Trending Assets

Top investors this month

Trending Assets

Top investors this month

Buy The Dip - $BOC

It's no secret I have been fascinated by Boston Omaha over the past few months. So it makes sense to make the incredible compounder my Buy The Dip choice.

So what makes this relatively unknown company so compelling?

I think in short it's the incredible interconnected web of businesses the company is assembling.

Of course, to start at the beginning requires traveling back to 2015 when Alex Rozek and Adam Peterson took over the struggling real estate business. Their involvement saw the company selling off its real estate in favor of buying billboards.

Billboards in particular have incredibly high margins. Using the cash flows from this business segment is what has allowed Boston Omaha to acquire and build out the various other businesses it would start over the years.

The second line of business BOC would enter would be insurance. General Indemnity Group would be formed with the intent of acquiring other insurance companies.

Most of the insurance firms that would be acquired would be those dealing in Surety Bonds which is certainly an interesting, yet niche field.

These two high-margin businesses are what allowed Boston Omaha to begin its intricate plan to interconnect all of their businesses.

Next would be a series of acquisitions of broadband providers to form Fiber Fast Homes. An internet provider that would install fiber internet to all homes built by...

Dream Finders Homes is a company that Boston Omaha invested in a few months after the broadband acquisitions. $DFH is an asset-light home builder that is one of the fastest-growing home builders in the nation.

Dream Finders Homes and Fiber Fast Homes would form a partnership called Dream Fiber Homes. This entity is controlled by $BOC and means every new home built by DFH comes with the option of Fiber Internet.

With this Boston Omaha avoids a lot of direct exposure to the cyclical housing market and instead gets the benefit of the recurring revenue should new home buyers engage with their services. Along with this BOC has been selling their stake in $DFH for a large profit, ideally to completely remove exposure to home builders.

Boston Omaha's most recent ventures have been primarily through their new asset management branch. Some of the investments include:

1.) 24th Street Asset Management

• Acquired in 2018

• Invests primarily in Commercial Real Estate

• Offers loans to Commercial Real Estate

2.) Logic

• Acquired in 2016

• Also invests in Commercial Real Estate, heavily focused in Las Vegas, Reno

3.) Crescent Bank

• Acquired in 2018

• Deals mostly in Auto Loans in almost every state across the US

Arguably their largest deal came when BOAM launched their SPAC Yellowstone Acquisition Corp. This SPAC would merge with SkyHarbour giving $BOC a ~30% stake in the company.

$SKYH is another interesting business whose ownership is split between $BOC and its CEO Keinan Tal. As of their most recent 13f, Boston Omaha appears to own about 50% of the business.

So you have read all this and maybe thought all this is cool but what's the actual pitch. Well, I'm glad you asked.

That is the pitch. Boston Omaha is building an interconnected web of incredible businesses while limiting its exposure to individual cyclical businesses. Boston Omaha is a bet on the CEOs of the business being able to effectively invest capital to get the best returns for investors. So far I think the track record is solid and will continue to prove itself over time.

But I also said CEOs, yes to the observant one there are actually two CEOs that run Boston Omaha. Alex Rozek and Adam Peterson share the role of CEO and make many of their investment decisions together. In one of their Annual Letters they talked about this:

An Interesting offhand statement to make that gives me more confidence that the CO-CEOs will be able to make effective decisions. Another interesting statement they make is about how if they are right you would know it.

Interesting bit of honesty from management saying they have nowhere to hide in terms of performance across time, it always shows up somewhere.

I also want to highlight this statement from their second annual letter.

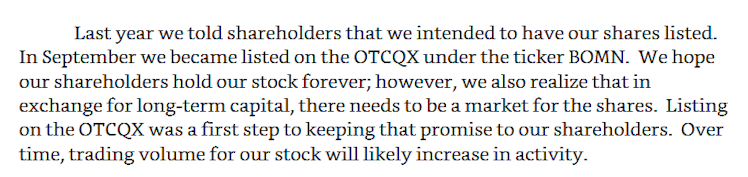

"Hold Our Shares Forever." This was when Boston Omaha was first listed on OTC markets under BOAM, before their transition to the Nasdaq.

Moving forward you may be wondering if Boston Omaha can continue the hot streak. I am fairly certain they can and allow me to explain why.

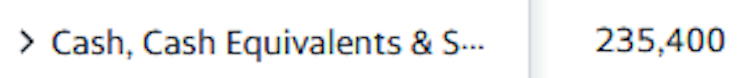

First is the mountain of cash they are sitting on. $BOC has more than 30% of its market cap in cash on the books.

This compares well with their almost non-existent debt. Only $166m in debt compared to $235m in cash, easily enough to sustain the business in case of a slowdown.

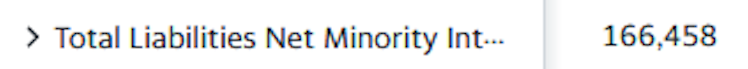

Finally to revisit their annual letters, in their most recent one for 2021 they reiterated their framework for running their business and it is as follows:

Personally, I think all this combines to make a compelling company to #buythedip and hold, not for just the next year, but forever.

Already have an account?