrates the value behind the Alliance can be found in this McKinsey article which I sent to my Teako teammates after I read it in May:

capturing-the-value-of-one-firm

The value of working together is intuitive to most leaders. Capturing the full value of

operating as one firm, however, is elusive for most. Those who drive integration and standardization from the top down often stifle business-level innovation, entrepreneurship, and client responsiveness, which can further create talent attraction and retention issues. Those who emphasize local autonomy, however, often create massive inefficiencies, competing priorities, and inconsistent client service. This often leaves organizations both competitively vulnerable and held hostage to rainmakers, as the client relationship is largely owned individually rather than institutionally.

The leaders of most large, global firms have endeavored to achieve the best of both worlds through the creation of a matrixed organization.

“The idea is to capture economies of scale, scope, and skill while creating strong accountability.”

- Step one in creating a one-firm value agenda is to ground it in a bigger mission and purpose (at Microsoft, for example, it is about empowering every person and every organization on the planet to achieve more).

- Step two is to articulate practically how operating as one firm creates value specific to the organization.

- Step three, then, is to articulate a set of strategic initiatives that will enable that value to be captured.

As the McKinsey article clearly shows, there are many advantages gained by working

collaboratively with others and operating under a “one-firm mindset”.

Sven’s original vision for Teako goes beyond that of building just another junior exploration company. Our desire is to create a successful business, built not only on the strength of the Teako team but through a shared effort with like-minded partners.

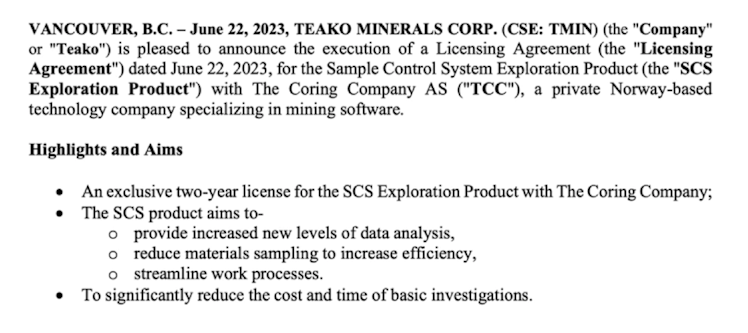

I’m sure you’d like me to offer specific details on how exactly Teako and Alliance partners will benefit, beyond hopes and dreams. Developments currently underway will emerge in the coming months and will be explained in official press releases. For now, I believe an excellent example that is publicly available information would be to look at our strategic partnership & licencing agreement with The Coring Company:

Frida Vonstad, CEO of The Coring Company comments, “The mining industry is an important factor in the world’s green transition. We believe our collaboration with Teako, can make a difference. Through combining The Coring Company’s knowledge of technology with Teako’s industry knowledge and network - the full potential of our innovative solutions can be reached. It is crucial that the mining industry and innovative companies work together to create viable solutions that increase efficiency as well as reduce the environmental footprint”.

Sven Gollan, CEO of Teako Minerals states, “By leveraging these proprietary tools, we believe we are at the beginning of a new era of exploration, one where newly developed and partly AI-assisted tools will enhance nearly every area of the discovery process. Our team feels privileged to partner with The Coring Company, whose visionary ground-breaking research, AI and robotics will assist in elevating the value of each property within our portfolio. The strategic partnership with The Coring Company aligns with Teako’s vision of incorporating best in class ideas from different sectors to pioneer new and innovative approaches to exploration, with the aim of disrupting the way exploration is done.”

One of my favourite terms in the partnership that seemed to be overlooked:

TCC will apply to Innovation Norway, a government funded entity, for each exploration testing site where up to 50% of exploration costs will be funded by the Norwegian government. TCC will be responsible for 30% and Teako responsible for 20% of the costs.

The License Agreement permits Teako to use the SCS Exploration Product internally and also to resell or refer sales of the SCS Exploration Product within the Teako group of companies, through its wholly owned subsidiary Valence Mining Services Ltd. and its alliance members, and to other entities outside the Teako group of companies.

One very important question posed to me via Twitter was “Why is Teako staking properties in BC & Norway with not enough cash to drill?”

On July 6, 2023, we announced a non-brokered private placement of up to $1,720,000 consisting of the issuance ‘of up to 12,000,000 units (each, a “Non-FT Unit”) at a price

of $0.10 per Non-FT Unit, for gross proceeds of up to $1,200,000, and up to 4,000,000

flow-through shares (each, a “FT Share”) at a price of $0.13 per FT Share, for gross

proceeds of up to $520,000.’

Investors in the junior exploration are well aware that it’s been a tough environment to raise, and in all honesty, it’s been no different for us. Financings in the sector are at a 7-year low. We feel that we have acquired high-quality projects and continue to build our portfolio in a very weak market with the possibility to do all-share deals with just minor work commitments. It’s been frustrating to have sentiment trump facts, as Teako is motivated and able to complete deals. We will continue to grow our portfolio with some of the incredible opportunities currently available to us.

“The number of major company investments in early-stage exploration through project earn-ins and purchases, and junior company acquisitions and financings fell to a seven-year low in 2022.”

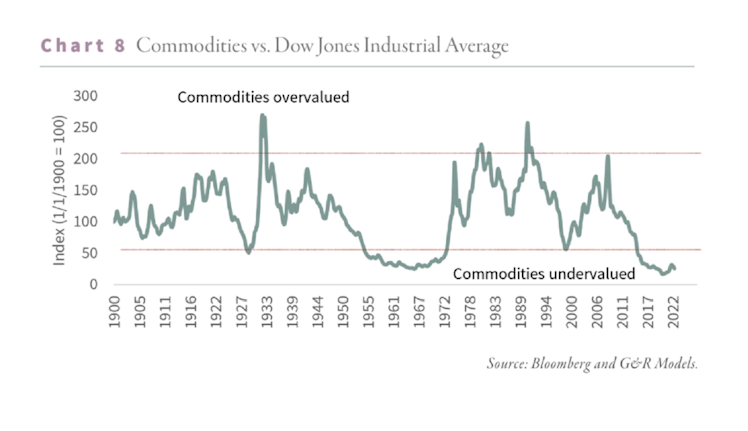

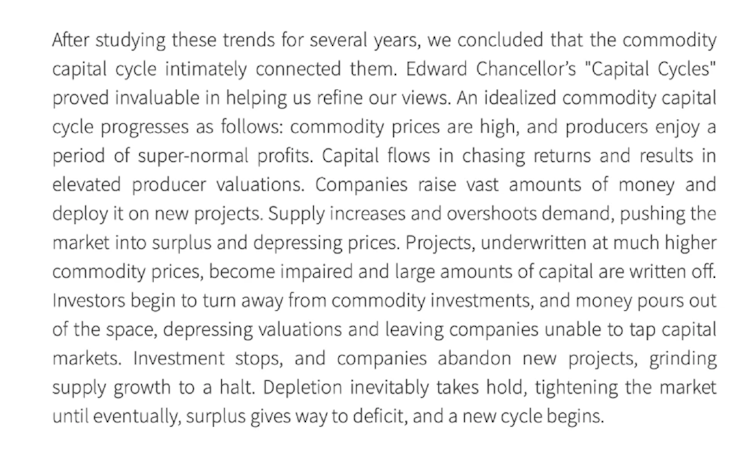

However, with commodities radically undervalued and an anticipated super-cycle, we feel we are in attractive position for those looking to invest at the bottom of a cycle. We are currently in talks with a number of investors and it appears promising that we will close our financing in the near future and be able to move forward with our drill program.

Our team is one that strives to keep their word. We are doing our best to achieve our objectives in a timely manner, barring any unforeseen circumstances such as the current forest fires in BC.

We encourage you to keep apprised of our goals and accomplishments updated regularly on our website:

Lastly, to address the concern expressed to me that Teako chose to hire a “social media personality” (me) - as much as I admire the Kardashians’ savvy in that regard, my background is a little more commodity-focused than if Sven had chosen to hire Kim. I’ve worked hard to grow my follower count and I try my best to provide users on Twitter & CommonStock with quality content and an honest & transparent take.

I feel as though I have written a novel at this point and yet I could still add several more details, such as:

- the addition of Director, Philip Gunst, who ‘brings a wealth of experience and expertise to Teako as a seasoned management consultant and investor in the mining sector’

- our acquired Interest in Norwegian Vaddas and Birtavarre Projects from Capella Minerals, allowing all-year round operations and a 100% interest in the Yellow Moose project in British Columbia

- an important update on the forest fire situation and the completion of our initial program at BQ: https://teakominerals.com/wp-content/uploads/TMIN-NR-2023.07.10-Pinaccle-Update-and-BQ.pdf

I hope you will monitor our website for developments as they are occurring frequently and I sincerely hope that I have cleared up some of the “mystery” that seems to have surrounded Teako. I can assure you, the Teako team is somewhat bewildered by this sentiment, as we feel we have laid out our plan as clearly as possible and will continue to do so.

Any member of our team is open to answering your questions and I can unequivocally state that we actually welcome them. We have a growth story that we are eager to share, so please don’t hesitate to contact any of us, anytime!

Special Disclosure:

I am a Director at Teako Minerals Corp., a publicly traded company, and I also own

stocks in other publicly traded companies. I trade occasionally, and don't always hold

for the long term. Please note that I may own stock in the companies I write about, but

I am not paid by any of these companies. I make an effort to increase transparency for

my followers by writing about my holdings on CommonStock & Twitter, however the

degree of coverage is not meant to be standardized across my holdings and therefore

cannot be considered comprehensive. Please note that this is not intended to be

financial advice and I encourage you to do your own research before making any

investment decisions. By reading my posts, you acknowledge and agree that any

actions you take based on my posts are your own responsibility and that I am not liable

for any losses or damages you may incur. If you have any questions or concerns, please

do not hesitate to reach out to me.

blog.gorozen.com

The US Reserve Currency & Commodities

The move away from the dollar has begun, potentially signaling the end of its status as the global reserve currency. In this blog, G&R discusses the U.S. reserve currency and commodities.

Already have an account?