Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Fed Announcement and Job Data

U.S. stocks are dropping today, giving back much of the post-Fed announcement gains yesterday.

Both the DJIA and S&P 500 had their best days since 2020 yesterday, while the Nasdaq rose over 3% for the day.

The Fed raised rates by 50 basis points, as expected. Fed Chair Jerome Powell said a larger increase was not considered.

Looking at economic data today, initial jobless claims jumped to 200,000 last week, well above expectations of 182,000 and the highest level since February. Initial claims were at 181,000 last week. Continuing claims fell to 1.38 million, the lowest level since 1970.

Nonfarm productivity fell by 7.5% during the first quarter, the biggest decline since 1947. Productivity had been expected to fall by 5.2%. Unit labor costs jumped 11.6% during the quarter, the biggest gain since 1982.

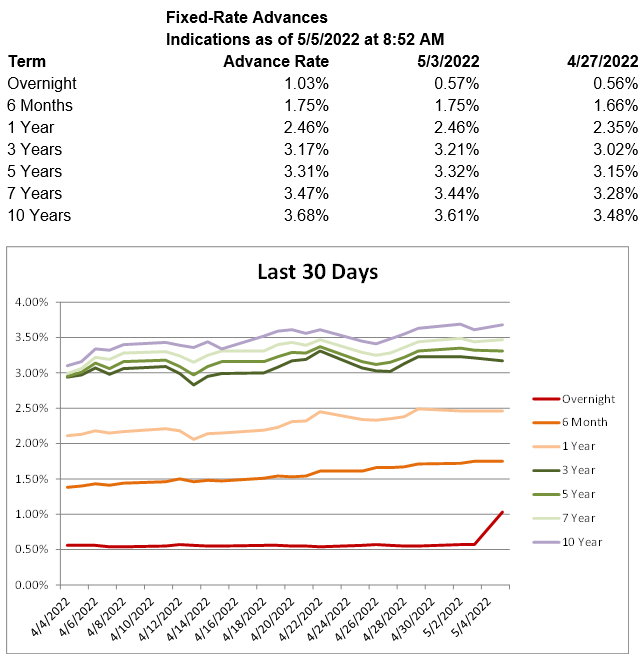

U.S. Treasury yields are higher today, with the 2-year Treasury yield up 8.5 basis points to 2.70%, the 5-year Treasury yield up 10.7 basis points to 3.00%, and the 10-year Treasury yield up 12.2 basis points to 3.04%. The shortest-term advance rates are higher today, while the rest of the curve is mostly lower.

Already have an account?