Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Investors

Hello everyone, I am noticing a lot of new faces following me today, so just wanted to say that if you are interested in dividend investing, then you can follow me :)

Some other great dividend investors here are @investor_from_nepal @thedividendpig @dividenddollars @stock.owl @dollarsandsense @scorebdinvestor and @yan_c_ospina.

A little bit about me

I have been investing for a long time, mostly in GARP and special situations, but this year (2022) I embarked upon a project to max out my £20K annual tax-free ISA allowance (like a Roth IRA but for the UK, and more efficient) to build out a dividend growth portfolio.

I document the construction of that project portfolio right here on Commonstock, and share every purchase, dividend, and my thoughts, transparently.

Below is an example of my February Update, only two months into the project. I will be sharing my March update soon.

----------------------------------

The following text is copy/pasted from my Commonstock post at the end of February.

February Dividend Growth Portfolio 2022

As the second month of this project comes to an end, I will share my activity for February. As a reminder to readers, the first year of this project will likely be a build-out phase until I conduct the necessary research on single stocks I want to own and construct the desired weightings of the portfolio. Interested readers can find more details about this project in "Maiden Post of Reasonable Yield", and the first month's update at "January Portfolio 2022".

As a reminder, in the maiden year of this project, I am seeking to grow the annual dividend income to £350 to form a base from which to expand in the coming decade. A further reminder to any potential newcomers, the goal of this project is to max out the £20,000 annual ISA limit, and build a robust, yield-bearing dividend growth account.

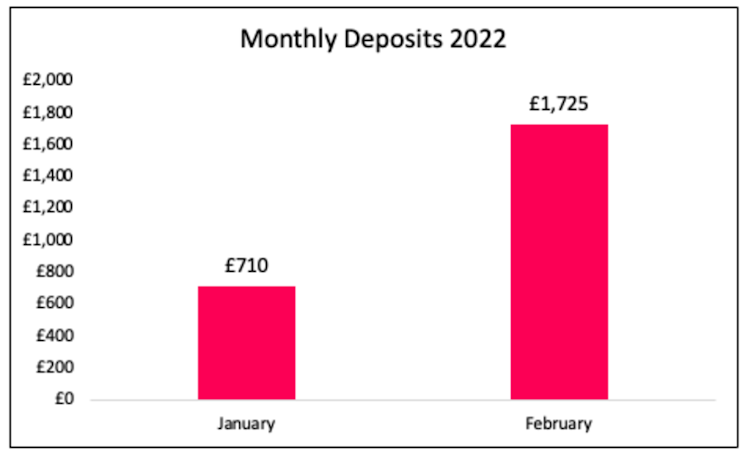

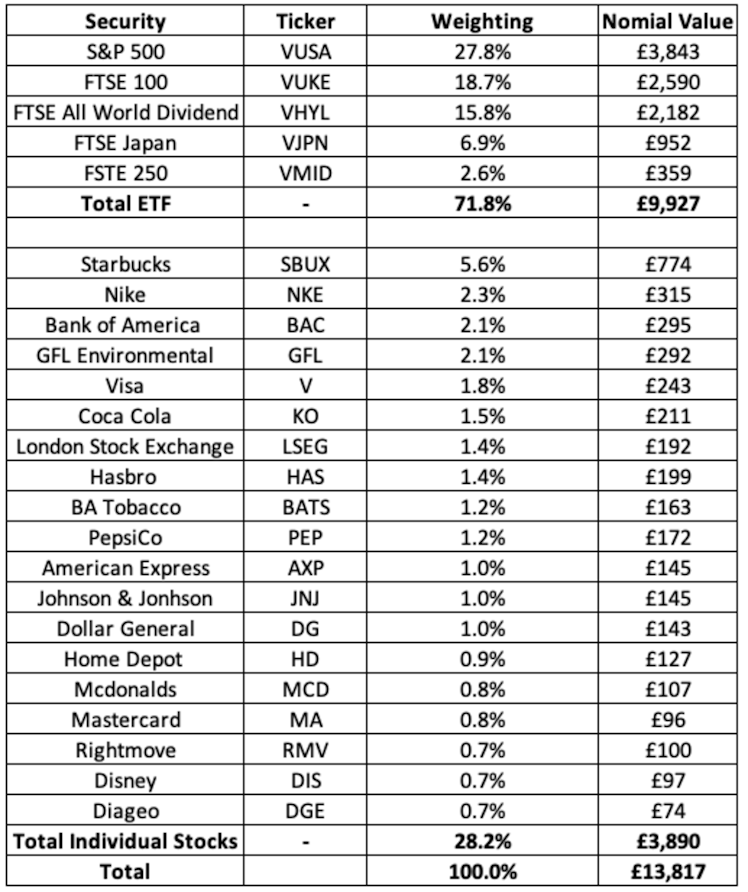

In February, £1,725 was deposited and invested, meaning a total of £2,435 has been invested this year, excluding the initial £10,000 or so that was allocated in December to create this pre-fund account and kick start this project. Thus, bringing the total value of the DGI portfolio to approximately £13,800. Dividends collected in February included a £2.69 dividend payment courtesy of British American Tobacco $BATS, as well as £2.15 from Starbucks $SBUX. I intend to report the dividend collection more thoroughly when the portfolio is built-out and generating material dividends.

Activity in February

Selling is not an activity that I intend to engage much in during the initial build-out of this portfolio, but this month I sold the position I owned in VFEM, an emerging market ETF listed by Vanguard, in wake of the uncertainty surrounding EMs. I felt the capital was better placed elsewhere. It was a small (2%) position.

This month, I opted to allocate more readily towards ETFs, in order to build up the annual dividend income (in anticipation of Q1 payments from Vanguard ETFs).

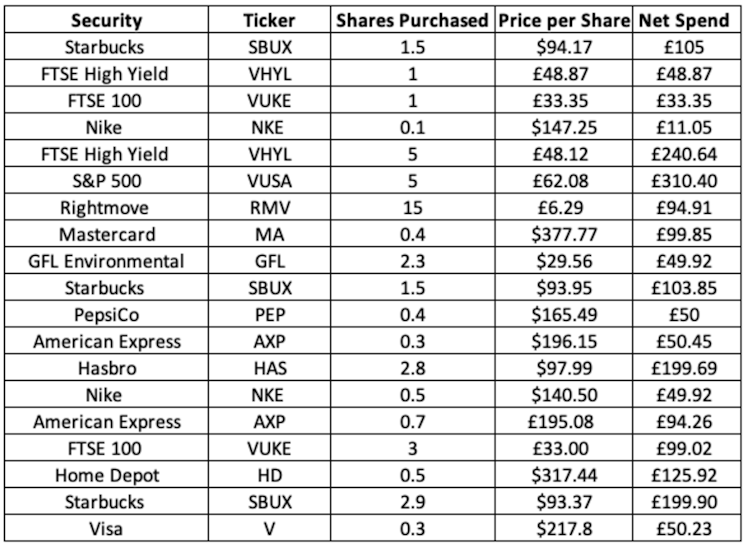

Above is a table of the purchases made during the month of February which includes new positions in; American Express $AXP, Home Depot $HD, Hasbro $HAS, Rightmove $RMV, American Express $AXP, and Mastercard $MA as well as additions to pre-existing positions.

Some commentary on a select few of the names I have been adding to this month.

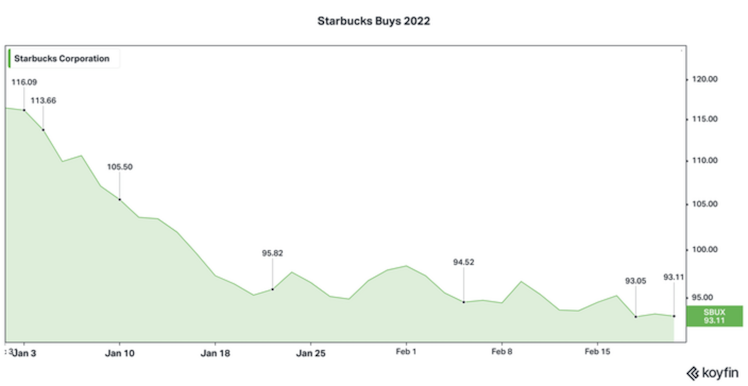

Starbucks (SBUX): The company is undergoing some tension from a recent unionisation effort. After the successful unionisation of two NY stores in December (and a third store in Memphis more recently), and the dismissal of 7 Memphis employees (for organising), this sparked a nationwide outcry, followed by over 110 stores now signing up with the intent to follow the same course of action as Buffalo. Starbucks' Q1 earnings showed that demand was strong, but that near-term margins are suffering at the hands of inflationary pressure, increased training costs, and good old supply chain disruption.

Unionisation only looks set to further dampen EBIT margins in the future but was not discussed during the call. However, management has committed to reinvestment in China, and the payment of dividends. Whilst the union possesses a threat to the LT margins of the business, and general partner morale, I do not believe it takes away from the company's status as an attractive dividend growth prospect, with attractive reinvestment capabilities to further grow their operations. At a dividend yield of 2.05%, and a rich history of dividend increases, I see this as an attractive prospect.

I have been pretty active buying up $SBUX stock this year. So far, I have bought shares on seven separate days in 2022 for an average price of $100 per share. I believe that the stock now trades at a fair valuation at around 17x 2023 EBIT, with a bountiful amount of share repurchases scheduled for the next three years, and plenty of FCF to increase dividends.

Although near-term margins look to be suffering (primarily as a result of the inflationary environment) and the China business is still lagging behind (the result of covid mobility restrictions), I think this company is priced at a reasonable valuation and is a great fixture in a DGI portfolio. I plan to continue buying in the $80-$90 range all year round.

Hasbro (HAS): Hasbro has long been a poorly managed enterprise, milking their high-margin 'cash cow' business, the Wizard of the Coast, home to popular trading card and community games, Magic the Gathering and others. Of late, shareholder activism has taken place (read here), and this created an attractive potential catalyst for the business, in light of the activist proposing a spin-off for this WOTC unit. Whilst the consolidated business yields 2.78%, I agree with the case study shares above, in that both the WOTC and RemainCo will be better businesses when separated. If the deal goes through, the HAS stock will endure a forced re-rate, at which point I may consider selling. Should I hold until the spin-off period, I am more so inclined to sell the WOTC business, and keep the RemainCo, under the condition that things actually improve without their cash cow, and the business becomes a more prudent capital allocator. One can dream.

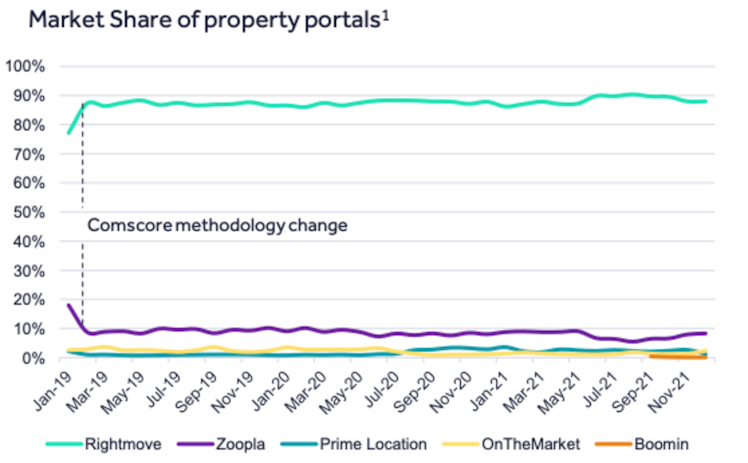

Rightmove (RMV): Rightmove, a UK-leader in the rental and home listings space, is a high-margin, market leader that has now emerged from the pandemic. After cancelling dividends in 2020, the company is now back on track paying semi-annual payments. While I adore near-monopoly-like businesses, Rightmove faces a great deal of competition but has the capital superiority to ensure they remain on top, building on top of their already market-leading product. For the FY21 year, revenues are back up to £305M (£205M FY20, £289 FY19), with site traffic at all-time highs, and advertisers and ARPA now showing signs of recovery. Operating margins (74%) are now back to pre-covid levels. Coming out of the tumulous 2-years, Rightmove continues to have a ~90% market share of property rental.

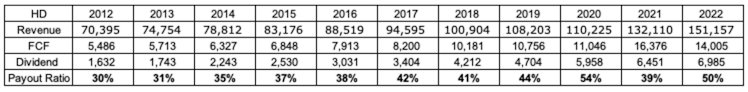

Home Depot (HD): A business I have been watching for some time. After a post-earnings rout of share price, I decided to initiate a small position. A strong Q4, with weak guidance and a 15% dividend hike, meaning HD's shares trade at a 2.36% forward yield. While the guidance is weak, I am not a bottom-timer and am happy to own (and add) to this business for years to come.

Home Depot has shown consistent revenue growth, a history of dividend growth, and has managed to do so whilst continuing to grow free cash flow and maintain a healthy payout ratio for their dividend. From 2012 through 2021, dividends have grown by a CAGR of 20%.

Mastercard (MA) and American Express (AXP): I am not gifted at the financial analysis of banks, payments businesses, and the like. To compensate for this, I tend to basket exposure to this industry, namely with Visa, Bank of America, and now American Express and Mastercard. Picking between the rails of modern finance (Visa, Mastercard) is too difficult for me, so I choose to own both. Moreover, American Express, a company I have long followed, is slightly differentiated with respect to the quality of their consumers, and Bank of America (alongside JP Morgan) is one of the top 2 banks in the States, and both have excellent CEOs. I don't currently own JP Morgan but may do in future after I spend time revisiting the business after a few quarters of absence.

As things stand, here is a table of the current holdings.

In the future, I intend to continue researching new companies and may add more. I am particularly interested in gaining REIT exposure in the coming quarters. The goal for this year is to bring the composition of individual stocks closer to a 50% weight and max out the ISA allowance for the next tax year, which begins in April. Thus, by the end of this year, the portfolio should more than double, reaching close to £30,000 - £35,000 depending on the timing and sizing of deposits. The following year, it should near-enough double once more. I thank you for following me on this journey.

That will be all for this month.

Thank you,

R.Y

Already have an account?