Trending Assets

Top investors this month

Trending Assets

Top investors this month

$RH: Restoration Hardware Too Good to Pass Up Right Now

Foreword: This long thesis of mine was written back in January but the underlying reasons are still very much the same, if not more attractive now. You'll see two minorly changed details in reality compared to this thesis (# of rate hikes and trading multiples.

Summary

- Despite the company consistently exceeding consensus estimates over the last two years, the stock has drastically receded from its mid-$700s high last year to sub $450 this week

- The company’s stock is attractive given its currently trading at a P/E multiple less than it has historically

- RH has been able to navigate inflationary and supply chain worries over the last year is shown in their financial performance

- Any shares under $400 are quite the steal and should not be ignored for the long-term investor

Who is RH?

RH (RH), formerly known as Restoration Hardware, is a luxury home furnishings retailer. They sell things like furniture, lighting, textiles, bath-ware, décor, and outdoor and garden furnishings. They sell their goods in their various retail locations (design galleries, like the one shown below), online, and through their catalog.

While they are a luxury retailer, what exactly does luxury mean? Well, a leather couch can push upwards of $16,000 if that paints you a picture. If it’s not evident yet, they clearly cater to a wealthier type of clientele that can afford couches of that price tag.

But RH is different than many home furnishings companies in that it is incredibly simplistic in how it runs its business model. It does not sell any seasonal products, does not derive its inventory based on fashion trends, nor does it position itself as a mass-market brand.

Things that many brick and mortar retailers try to get in early on and ride the wave as long as they can, which if you think about it can leave them with some serious inventory surplus risk.

Reiterating LONG Thesis

=======================

1) Beat. Beat. And Beat Again.

Not sure why investors bet against this company but I firmly believe that those who do truly do not understand it and have never actually walked into one. If you haven’t yet, you should because they are insanely nice.

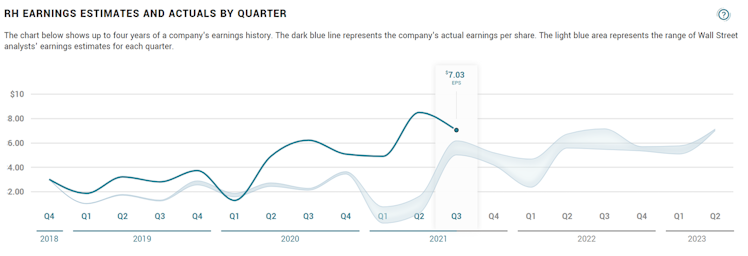

Regardless of how I feel about the naysayers, RH has consistently beat Wall Street estimates time and time again. In fact, the company has beat estimates on both the top and bottom lines (revenue and EPS) almost every quarter dating back to Q1’19 except for one. That’s 10 out of the last 11 quarters! And curious to know which quarter they missed? Well, it happened to be the quarter ending March 30th, 2020, and it was a ~$40 million miss on revenue. Hmm, wonder why that was?

Source: Market Beat.

To add more weight to this point, over the last eight years, the company has grown non-GAAP EPS at a 21.3% CAGR. Impressive!

This continued financial performance fits in well with what I mentioned previously, which is the company being recession-proof(ish). Even at the height of the pandemic, consumers were still spending their money lavishly and RH happened to be a strong beneficiary of the bountiful surplus in American wallets.

If you’re looking for a company that not only a) has earnings, but also b) a strong track record of proving investors wrong, I’d say RH is a top contender.

2) Trading under its historical P/E

Another point that I want to highlight is its valuation. The good thing for RH is that they have earnings so there will be none of this P/S valuation methodology BS taking place for this company. No sir. We’re working with solid earnings and can look at P/E ratios in order to help us determine how it’s being benchmarked.

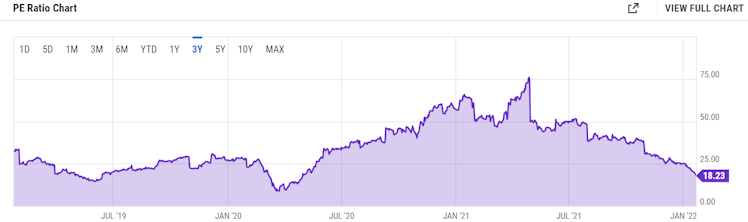

Source: Y-charts.

Looking at the chart above, as of the close on January 21st, 2022, RH was trading at a P/E ratio of 18.2x. So let’s put what this means into context. 18.2x for a P/E ratio isn’t all that bad when you consider the company’s median TTM P/E ratio over the last three years of ~25x. This three-year time frame consists of a FED funds rate that was over 2% for half of 2019 and ~1.5% for the second half of the same year before plummeting to near zero during the pandemic.

I’m briefly highlighting the company in a much higher rate environment but I’ll dive into that more soon.

What’s also key to note is that even though the company’s current TTM P/E is lagging its historical median, it’s still well under the Consumer Discretionary Select Sector SPDR Fund (XLY) and the overall S&P 500 Index of 36.6x and 27.2x, respectively.

But Paul, this is all backward-looking, the market is forward-looking. Yes, I know but I still wanted to highlight this as one point to consider and will address this in a minute.

Why have investors lost faith?

I believe that there are three main reasons why investors have sold off this stock, again, without good reason.

- Inflation → worries that higher input costs will eat into the company’s margin.

- Supply chain issues → will cause delays in inventory and higher shipping and freight costs.

- FED raising rates → higher rates means more interest expense.

Let me address all these three.

1) Inflation

So fears of inflation, which are pretty obvious at this point, have caused panic amongst investors who are selling their stocks off in response. However, the company has done well to not affect its margin efficiency it’s achieved over the years. To make sure margins don’t deteriorate, the CEO mentioned on the last earnings call that to an extent, they’ve passed the price increases to the consumer.

Yes, I'm not even sure price changes are over yet. So yes, there's still price inflation happening. And so we're going to continue to do what's fair and right and -- but we don't want to do anything that kind of undercuts the margin structure that we have….but everywhere it's happening. Restaurants crazy price increases and a lot of the input costs, and we're just doing what we believe is right and fair.

As our price is going up, we're passing them through. - CEO Gary Friedman

And to the point of how much are customers willing to pay as RH continues up the luxury ladder, Gary also responded with,

And so when you think about price elasticity, you've got to think about all of these things that we're doing and all these investments we're making that will render the RH brand more valuable, that will render our product more valuable and more desirable.

And yes, we think we're on a path in our industry that's not too dissimilar to the path of Apple, the path of Nike, the path of Tesla, the path of people who really, really built the best brands of their kind in their industries, and they became the best brands in the world….and that gives you a lot of pricing power.

And yeah, I agree with him.

2) Supply chain

Talk about buzzwords, that was of the many words that were on everyone’s minds during 2021 but, luckily for RH, they have an underlying trend that helps them greatly. Many consumers had to go about long wait times to get their goods than they usually had to in the past.

To put this into context, the Washington Post gave a great example of a puffer jacket and how long it was taking to reach consumers. The time to manufacture said puffer jacket was the same, but the time to ship jumped from 33 days in 2019 to 70 days in 2021. More than doubling during the pandemic!

But what does RH have under their sleeve that somewhat mitigates this risk? Even before COVID, they had longer wait times than traditional retailers. While smaller items were shipped out faster, their bigger ticket items like couches, etc. would take weeks. Their customers were almost kind of trained to wait for their goods to arrive which some could argue just builds up the excitement until your goods actually come through the door. Since customers were already accustomed to this, having to wait an extra few weeks isn’t crazy.

Additionally, ~20% of their goods are made in Viet Nam which had their whole country shut down for a while due to COVID. Though overall, their sourcing of products is diversified across many countries so there’s no single country risk when it comes to supply chains.

3) Rising rates

Another issue that everyone is well aware of is the FED raising rates and the market is now projecting 7 rate hikes in 2022 in total.

Source: Twitter.

With that being said, the obvious factor is that debt gets more expensive and the desire for investors to have an appetite for riskier investments subside.

That being said RH does have a decent amount of debt, roughly $2.2 billion in LT debt and ~$150 million in ST debt. What I love about RH however is that it’s been able to take on debt quite often using 0% convertible notes, most recently in June of 2018 (which I was on back at Merrill Lynch) for $350 million. This allows them to essentially get a zero-interest bond with the option for the bondholder to convert at a specified price, in this case, $193.65. This gives the company access to cheap capital that doesn’t necessarily need to be exercised, though I don’t see why they wouldn’t.

Last year, the company took out a Term Loan for $2 billion with a maturity date of 2028 for LIBOR + 2.50% with LIBOR floor set at .50%. Not to get too technical but this is not that expensive of debt and is quite the typical rate for healthy companies that aren’t massive conglomerates.

My point to all this is that, yes, the company has debt on the balance sheet but even if interest rates were to rise, it wouldn’t put the company in any jeopardy. In fact, the company right now has an interest coverage ratio of 16.1x, meaning it generates more than enough pre-tax operating income to cover its interest expense.

Am I worried, not at all. RH has a proven track record of being able to borrow cheaply and is in a healthy position to pay back its loans.

Valuation

================

Back to the valuation portion which I know everyone is waiting for, if we look through a forward lens, we get a slightly different picture than what I mentioned previously. RH’s forward P/E (fiscal year ending January 2023) is at 15.6x, the S&P 500 Index is at 20x, and the Consumer Discretionary Index is at 25.9x.

Even if you switch to forward-looking, I’m estimating that EPS will be ~$26 in FY’22. If we look at the Consumer Discretionary average multiple, that gets you to $673 while using the S&P 500 Index average multiple gets you $520, or a 65.4% and 27.8% upside from yesterday’s close, respectively.

Stars are pointing north over here.

Closing Thoughts

================

RH is an amazing company and has an excellent management team that is executing on all levels to deliver maximum shareholder value. The company is trading down 43% from its ATH while more than tripling its EPS over the last two years. They have gone places and will continue to go places which is why I’m bullish on the long-term prospects of RH.

If you'd like to read the full article (including the points of why I originally went LONG) then click the link here and don't forget to sign up, it's free!

_Disclosure: I/we currently have a stock, option, or similar derivative position in RH (RH) at the time of writing this article.

_

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. This article is not meant to be taken as investment advice and you should do your own due diligence prior to taking any action.

cedargrovecapital.substack.com

RH: Too Cheap to Ignore at These Levels

Restoration Hardware is on a tear financially, but its stock price is beyond disconnected

Already have an account?