Trending Assets

Top investors this month

Trending Assets

Top investors this month

The GoRozen Split: A Formula For Success Includes Agriculture

In one of Goehring & Rozencwajg’s top posts of 2022, “The Commodity Bull Market Has Only Just Begun” they mention a frequently asked question:

“Have I missed it - is it too late to make an investment in natural resources?”

Since their June 16th blog, many commodities & related equities have further declined and are undervalued, perhaps more than any other time in history.

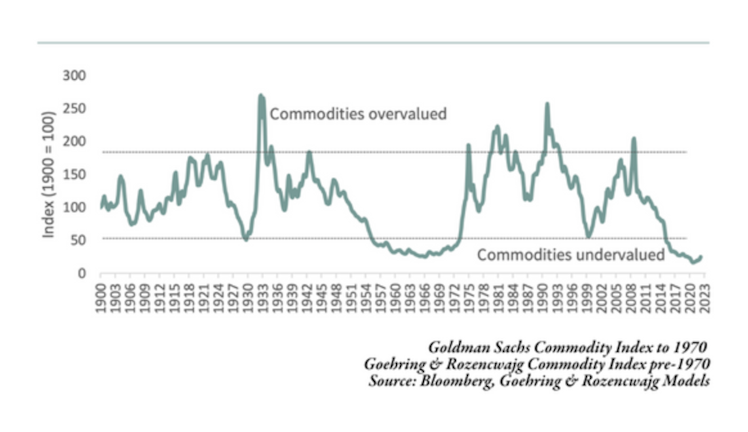

This chart shows the returns of the Goldman Sachs commodity index versus the level of the US stock market, as measured by the Dow Jones Industrial Average.

Over the last 130 years, there have been four times when commodity markets became radically undervalued versus the stock market: 1929, the late 1960s, the late 1990s, and today.

According to their research, constructing a natural resources equity portfolio that consisted of 25% energy, 25% metals and mining, 25% precious metals, and 25% agriculture would have significantly beaten the stock market in each of these cycles.

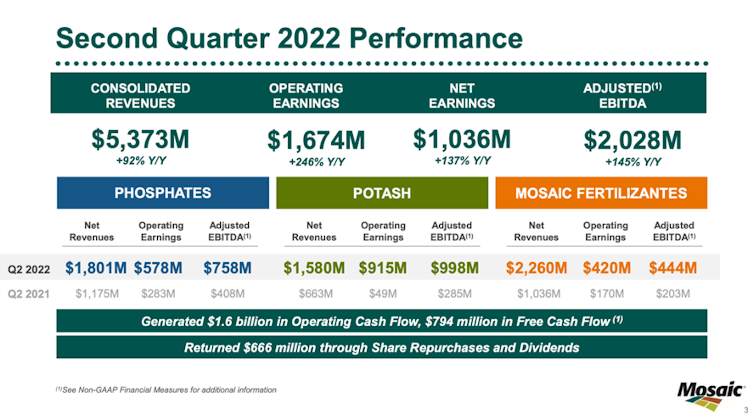

I have written previously about energy, precious & base metals/mining, but haven’t yet mentioned agriculture. I had been waiting to re-enter the sector as many equities spiked following Russia’s invasion of Ukraine. At the time I held the ETF $WEAT and a small position in $NTR, which I fortunately sold close to the top. Having come off their 52wH’s after large upward moves the past 12 months, I am in agreement with GoRozen -- stating fertilizer stocks “remain extremely cheap based upon their earning power”.

On April 21, GoRozen came out with another research report about the natural gas crisis. In the report they discuss why the global shortage of fertilizer is a huge problem, potentially one of catastrophic proportions.

In Europe & China, surging natural gas and coal prices have severely disrupted nitrogen and phosphate fertilizer production. Fertilizer shortages were created in Australia and South Korea, as Russia and China banned urea and phosphate exports. With Russia and Belarus supplying almost 40% of the world’s potash, the impact on the global fertilizer market has been enormous.

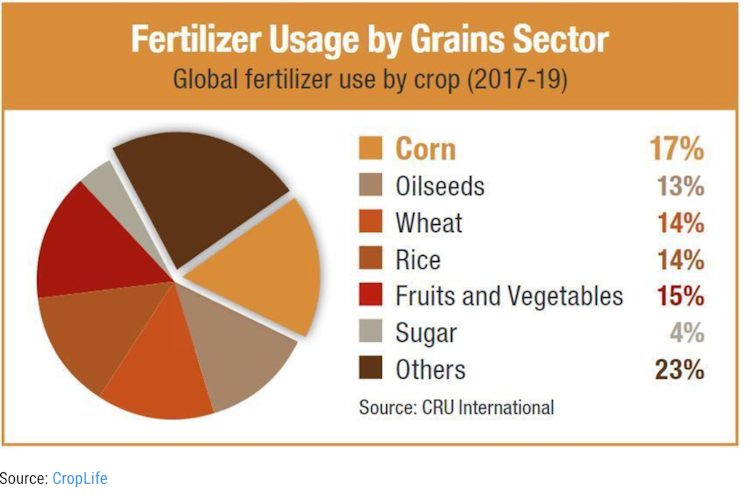

The size of the global grain harvest has grown over the past decade and fertilizer applications have seen a significant increase. Nitrogen has had its production cut by 5% in Europe, and Russia constitutes 30% of the total export market. The availability of nitrogen will have an impact on yields, as GoRozen estimates that as much as 40% of the coarse grain yield increase since 1961 can be attributed to increasing application of nitrogen.

As countries seek to provide for their own citizens first, fears of scarcity and price increases could see the emergence of food protectionism for the first time since the 1970’s. Countries are likely to restrict agricultural exports and prices will be driven up further.

Another catalyst for a rise in fertilizer prices could be an expected announcement from the Biden administration, ruling that annual biofuel blending mandates for the refining industry could last for three years rather than one. The extension of the E-15 mandate is expected to provide additional demand pressure on corn, though to what degree remains uncertain.

The Inflation Reduction Act, a massive climate legislation deal, included extended credits for biodiesel and incentives for sustainable aviation fuel needed to reduce emissions from the airline industry. Biofuel advocates say rising public subsidies for the industry could also grow production in unexpected ways.

Lastly, weather patterns have proved challenging for crop yields. GoRozen anticipates a cooling trend driven by declining sun-spot activity will produce adverse conditions that could severely “hinder global grain harvest” for the long term.

Fertilizer producers admittedly aren’t among the sexiest segments of the market. But they produce a product which is vital to ensure our high standard of living. For without modern farm chemicals, high-production agriculture would be impossible and our grocery bills would be considerably higher. While farmers are among America’s unsung heroes, agri-chemical producers are equally under-appreciated.

To understand what drives the fertilizer industry, it’s first important to know what the main fertilizers are used for. For those of you who don’t garden, the three macro nutrients essential for healthy plant growth are nitrogen (N), phosphate (P) and potash/potassium (K). Sulfur (S) is needed in smaller amounts than the other three, but is often used as a soil amendment. Fertilizer producers often specialize in just one of these three nutrients, or sometimes all three.

Nitrogen fertilizer is made through a combination of natural gas and air, while phosphate and potash are typically mined from the earth, although some commonly used fertilizers—such as monoammonium phosphate (MAP) and diammonium phosphate (DAP)—combine nitrogen with phosphate rock.

It’s also useful to know that nitrogen is the most widely used nutrient, especially in corn and grain crop production, while phosphates and potassium are mostly used in legumes, fruits and vegetables.

Fertilizer companies ultimately profit from buoyant N-P-K prices, and rising nutrient prices are determined by three key variables: 1. rising crop prices (and thus rising fertilizer demand), 2. input costs (e.g. natural gas prices) and 3. currency factors (e.g. inflation).

The current inflationary backdrop is particularly worth mentioning. In fact, some of the strongest bull markets in fertilizer stocks have occurred when the inflation rate was increasing at a sustained fashion over a period of several months to years. Today’s inflationary trend is a prime reason why fertilizer stocks are strengthening, for dollar weakness—plus supply constraints—typically translates into commodity price strength.

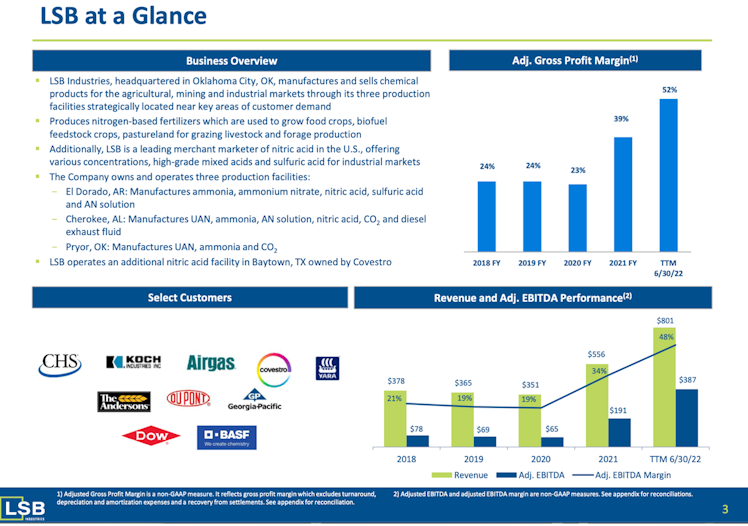

For those looking to invest in the sector, other suggestions for your watchlist include $CF (CF Industries Holdings, Inc.), $NTR (Nutrien Ltd.), and $UAN (CVR Partners, LP).

Please DYODD and I’m happy to answer any questions that I can.

Cabot Wealth

3 Fertilizer Stocks for Hedging Inflation

Fertilizer stocks may not be the most glamorous option for your portfolio, but they're a great inflation play. Here are three that are making a big move.

Already have an account?