Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio: Hermes International ($RMS) - Where Craftmanship And Quality Also Apply To The Financial Performance.

We are constantly looking for new potential additions to the SLT Core portfolio and especially among international stocks for diversification purposes. Given $RMS margin profile, financial condition and brand's uniqueness, we decided to further analyze the company.

Thesis

- The company's strong brand reputation, commitment to quality/craftsmanship, and exclusivity of products, as well as its position in the luxury fashion industry, provide a competitive moat.

- Additionally, the expected sustainable growth in the luxury goods market, driven by increasing wealth in Asia and the shift towards online sales, presents a growth opportunity for the company both in terms of revenue and profitability.

- The company's strong financial performance and stable financial position, as well as its commitment to ESG considerations, further support the investment thesis.

- Based on historical multiples and a DCF model, RMS shares are currently trading at a premium compared to its peers and fairly valued on an absolute basis. The implied growth rate from the reverse DCF model is reasonable but not cheap.

Description

Hermes International (RMS) is a luxury goods company that was founded in France in 1837. The company is known for its high-end luxury products, including clothing, accessories, and home furnishings. RMS is particularly famous for its leather goods, including handbags, wallets, and belts, and its iconic orange boxes.

The company has a strong reputation for quality and craftsmanship, and its products are often considered status symbols. RMS operates stores and boutiques in cities around the world and is highly sought after by consumers who value luxury and exclusivity.

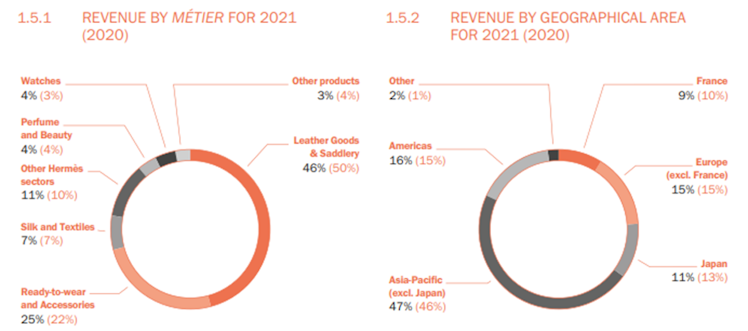

The company employs more than 18k people, is listed on the French stock market and has a market capitalization of € c.166bn. Production sites are almost all located in France

(100% in Europe). RMS products are available worldwide through a network of 303 exclusive stores, most of them being branches and only a few set up as concessions.

Source: RMS Annual Report 2021

Competitive Moats

- Brand

There are several factors that contribute to the value of the Hermes brand:

One of the main reasons is the company's reputation for quality and craftsmanship. RMS

products are known for their attention to detail and use of high-quality materials, which gives them a reputation for durability and longevity. RMS maintains a commitment to high quality by having, for example, the artistic director personally approve every product before it is released. The company values craftsmanship and believes that the love and care put into each item by the artisan is reflected in the finished product.

The CEO, Axel Dumas, believes that this focus on craftsmanship is a key strength of the Hermes brand. Pierre-Alexis Dumas, the artistic director, has stated that RMS products are desirable because they connect people to their humanity and allow the customer to feel a connection to the person who made the object while also experiencing pleasure through their senses.

Before working on any leather products, a craftsman at RMS must undergo a mandatory

2-year training period. The company places a strong emphasis on quality in its production process, including the principle of patience as a key element in achieving the highest level of quality. In terms of marketing, RMS does not use celebrity endorsements and instead focuses on authenticity, opting not to follow the common practice of using this tactic in its brand-building efforts. The company has a strong brand image, with a clear vision and aesthetic that is consistently reflected in its products and marketing efforts.

This reputation is further enhanced by the exclusivity of RMS products, as the company only produces a limited number of each item, making them highly sought after by consumers. Finally, the company has a long history and heritage, which adds to the prestige and

perceived value of its products.

Source: RMS Annual Report 2021

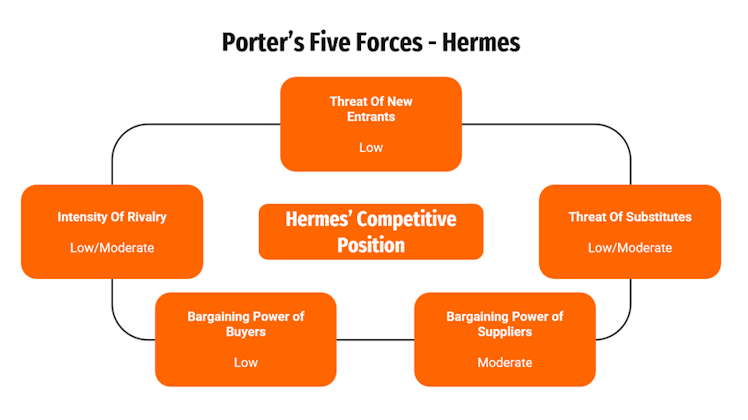

Porter’s Five Forces

Porter's Five Forces is a framework used to analyze a company's external environment and

guide business strategy. The five forces include the threat of new entrants, intensity of rivalry, threat of substitutes, bargaining power of buyers, and bargaining power of suppliers.

Source: SLT Research

- In the luxury fashion industry, the threat of new entrants is relatively low due to the difficulty of establishing a new brand as a luxury brand. RMS itself has operated for more than 185 years.

- The intensity of rivalry is low to moderate. Despite not being the sole player in the luxury goods industry, as competition is based on quality and customer perception of brand image rather than price, the company is able to overcome the intensity.

- The threat of substitutes for luxury fashion brands is low to moderate due to the potential for counterfeit products.

- The bargaining power of suppliers is moderate, as luxury fashion brands have a limited number of suppliers who can meet their high quality standards.

- The bargaining power of buyers is low, as the exclusivity and high quality of luxury fashion brands may make it difficult for customers to bargain for lower prices.

Overall, RMS is well-positioned in the luxury fashion industry due to its strong brand reputation

and focus on quality and exclusivity.

Sustainable Growth

Luxury goods are expected to continue to see strong sales despite the potential for a global recession, according to research from Bain & Co and Altagamma.

Luxury goods sales increased 15% at constant exchange rates between 2021 and 2022, despite rising inflation and lockdowns in China. Around 60% of the growth was driven by price increases for core items, including handbags, which can be classified as Veblen goods, a type of luxury good for which the demand increases as the price increases, in apparent contradiction of the law of demand, resulting in an upward-sloping demand curve.

Luxury brands are better positioned to weather financial shocks than they were during

the 2008-09 financial crisis, as ultra-wealthy individuals now account for 40% of sales, up from 35% in 2009.

Still according to research firm Bain & Co, the global luxury market is predicted to see sales growth of 60% from 2022 to 2030 (5.6% CAGR). This growth will be driven by an increase in wealth in Asian regions such as India, South Korea, and Indonesia, leading to the addition of approximately 10 million new luxury consumers annually. It is expected that 40% of the global luxury sales will be made by Chinese consumers by 2030. Beyond China, India’s luxury market is forecasted to expand to 3.5 times today’s size by 2030.

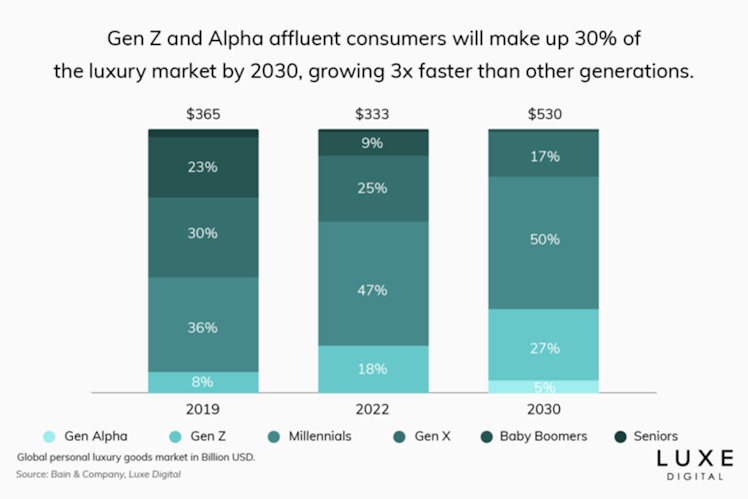

Additionally, younger shoppers, specifically those belonging to Gen Z and Alpha, are expected

to make up about one third of luxury purchases by the end of the decade. Their spending is expected to grow 3x faster than other generations. Gen Z purchase luxury items three to five years earlier than millennial predecessors.

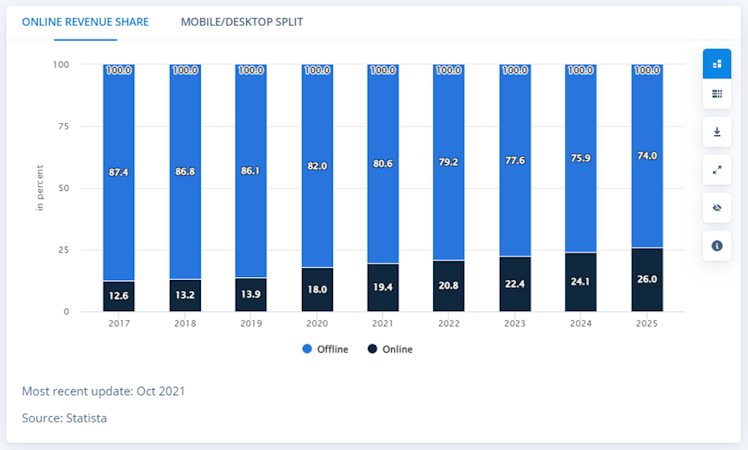

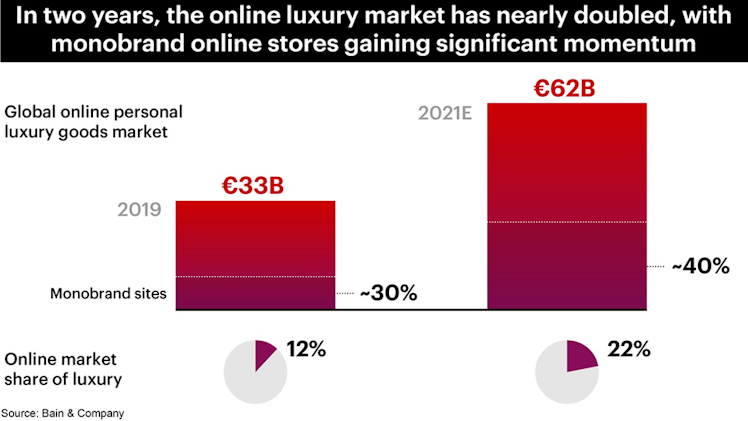

The COVID-19 pandemic has changed the way we work and shop. Prior to the pandemic,

there was already a trend towards digital shopping, but the former has increased the need for an omnichannel strategy. And even if in-store shopping experience is still important for luxury brands, Statista data shows that online sales of luxury items are likely to make up more than 25% by the end of 2025 due to changes in consumer habits.

Historically, luxury brands relied heavily on multi-brand retailers to sell online, however driving sales through their own websites is crucial going forward, to own the customer data and control the entire omnichannel experience.

Financials

- Income Statement

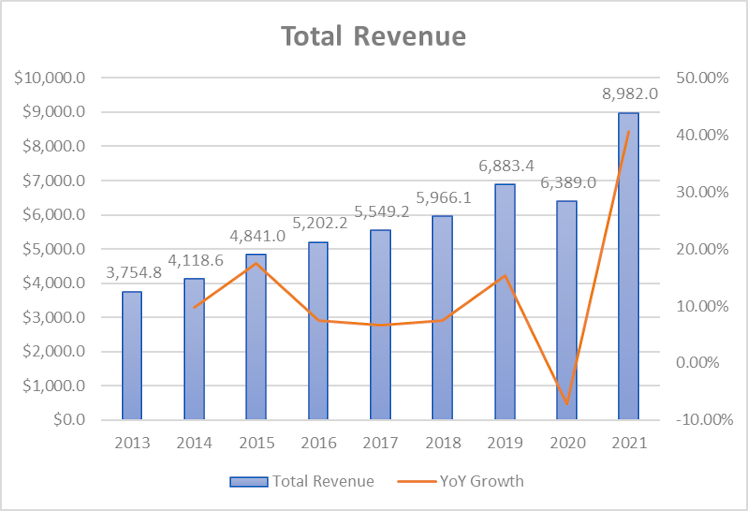

RMS reported a 2021 total revenue of €8.92bn, growing an average rate of 12.21% over the last 8 years. Revenue has been multiplied by 2.39 over the period representing a 11.52% CAGR. Prior to the Covid-19 pandemic, revenue grew every year within a high-single to mid-double digit rate range. In 2020, while a lot of stores where closed for a good part of the year due lockdown restrictions, revenue only dropped c.7% before bouncing back strongly in 2021 to surpass pre-pandemic level by more than €2bn.

RMS typically caps volume growth in the production of leather goods at about 7% annually. RMS’ revenue CAGR c.4% above its production growth rate shows that demand for its products is strong but mainly that the company is able to charge more each year for the same product i.e. pricing power.

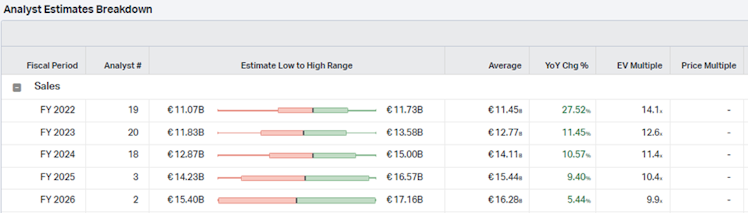

TTM revenue follows a similar trend, above the €10bn mark and growing 25.64%. Consensus expects total revenue to keep growing more than 10% p.a. until 2025.

Source: koyfin

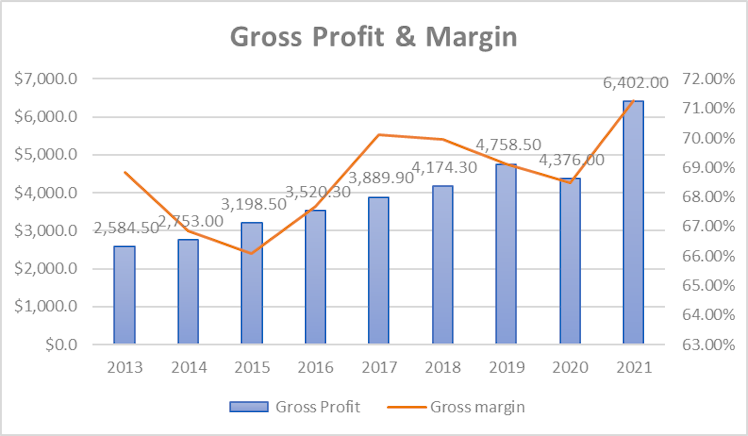

Based on the below chart, we can observe that RMS applied higher selling prices to its customers but did not suffer them from its suppliers to the same extent. Despite global supply chain bottlenecks over the last 2 years impacting COGS, the gross profit margin oscillated between 67% and 71% following an upward sloping trend. RMS has been able to improve its gross profit margin over time with the LTM margin being also above 70%.

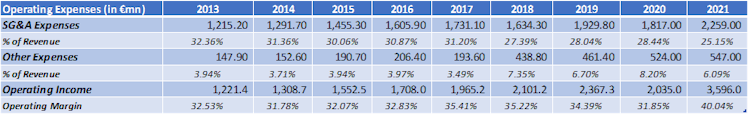

Looking at operating expenses, the company reports them into two different segments:

- SG&A.

- Other Expenses: They include mainly depreciation and amortization with half of which relates to PPE & intangible assets, and the other half to rights-of-use. Other expenses also include free share plans.

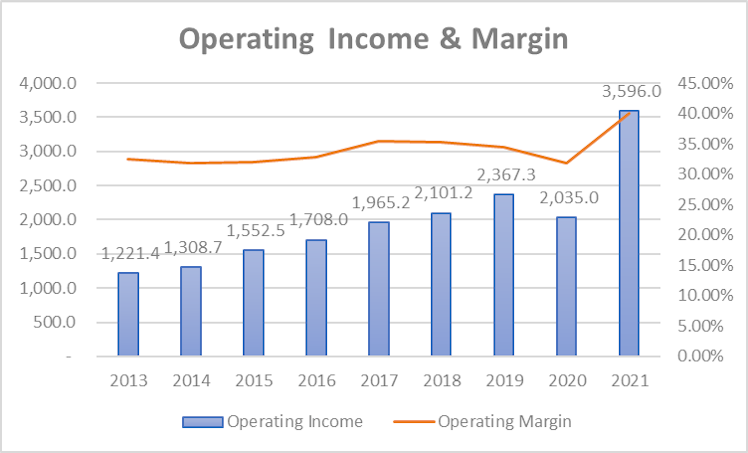

The main takeaway from the below table is the fact that over the years, RMS significantly improved its operating profitability with a margin reaching 40% over the last exercise. This was

enabled by a continued reduction of SG&A expenses as a percentage of total revenue and despite an increase in other expenses.

Increase in the latter can be associated with higher depreciation and amortization. It reflects continued investments in the distribution network, production facilities, digital technology and information systems. In other words RMS is more profitable while investing more to support its long term growth.

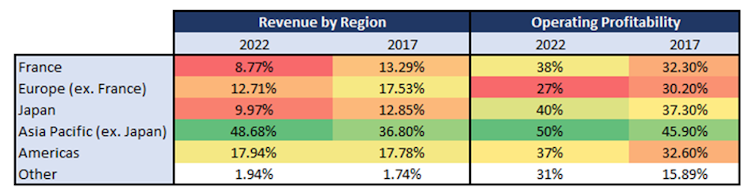

In addition to pricing power, improved operating profitability is likely the result of a better product and region mix. When doing some research, we discovered that the company reports the operating profitability by region in its half year report. We decided to compare H12022 with the same period 5 years ago.

It is interesting to note that revenue in lower margin regions (especially Europe) declined as a percentage of total revenue to the benefit of significant revenue (% of revenue) and margin expansion in Asia. The latter is likely to be one of the main driver for the industry and the fact that it is the most profitable region for RMS, implies potential for further overall margin improvements.

TTM EBIT is €4.21bn (c.+17% YoY) and consensus expects it to increase in a relatively similar fashion than revenue over the coming years, implying a forecasted stable c.40% operating profit margin.

Source: koyfin

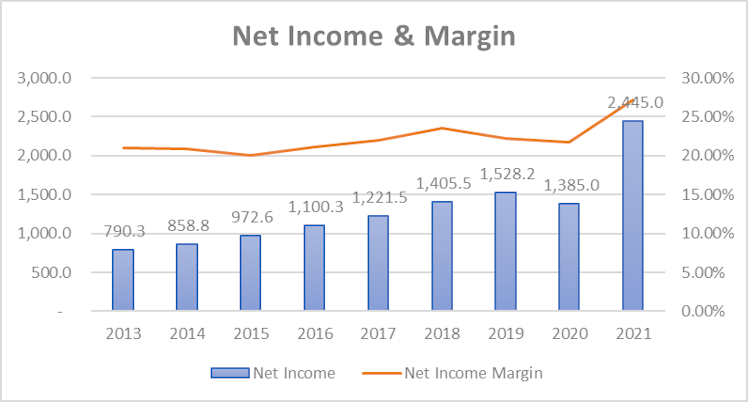

The company has a low level of debt and net interest expenses are insignificant (avg. 0.2% of revenue over the last 5 years) and hence taxes is the main item deducted to EBIT in order to derive the net income.

The margin improvements observed at the operating profit level is directly translated in to RMS’s net income margin, which has been constantly above 20% over the period, topping 27.22% for the last FY.

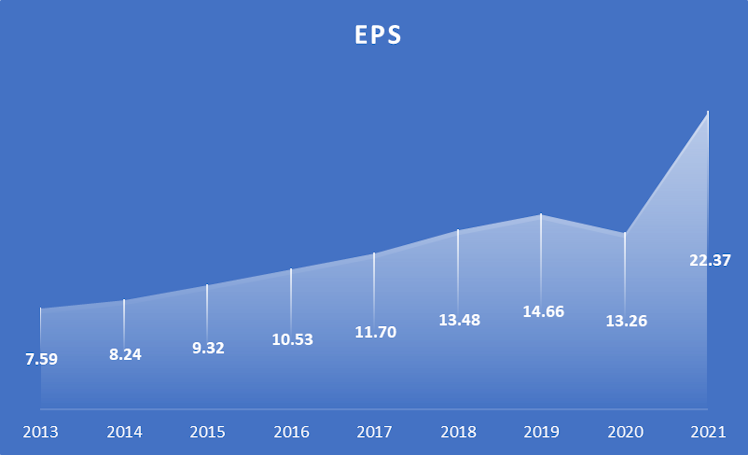

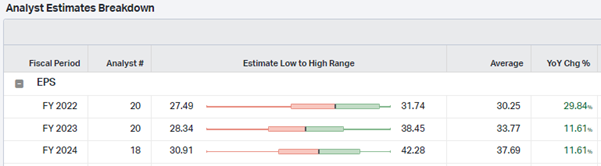

Thanks to RMS operating leverage and continued share count reduction, the EPS grew faster than revenue, posting a 14.5% CAGR over the period.

EPS is estimated to keep growing quickly and in line with revenue to almost reach €38 by 2024. Using the 2022E EPS of €30.25 and current stock price, it represents an earning yield of c.1.8%. The company distributes around 30% of its earnings to shareholders as dividend

(0.5% yield).

Source: koyfin

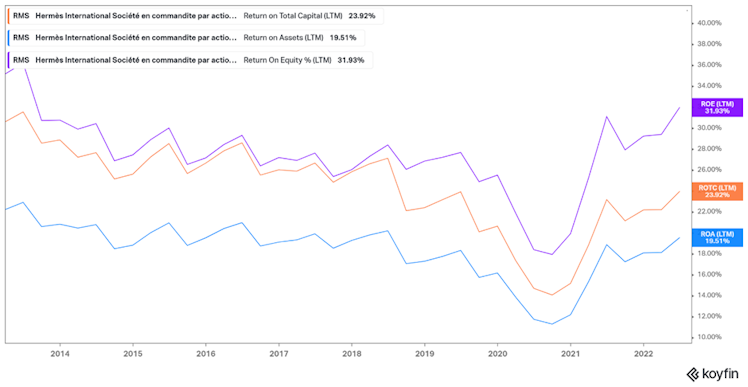

Despite a notable drop directly related to, and explained by the pandemic in 2020, return on assets (ROA) remained stable over the 20% level. ROE and ROTC follow the same pattern. The

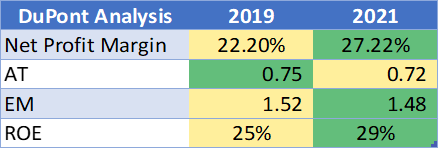

latter is way above the company’s WACC (6.2%) indicating shareholder value creation. We decided to get more insights on what drove the 4% ROE improvement post Covid-19 (FY2021) and performed a DuPont Analysis.

We can quickly observe that ROE was entirely driven by margin expansion since the asset turnover (AT) decreased slightly and the equity multiplier (EM) declined implying lower leverage. As a result, a 5% net profit margin improvement resulted into 4% ROE expansion. ROE keeps its post-pandemic trend and is currently above 31%.

- Main competitors to RMS are LVMH ($MC), Kering SA ($KER) and Christian Dior ($CDI).

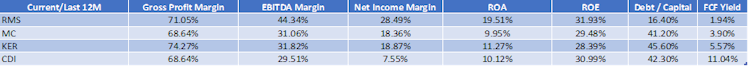

All companies exhibit a quasi-similar gross margin ranging from 68% to 74% with RMS at 71%. RMS really stands out from others when it comes to operating profitability with an EBITDA margin 13% higher than its closest competitor. The capital structure also gives RMS an edge especially given insignificant interest expenses and as a consequence, the company has a NI margin 10% higher. CDI is lagging in terms of profitability. RMS also leads with regards to ROA and despite lower use of debt (lower gearing), RMS shows slightly higher levels of ROE. Cash flow will be discussed later.

- Balance Sheet

From a liquidity point of view, the company’s balance sheet is very solid. Current ratio is 3.6 and cash represents almost 75% of current assets. Logically the company holds inventories but the latter is limited (fixed production, scarcity). Historically the company kept inventory

levels equivalent to a well managed 16% of total revenue. On average, inventory sits on the shelf 190 days (DIO). Given the company’s DTC strategy, days of sales outstanding are actually 0 and it takes on average 75 days to RMS to pay its suppliers. The cash conversion cycle is then 115 days.

From a solvability point of view, as discussed earlier, RMS’s debt level is low, especially on a relative basis. Debt to equity and capital are 19.6% and 16.4% respectively. EBIT covers 120.3x

interest expenses and current Altman Z-Score is 19.07.

- Cash Flow Statement

Operating activities generated more than €3.4bn in cash during the last exercise. Depreciation & amortization added the most to NI in order to derive CFO, which makes sense based on RMS activity. Other items were not material with SBC at only €59mn for example.

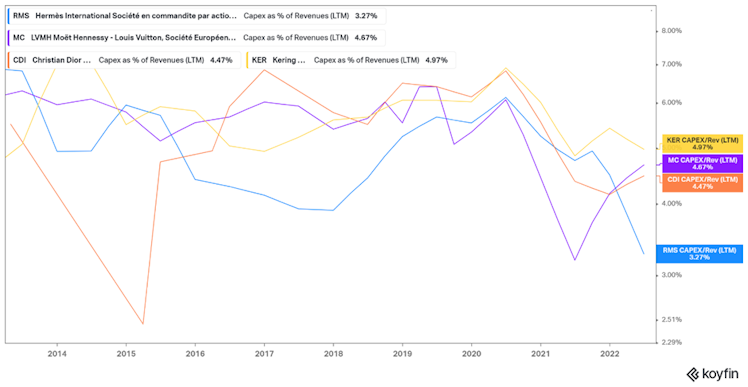

Investing activities used €669mn in FY2021, mainly spent in CapEx and purchases of marketable and equity securities. The company continued to invest in its development and exits a period of 2 years with capital expenditures equalling c.6% of its revenue. More recent data shows a 50% reduction in CapEx (% of revenue) and should theoretically improve future FCF, all other things being equal.

Financing activities used another €869mn in 2021. The company rarely issue debt and has not issued a single euro worth of shares during the period covered. RMS is committed to repay debt (238mn for LTM and 220mn in 2021). AS already mentioned the company pays a dividend and combined it with frequent share repurchase programs.

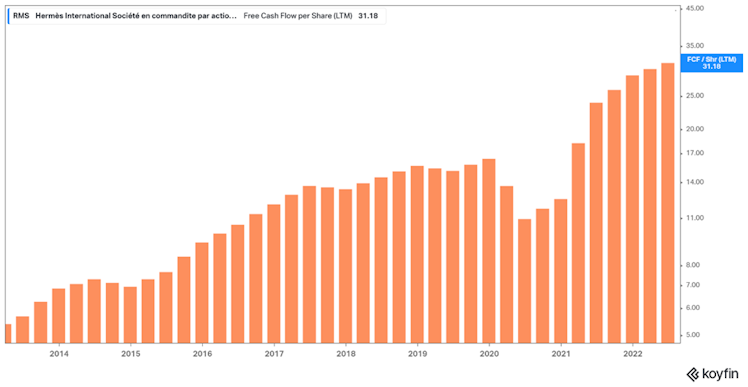

FCF exceeded €3bn for the first time in 2021 (€28.68/share). Using LTM FCFPS and given current stock price, it represents a FCF yield slightly below 2%. RMS is a strong FCF generator and grew the latter by almost 6x over the last decade.

Management and ESG considerations

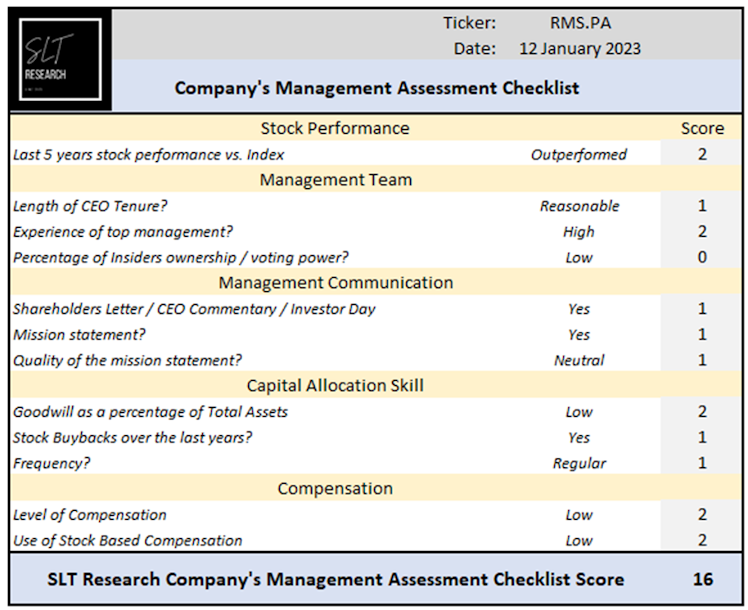

The stock literally crushed the Euro STOXX 50 over the last decade.

RMS is a luxury company that has been passed down through six generations since 1837. The company was founded by Thierry Hermès as a high-quality saddlery maker and has evolved over the generations to include a variety of luxury goods such as ready-to-wear clothing,

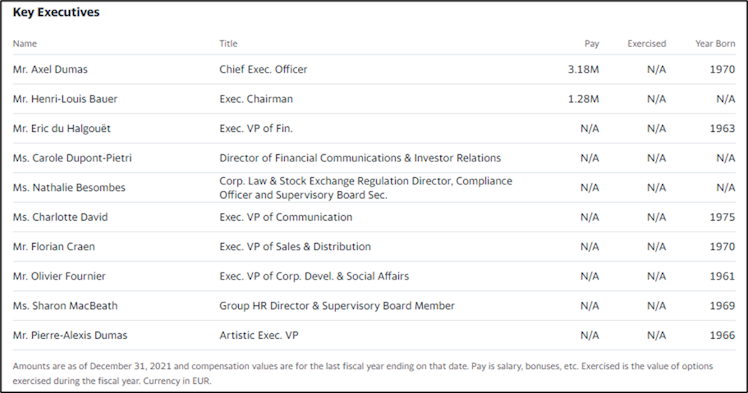

watches, and gloves. The company was passed down from Thierry to his son Emile-Charles, who moved the business to the famous rue du Faubourg St. Honoré, then to Emile-Maurice, who diversified into travel- and sport-related leather goods, then to Robert Dumas, who produced the first Hermès scarf, then to Jean-Louis Dumas, who transformed the business into an international luxury retailer, and finally to Pierre-Alexis Dumas in 2010. Jean-Louis Dumas' nephew, Axel Dumas was appointed as CEO in 2014.

Axel Dumas is also co-executive chairman alongside Henri-Louis Bauer. As for each generation, Axel added its touch to the multi-century success of the family business with notably continuing the international expansion initiated by Jean-Louis and investing in the

e-commerce. Pierre-Alexis Dumas (creative director) also plays a crucial role in RMS’ intense focus on innovation and creativity.

Source: Yahoo! Finance

The current compensation of Axel Dumas is way below the median value of CEO compensation by company size (revenue).

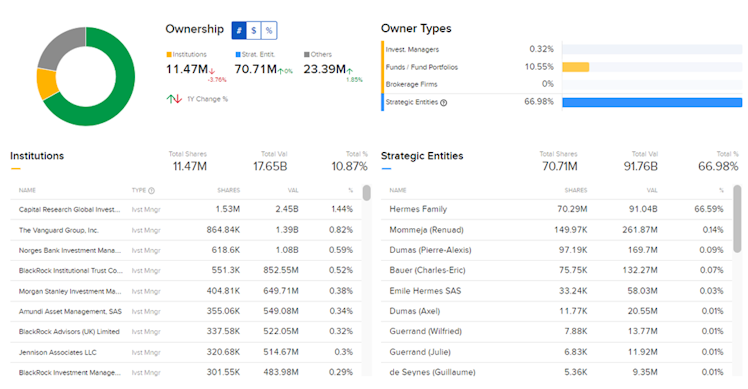

RMS is a family-run business that operates with a democratic monarchy principle. The leadership and management is closely tied to the family, and the board of directors is mostly composed of family members from 3 different family lines. To ensure that ownership and

influence remains within the family, a large majority of 75% is required to make changes to the company's statutes or the CEO's position.

Source: InteractiveBrokers

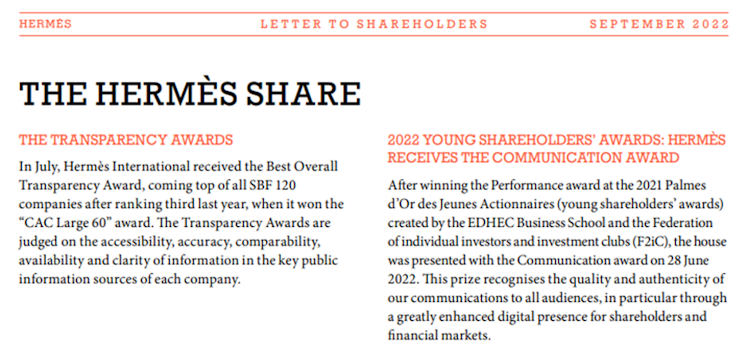

RMS’ communication to shareholders is impressive. The management issue a letter to shareholders on a quarterly basis with key figures and the main topics in terms of strategy, ESG, as well as an outlook. The company even won recently transparency and communication awards.

RMS’ bet on the e-commerce is a necessity as explained earlier (sustainable growth section). The below illustration clearly shows that the pandemic changed consumer’s habits. Online sales are gaining share of total luxury market. More interestingly, monobrand online

stores (like hermes.com) are gaining significant momentum.

This trend was confirmed in the last shareholders letter available:

- “In the first half of 2022, the hermes.com website performed very well worldwide, in terms of both visits and purchases. The Hermès e-commerce platform is a gateway to the house, complementing in-person store visits. The group continues to offer new omnichannel services to its online community, which enjoys an increasingly wide choice of products.”

It is also worth precising that as for many retailers, online sales help improving overall margins.

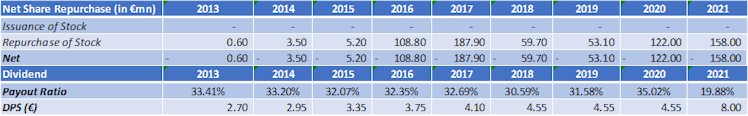

In addition to investing in organic growth, the management team also allocates capital in the form of dividends and stock buybacks in order to return cash to shareholders:

Dividend grew at a 10.65% CAGR over the last 10 years. If we include the LTM €119mn worth of share repurchased, the company bought back almost €1bn of its market capitalization,

but compared to the current €169bn market value it does not represent an important amount. To the total shareholder yield, we could also include the €891mn amount of debt repaid over the last decade.

Source: koyfin

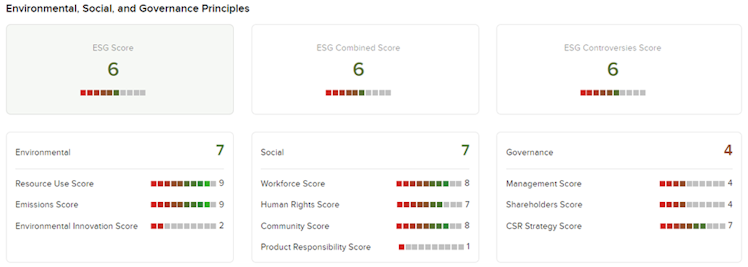

- ESG Considerations / Glassdoor Review

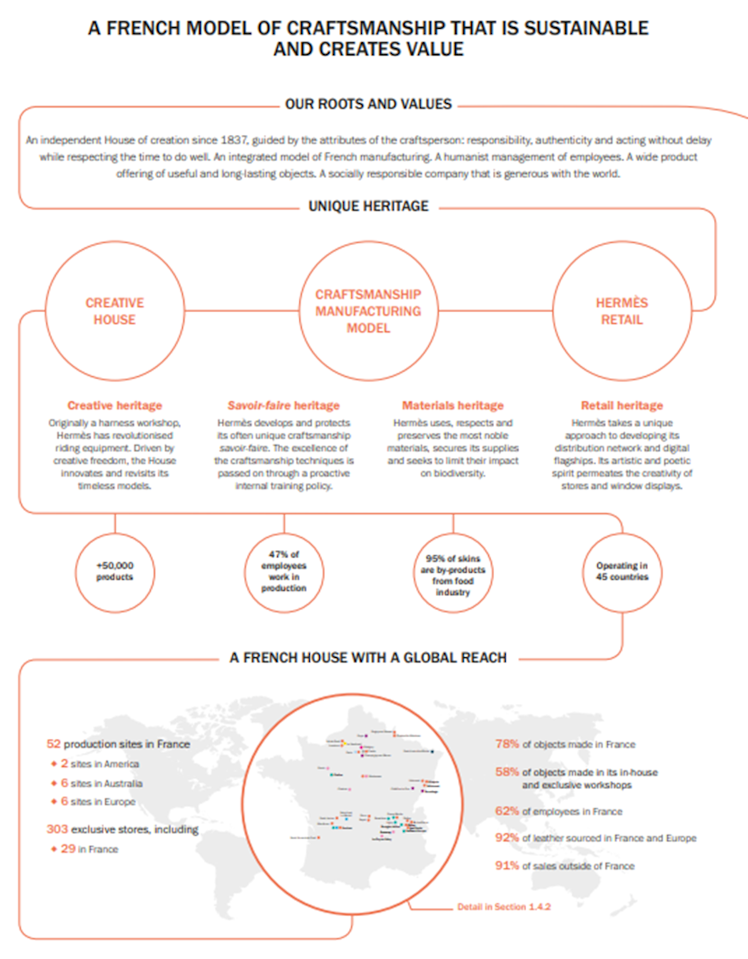

The company developed a French model of craftmanship that is sustainable and creates value. For more detail we invite you to have a look at the document summarizing perfectly how ESG is incorporated within RMS business model (link).

The company has good environmental and social scores but overall ESG scores is impacted by a low governance score. However if we add a little context around this score we are not really

surprised given RMS ownership structure and the concentration of power within the family.

Source: InteractiveBrokers

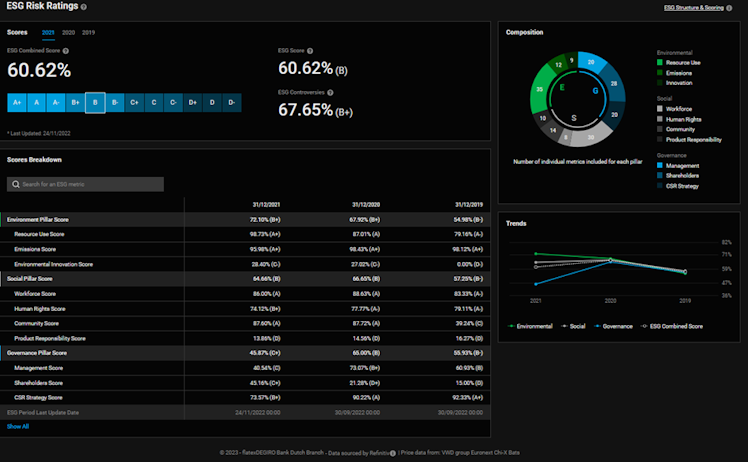

If we look at ESG from a risk perspective, RMS represents limited ESG risk with a rating of B, indicating good relative ESG performance and above average degree of transparency in

reporting ESG data publicly.

Source: DeGiro

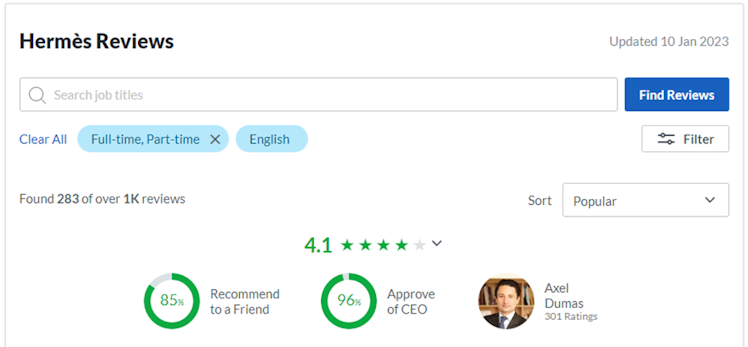

The workforce score of 8, according to IBKR ratings, is confirmed by some impressive Glassdoor reviews. 85% of employees who gave a review would recommend to a friend to work in the company and almost 100% approve Axel Dumas as RMS’ CEO.

Source: Glassdoor

Valuation

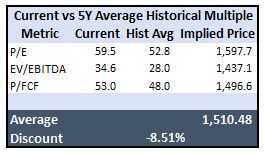

Looking at historical multiples, the company trades at a premium and way above -1 std deviation from the last 5 years average. The value derived from the average of the above multiples imply an intrinsic value of €1,510.48 per share, more than 8% lower than the current

price.

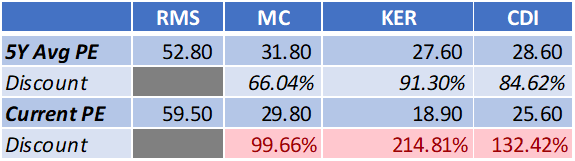

On a relative basis, and partially explained by the competitive comparison detailed earlier, RMS historically traded at an important premium versus its peers. However, the current premium is largely higher than RMS’ 5Y premium (using P/E).

Not to rely solely on absolute/relative multiples, we ran a DCF model to assess RMS intrinsic value.

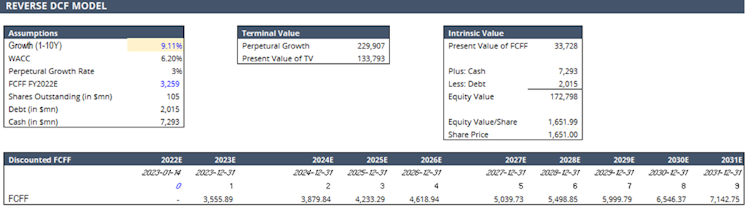

We have extended our FCFF forecast period to 10 years, using consensus estimates for the revenue during the first 3 years of the period and then a revenue gradually reverting back to the long-term industry growth rate for the 7 remaining years.

The DCF model is implying that shares of RMS are currently fairly valued, at a 3% discount but with an IRR actually lower than the company’s WACC.

As an extra layer in our valuation process, we decided to cross check with a reverse DCF model, please see below.

Based on the reverse DCF model, current market price implies an FCF annual growth rate of c.9.11% for the next decade and 3% perpetually. Based on the industry outlook/growth perspectives, the increasing share of online sales (margin improvement), and the company itself (strong position with valuable brand and competent management team), the implied rate appears reasonable but not cheap.

Risks

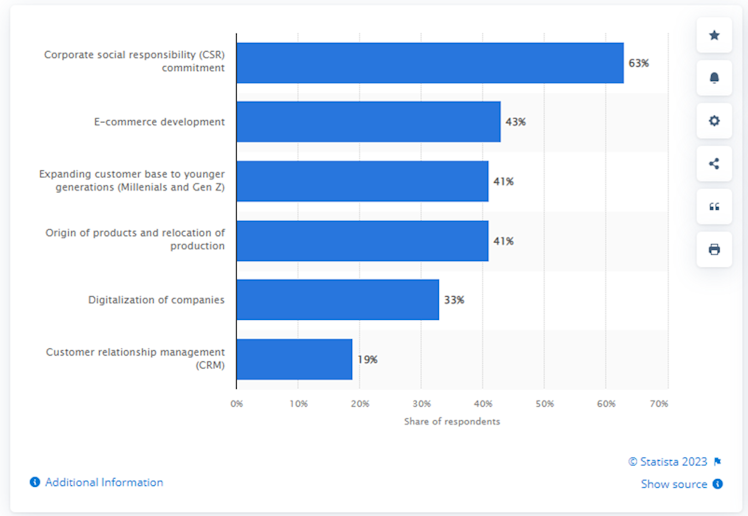

According to a Statista survey, the below horizontal bar chart summarizes the most important challenges the luxury industry is currently facing:

- The group is well aware of the importance to address the CSR issues and as a consequence RMS developed back in 2015 a CSR strategy. The latter makes a tangible contribution to most of the 17 SDGs as defined by the UN.

- As already discussed earlier, given the increasing share of online sales in the luxury industry, the online presence of luxury brands is primordial. Despite being historically present on the web through multi-brand retailers, RMS made the expansion of its e-commerce site one of the main priorities for the company in order to build its omnichannel network.

- Attracting younger generation, likely to be more attentive to ESG consideration before buying a product, is a challenge for all brands. RMS is clearly trying to attract millennials and Gen Z. A perfect example was the launch of the perfume H24. The latter benefits from eco-designed development, with raw materials mainly derived from biotechnologies, a recyclable case made of recycled fibres, and a refillable bottle. It attracted younger audience and perfume can familiarize this cohort with the other product’s range of the brand.

Our aim is to provide you with accessible analysis but we truly believe we can all learn from each other, so please let us know your feedback in a comment!

Disclaimer: The information provided in this post is for information only and solely on the basis that you will make your own investment decisions after having performed appropriate due diligence.

Already have an account?