Trending Assets

Top investors this month

Trending Assets

Top investors this month

What Moves This Stock? MP Materials

Everyone loves revenue growth and a plump bottom line. MP Materials checks both of these boxes. Of course, you won’t hear any shareholders complain about MP’s sales of rare-earth concentrate — but that’s not what moves this stock.

What does? Progress toward becoming the only fully-integrated supplier of rare-earth elements (REEs) in the US.

A little background:

MP Materials Corp. ($MP) is a rare-earth mining company — the only one operating at scale in North America. Since purchasing Mountain Pass out of bankruptcy in 2017, MP has revamped the mine’s process flow and established a profitable, environmentally-friendlier operation. Currently, the company is still reliant on China for processing, but a three-stage plan to build out its infrastructure and become a fully-integrated supplier of rare-earth elements (REEs) is underway.

The most sought-after and valuable REEs are neodymium (Nd) and praseodymium (Pr; together, NdPr or PrNd) — two key components of permanent magnets. Really important things like refrigerators, smartphones, EVs, wind turbines, and even jets and missiles need permanent magnets. But China controls most of the world’s supply.

MP Materials (and the US government) want to change that. At the moment, thanks to Mountain Pass, the US has a bountiful source of REEs — but that’s the extent of its supply chain.

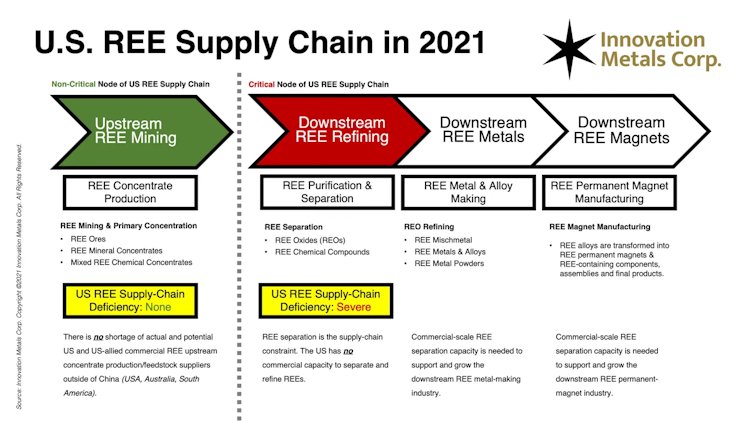

Here’s a perfect overview from a 2021 Innovation Metals Corp. investor deck.

So long as the above remains true, the US must rely on China. However, MP is currently progressing through a three-stage process that will conclude with a vertically integrated operation, all the way from mining REEs to producing permanent magnets and selling them to manufacturers.

Stage I

Naturally, the initial stage commenced with the purchase of Mountain Pass in 2017. MP leveraged the existing facility — which Molycorp had already put a sizable amount of funds into — and implemented changes to improve efficiency, plant up-time, and mineral recovery. All said and done, MP’s adjustments helped achieve 3.5x more REO production volume than the mine’s previous operator, Molycorp.

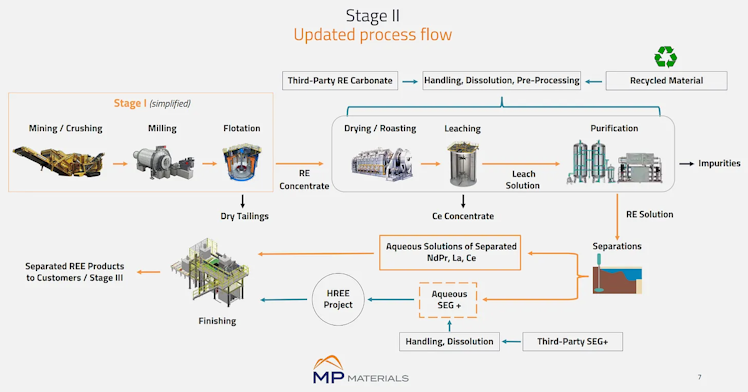

Stage II

“Upon completion of Stage II, we expect to be a global low-cost, high-volume producer of NdPr oxide, which represents a majority of the value contained in our ore.” — MP’s 10-K

Stage II is currently underway. In short, MP is expanding its operations to enable the separation of rare-earth concentrate — the “Downstream REE Refining” phase of the above supply chain graphic. As the following table outlines, this is no small feat.

MP’s upgrades to facilities and broader process flow should translate to lower cost separation and a smaller environmental footprint. The company expects to achieve full run-rate production volume for Stage II in 2023. Once the separation facility is operating, MP will be able to separate its concentrate into four products:

- Neodymium-praseodymium (NdPr) oxide

- Samarium, europium, and gadolinium (SEG+)

- Oxalate, Lanthanum (La) carbonate

- Cerium (Ce) chloride

More recently, the Department of Defense awarded MP Materials a $35 million contract to develop an HREE processing facility at Mountain Pass, which will be the first of its kind in the US.

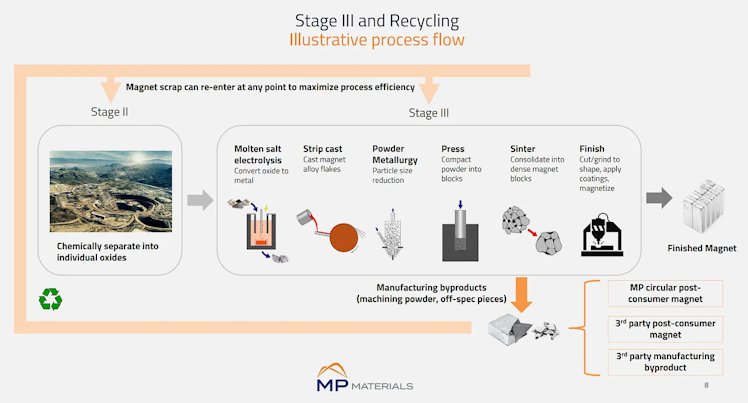

Stage III

The final stage of this operational revamp will establish MP as the only vertically-integrated rare-earth magnets producer in the Western Hemisphere. These facilities would enable MP to convert NdPr into permanent magnets, which are integral components of EV motors. Again, referring back to the Innovation Metals Corp. graphic, MP will have built out the “Downstream REE Metals” and “Downstream REE Magnets” segments of the rare-earth supply chain.

In December 2021, MP announced the development of its initial magnet manufacturing facility in Fort Worth, Texas — as well as a long-term supplier agreement with General Motors to source and manufacture the finished magnets necessary for more than a dozen GM electric vehicle models. The company expects to begin delivering alloys in late 2023 and magnets in 2025.

The facility is expected to produce 1,000 metric tons of finished NdFeB magnets (NdPr, iron, and boron) each year, which is enough material to power roughly 500,000 EV motors. And this would only account for roughly 10% of the company’s NdPr output, giving it much more runway to sell these magnets to other manufacturers.

Where do things stand now?

Last week, we got an update via MP Materials’ Q2 earnings call. The company’s production sales and bottom line continued to benefit from high market prices for rare earth concentrate — net income increased 170% to $73.3 million compared to Q2 of 2021.

More importantly, Stage II is making great strides.

Here’s some color from Jim Litinsky, CEO and Founder of MP Materials (emboldened for emphasis):

“We remain on target for a mechanical completion by year end and we've begun pre-commissioning, which includes checkouts and initial performance testing on both legacy and new circuits in preparation for commissioning. In addition, our Stage 3 facility is going vertical and forward, and we remain heavily focused on key hires, procurement of long lead equipment and other items tracking for a late 2023 start of product for magnetic alloy.”

And there’s no shortage of demand for what MP will eventually produce. On the call, an analyst asked for more insight into potential supplier deals on the horizon given the growing electrification efforts around the country, particularly in the auto industry. Here’s Jim’s response:

“We're not demand constrained, we're supply constrained. There's a lot of interest from a lot of parties. It's not just the OEMs — it's OEMs, wind and a number of other use cases.”

As the company continues to progress through Stage II and III, expect $MP to make significant movement.

Already have an account?