Trending Assets

Top investors this month

Trending Assets

Top investors this month

We Should All Be Feeling a Little More Happier about our Portfolios !

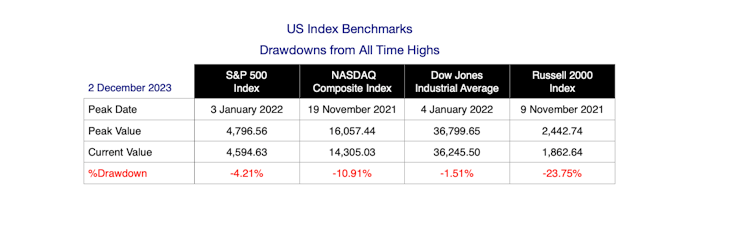

November turned out to be a cracker, almost fully recovering the -10.3% down leg we suffered from late July. The following table shows the current gap from the all time highs for each major US index:

The S&P 500 index and the Dow Jones are a stone's throw away from reclaiming all time highs. The tech-laden NASDAQ composite index has some way to go, while the small-cap focused Russell 2000 Index is tail-end Charlie by the country mile. With any luck, the current wave of market optimism continues into the New Year to deliver us new all time highs. I hope Santa is listening.

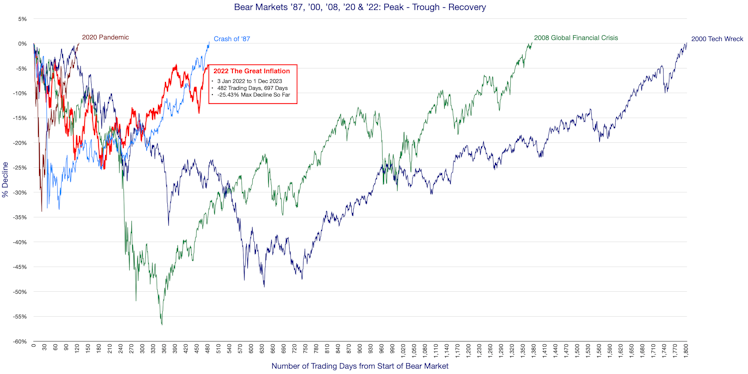

If we look at the chart of the S&P 500 index since the start of 2022, we can see our bear market journey before a gradual ... and sometimes fragile ... recovery. I have to admit, I was feeling a little nervous when the recovery stalled and we had to endure another -10% down leg. The rally in November was quite a relief.

If we look closer at the technical picture, this recent up leg restores the bullish optimism as we're trading well above the up trending 50-day and 200-day moving averages. We should expect the possibility of some friction around the 4,600 to 4,610 level. Don't be surprised if the market takes a bit of a breather and finds resistance here. If we blow past this level, there's a good chance the market has enough exuberance to challenge the all time highs. Wouldn't that be something ??

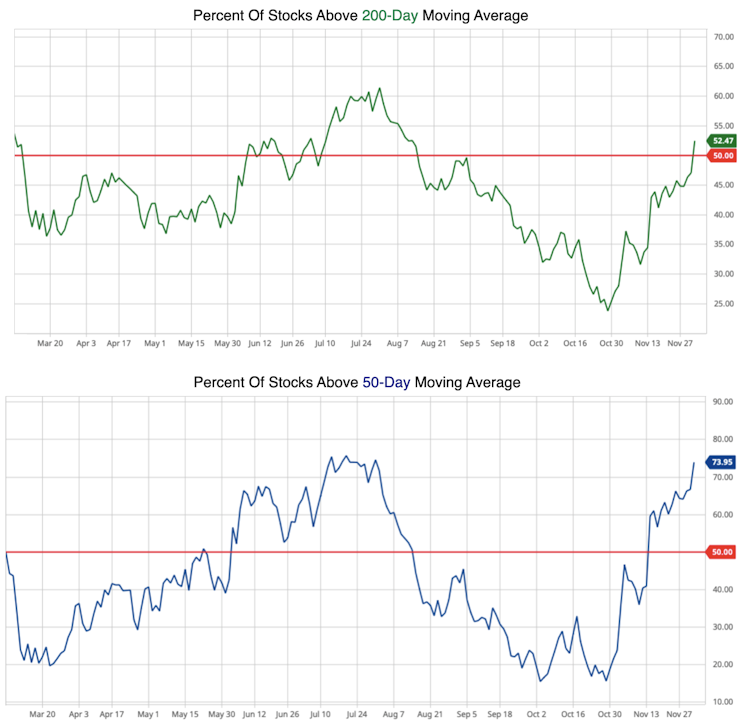

One of the criticisms of this market rally has been the concentration of gainers has been very top heavy. The mega-cap tech companies have been the key stocks driving the indices higher. Looking at the market breadth, we can see a smidgen above 50% of stocks trade above their long-term moving average. Breadth comes in at a healthier 74% of stocks trading above their shorter term 50-day moving average. This is a reflection of the strong November we had in the market. If we want to see a sustainable rise to new all time highs, we preferably want to see the majority of stocks trading above their long-term moving average. A market is healthier when a broad range of stocks drive the market higher.

Finally, let's compare this current bear market to the ones of the recent past. It's looking like our recovery might take a little longer than the bear market of '87, but we've hopefully and thankfully avoided the deep drawdown and the long, protracted recovery of the calamitous 2000 and 2008 bear markets. This one certainly felt long enough thank you.

Let's hope December continues our good run. There's nothing better than celebrating Christmas and New Year with a stock portfolio at all time highs ! Opening that bottle of bubbly would feel oh so sweet.

Already have an account?