Trending Assets

Top investors this month

Trending Assets

Top investors this month

Uncut Gem - $SURG (started a position - anything under 4.50 is gravy)

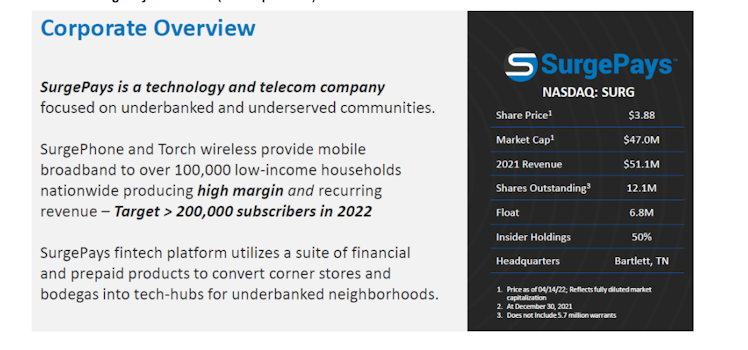

Uncut Gem - $SURG (started a position - anything under 4.50 is gravy) - this caught my attention after the Mint Mobile acquisition over the last couple weeks.

This company has a lot of potential. Playing a small fish in a big pond with ACP. Finally, is doing all the work that no one wants to put the effort into. Underbanked community. However, once successful, I think someone will see what I see and want to take them out.

OVERVIEW

SurgePays recently (on March 30) reported its fiscal Q4 2022 (ending December) results.

Revenue was $36 million (+156% y-o-y), compared to our estimates of $45 million and consensus of $43 million.

EPS was $0.23, compared to our estimates of $(0.04) and consensus of $(0.01).

Q4 revenue guidance was $45 million. In early March, the company had preannounced Q4 revenues of $35 - 36 million.

The company provided initial 2023 guidance for revenue of “at least” $190 million (+56%).

We are adjusting our 2023 estimates for revenue to $190 million, from $200 million, and for EPS to $0.40 from $0.12.

We are initiating our 2024 estimates for revenue of $228 million, and for EPS of $0.67.

ADDITIONAL DETAILS

Gross profit for the quarter was $6.7 million, compared with our estimate of $2.2 million.

Gross margin for the quarter was 19%, versus our expectation of 5% and 13% last year.

Operating expenses were $3.2 million, versus our expectation of $2.7 million.

Operating income was $3.5 million, versus our expectation of a loss of $0.4 million.

Net income was $3.0 million, versus our expectation of a loss of $0.4 million.

In November 2021, the company’s stock was uplisted to the Nasdaq Capital Market (from OTCQB).

In November 2021, the company effected a 1-for-50 reverse stock split.

In February 2021, the company filed a Form S-1 registration statement with the SEC for the planned sale of ~25% of LogicsIQ

shares to the public (IPO). LogicsIQ will remain a majority-owned subsidiary of SurgePays. The exact details and timing of the

spinoff/IPO, capital structure, and management teams will be determined later.

In April 2022, the company announced the acquisition of Torch Wireless, a provider of wireless broadband with the FCC’s

Affordable Connectivity Program (ACP) in a cash and limited royalties deal. The purchase price was ~$800,000.

The company’s balance sheet had $7 million in cash and $8 million in debt, compared with $8 million in cash and $13 million in debt

at the end of September. In November, the company announced a new $25 million credit line

The first thing I thought of when I saw the title was Julia Fox saying "uncut jaaaaeeems" lol

Do you know if they have plans to acquire newer players like PureTalk (https://www.puretalk.com/)? Regardless, this is definitely on my radar now thanks to your write-up!

Already have an account?