Trending Assets

Top investors this month

Trending Assets

Top investors this month

Opendoor ( $OPEN ) will easily survive a housing market crash.

Here's 3 reasons why:

- Unlike the stock market the housing market crashes really really slowly.

So much so that some of the worst down turns over a 3 month period were only around a drop of only 2-3%

Opendoor on the other hand is built from the ground up to sell homes FAST ( on avg 45 - 75 days)

- Opendoor has a huge focus on machine learning to anticipate/detect how the market is moving.

The more volatility/risk the higher their fee can be raised to form a margin of safety.

- When home prices fall, the more it's a buyer's market, and selling becomes hard.

Once it's hard to sell your home you won't have much

liquidity

flexibility

certainty

This causes agents to raise their fees

Opendoor won’t have to because they provide all three by design.

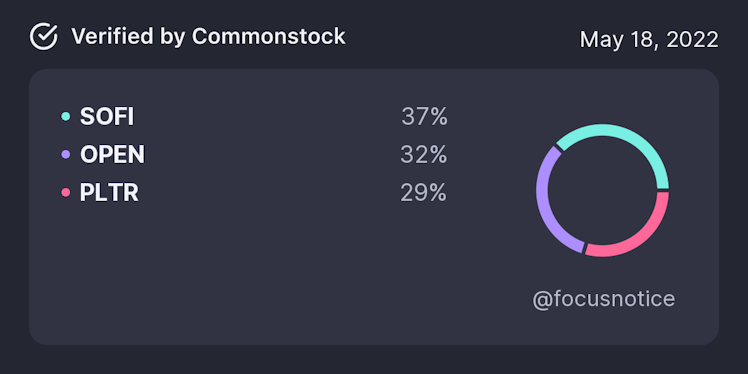

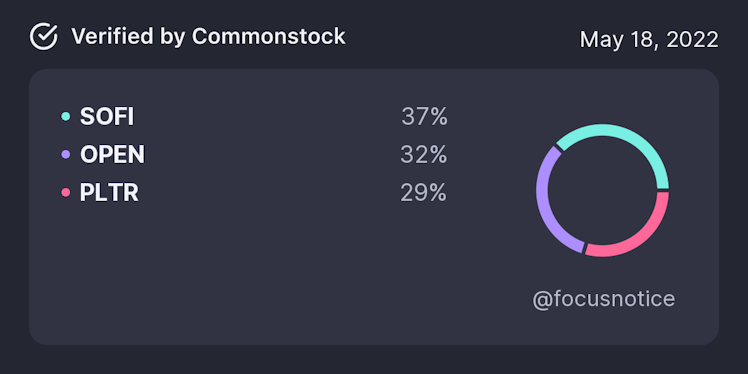

Soon $OPEN will be my largest holding

Already have an account?