Trending Assets

Top investors this month

Trending Assets

Top investors this month

Kelly ETFs, An AUM Problem

In searching for ETFs for my most recent thread on Twitter I came across $RESI which doesn't even show up on Commonstock which is already a bad sign.

At first, I thought the ETF was quite compelling. A Residential focused real estate ETF that seemed relatively promising. Its top holdings we're all seemingly decent operators in the residential and apartment real estate space.

And the expense ratio while quite high at 0.68% was also somewhat alright for an actively managed ETF.

But then I came across the problem.

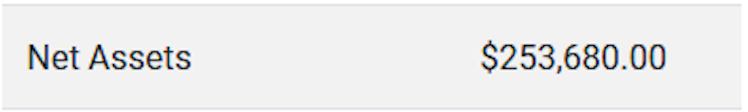

$253k in total AUM. Also...

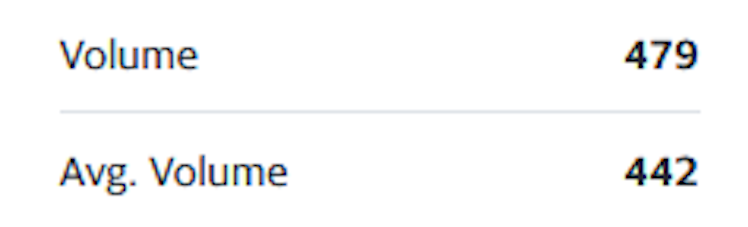

Virtually no daily volume. So a highly illiquid ETF that has almost no AUM. These two seem like quite a bad combination and I would expect this ETF to close up shop quite quickly if they can't find investors.

But interestingly this ETF is from a relatively new issuer Kelly ETFs. They currently have 3 of these products $RESI, $XDNA, and $HOTL. Residential Real Estate, Gene Editing Companies, and Hotel Companies.

The combined AUM across all their funds is a little over 6 million dollars. And I have found myself rooting for their success in the space to see what the future holds but at the same time not wanting to take the illiquidity risk of any of their funds.

Already have an account?