Trending Assets

Top investors this month

Trending Assets

Top investors this month

What Should You Do When Your Stock Flames Out After Earnings? Jarvis® Update March 3, 2023

Earnings season is so crucially important to investors that adhere to a philosophy of investing in the best businesses.

Sometimes earnings reports come out and disappoint the market, causing a stock to fall 10, 20, 30% or more immediately. When a stock you own does this, it can be such a crushing and demoralizing blow.

The question then becomes: What should you do when your stock flames out after earnings?

On this week's Jarvis® Update, CEO Noland Langford and Director of Research, Brian Dress, cover the some of the latest earnings reports and give you some real world examples of how to answer this question in practice in the context of your portfolio.

We discuss the earnings coming out of some of the companies we follow, including Snowflake (SNOW), Box (BOX), Pure Storage (PSTG), and Teladoc Health (TDOC). In the video, we go through the process we use to determine whether it is time to Buy More, Hold Tight, or Sell, Sell, Sell.

Remember, being a long-term investor means sifting through the short-term noise to find the true trajectory that the BUSINESS is on. If the business is doing well, eventually the stock will follow!

Topic 1: Are Earnings Misses Macroeconomic-Driven or Business Specific?

Topic 2: What Should You Do When Earnings Miss the Mark?

Get signed up to our mailing list to receive all of our investment content (video and written) to your inbox every Saturday morning: https://leftbrainir.com/jarvisnewsletter

YouTube

What Should You Do When Your Stock Flames Out After Earnings? Jarvis® Update March 3, 2023

Earnings season is so crucially important to investors that adhere to a philosophy of investing in the best businesses.Sometimes earnings reports come out an...

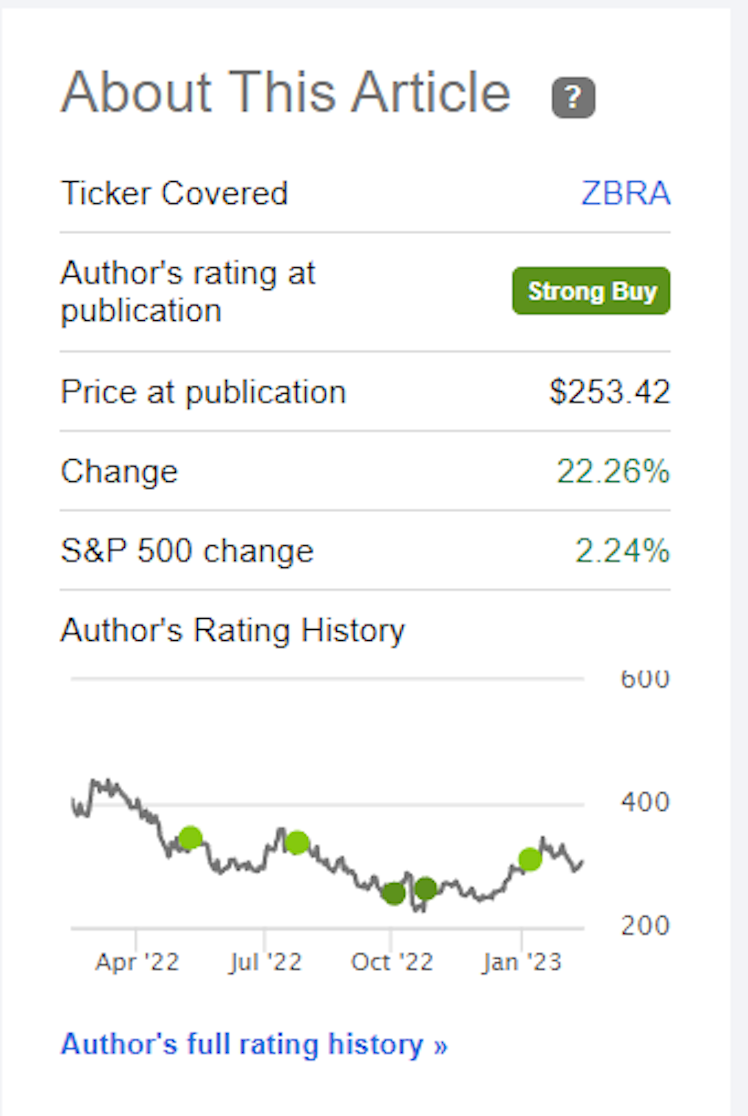

Great post and a very important dialemma investors will be faced with many times in a year. I recently went through this in November with a large position of mine, $ZBRA.

The stock crashed 20% on disappointing results, but I did the work and found that management has a plan and market blew it out of proportion. Turned out to be an amazing buying opportunity and I'm glad I was able to quickly analyse and update my readers on the situation.

https://seekingalpha.com/article/4555800-here-is-why-i-keep-buying-zebra-technologies-even-after-bad-q3-results

Already have an account?