Trending Assets

Top investors this month

Trending Assets

Top investors this month

Global Copper Mines

With the recent shutdown of First Quantum's Cobre Panama mine about to impact 1.5% of the world's copper production, I thought it would be interesting to see where some of the others in the global top 10 are at:

- Escondida

Owned by the world's biggest copper miner and operating in the world's biggest copper producing country, Chile’s Escondida remains by far the top producer in the world, again surpassing the one-million-tonne mark.

As of July, 2022: BHP sees production increasing to between 1.08Mt and 1.18Mt in 2023 and the medium-term guidance of an average of 1.20Mt/y over the next five years remained unchanged.

However, aside from repeated threats of strikes in 2022, Escondida's ability to combat declining head grades remain an issue.

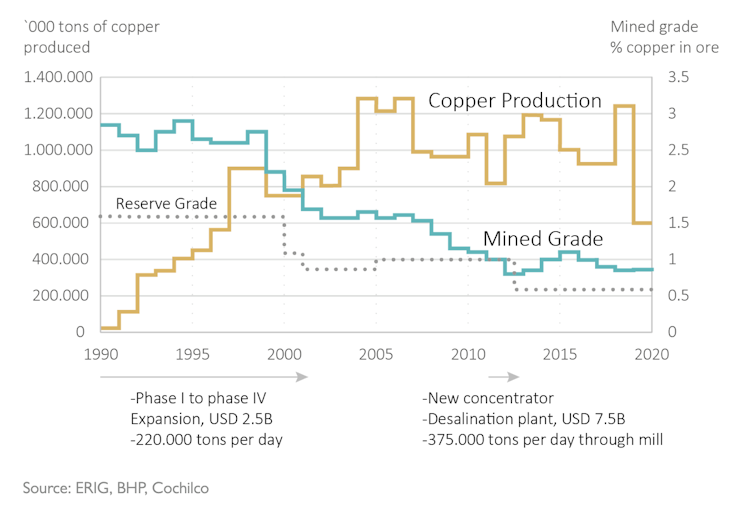

When Escondida started production in early 1990, the mine was very rich in copper with a mining head grade of around 2.5-3% copper. The mine expanded quickly, implementing four major expansion phases until the Escondida concentrator reached daily throughput volumes of around 200,000 tons. Around 800,000 tons of copper were produced annually by the year 2000. With the richest portions of the ore body being mined around the turn of the century, the grades started to drop off quickly. The reserve grade, the grade used to calculate the future ore tonnage to be mined, was continuously adjusted downwards and is today around 0.5%, around a third of what it was when the operation started.

BHP continued to expand the Escondida concentrator in order to increase mined volumes and to keep up copper production volumes to compensate for the declining grade. By doing so, BHP invested close to USD 10B to date through several expansion phases. Today, the mine processes an incredible 375,000 tons of ore per day. Since the start of the operation, mass handling and material movement have roughly tripled.

This case study impressively illustrates the problem the mining industry is confronted with today. Declining ore body grades require ever-increasing tonnage to be moved and processed. This requires large amounts of capital, as well as commodity prices that allow such large, earth-moving exercises to be performed in a profitable, and sustainable way.

- Collahuasi

Collahuasi, also in Chile and jointly owned by Anglo American and Glencore is in second place, with 630 kilotonnes (Kt) grading 0.81% Cu produced in 2021.

Anglo American cuts 2023 copper output target on poor Chilean ore grades

Global miner Anglo American Plc (AAL.L) on Friday cut its copper production estimates for 2023 because of deteriorating ore grades at its Chilean mines, and trimmed the higher-end of its output target for 2022.

The London-listed miner expects its copper mines to produce between 840,000 and 930,000 tonnes in 2023 compared with a prior estimate of 910,000 tonnes to 1.02 million tonnes.

In 2022, Anglo aims to produce between 650,000 and 660,000 tonnes of copper compared with the earlier guidance of 640,000 to 680,000 tonnes.

- Grasberg

Indonesia's Grasberg operations, owned by Inalum, come in third, churning out 606 kt grading 1.07% Cu during the year.

The full ramp-up of the Grasberg underground mine will support growth in Indonesia’s production levels to 701.9kt in 2023, with daily average production capacity at the mine gradually increasing from 30kt in 2020 to 130kt in 2023.

- El Teniente

Back in Chile, Codelco's El Teniente produced 459.8 kt of copper grading 0.83% in 2021.

State-owned Codelco slashed 2022 production guidance, revising expected output down to 1.49 Mt to 1.51 Mt of copper from 1.61 Mt. Codelco, the world's top copper miner by output, cited lower grades at its Ministro Hales mine and poorer processing and recoveries at the Chuquicamata and El Teniente mines as weighing on production.

- Antamina

A joint venture between BHP and Glencore, Peru's Antamina mine is in fifth place, producing 429.6 kts grading 0.91% Cu.

Protests against the ouster of President Pedro Castillo are starting to disrupt the movement of staff and supplies at Cerro Verde and other copper mines in Peru, the No. 2 supplier of the metal.

While BHP Group and Glencore Plc’s Antamina mine in north-central Peru is running smoothly, Chief Executive Officer Victor Gobitz said mines in other regions are encountering setbacks to the free movement of people and supplies.

Antamina has ~5 years of mine life left.

Antamina, Peru’s largest copper mine, hopes to get the go-ahead from the country’s environmental authority early next year to extend the useful life of its deposit to 2036, the company’s chief executive officer told Reuters.

Antamina had announced in April an expansion project that includes investments of $1.6 billion to extend the mine’s useful life, currently set to expire in 2028.

“In an optimistic scenario, we should have the approval by the end of this year or the beginning of the next,” Antamina CEO Victor Gobitz said late on Monday, adding that the approval would give the base metals miner a green light for its planned investments.

Antamina is co-owned by Glencore PLC, BHP Group Ltd, Teck Resources Ltd and Mitsubishi Corp. Peru is the world’s second-largest producer of copper.

Gobitz said Antamina is waiting for a response from local authority Senace to the company’s request to modify its environmental impact assessment, which currently allows for the mine to operate only until 2028.

He said that Antamina, as part of that process, is currently carrying out a third and final “public participation” with residents of the northern Andean region of Ancash, where the mine is located.

“The operational footprint remains the same and production would not change,” he said.

- Buenavista

In Mexico, Southern Copper's Buenavista mine churned out in 2021 422.8 kt grading 0.32% Cu.

The Buenavista open-pit copper mine in Sonora, Mexico is one of the biggest porphyry copper deposits in the world. Southern Copper Corporation, a subsidiary of Grupo Mexico, is the 100% owner and operator of the project.

Producing since 1899, it is the oldest operating copper mine in North America. The deposit was mined exclusively through underground methods until the Anaconda Company started open-pit operations in the early 1940s.

Grupo Mexico has continuously expanded the Buenavista operation since it acquired the property for £290m ($475m) in 1990.

The Buenavista mine produced 965 million pounds (Mlbs) of copper in 2019 which accounted for approximately 44% of Southern Copper’s total copper production during the year. The mine also produces silver and molybdenum as by-products.

Scheduled for commissioning in the second half of 2022, the Buenavista zinc project is expected to produce 80,000 tonnes (t) of zinc a year and increase the annual copper production capacity of the mine by 20,000t.

- Cerro Verde

Cerro Verde in Peru, owned Freeport Mc-MoRan is in seventh place, producing 402.3 Kt in 2021, grading 0.36% Cu.

Protests against the ouster of President Pedro Castillo are starting to disrupt the movement of staff and supplies at Cerro Verde and other copper mines in Peru, the No. 2 supplier of the metal.

While on-site operations at mines have been unaffected by roadblocks and airport and rail shutdowns, off-site logistics have encountered some delays. Cerro Verde, near the southwestern city of Arequipa, is experiencing holdups in transport of people, supplies and product, owner Freeport-McMoRan Inc. said in an email late Monday.

- Morenci

Freeport Mc-MoRan's majority owned Morenci mine in Arizona is the biggest copper mine in the United States, and no. 8 in the world, churning out 397.3 kt grading 0.29% Cu.

The Morenci copper mine is in Greenlee County, Arizona, in the southwestern part of the US. It is among the largest copper producers in North America.

US-based mining company Freeport-McMoRan (FCX) operates the Morenci project.

The company owns 72% of the project while the remaining 28% is held by Sumitomo Metal Mining’s subsidiaries Sumitomo Metal Mining Arizona (15%) and Sumitomo Metal Mining Morenci (13%).

The mine area spanned more than 61,700 acres as of 31 December 2021. Operations at the open-pit mine are expected to continue until 2041.

- KGHM Polska Miedz

Poland's national KGHM Polska Miedz Mines are in ninth place, producing 391.2 kt during 2021.

(unable to find current data)

- Cobre Panama

Rounding out the list is First Quantum Minerals' Cobre Panama mine in Panama, which produced 331 kt grading 0.37% Cu for the year.

Panama's government ordered Canada's First Quantum Minerals (FM.TO)on Thursday to pause operations at its flagship copper mine in the country after missing a deadline to finalize a deal that would have increased payments to the government from the mine.

The government had given Minera Panama, which is majority-owned by First Quantum Minerals, until Wednesday to sign an agreement reached in January to pay $375 million a year to the government from its Cobre Panama mine.

MINING.COM

The world’s 10 largest copper mines

Copper is a metal essential to construction, manufacturing industrial machinery and to the green energy transition — and demand is increasing worldwide. […]

Already have an account?