Trending Assets

Top investors this month

Trending Assets

Top investors this month

TA Opinion: S&P 500 index Chart Technicals looking Precarious

It's been a while since I last posted. We were enjoying a very nice (but cold) vacation in Queenstown NZ. Unfortunately on our return, we tested positive for Covid after feeling a little under the weather. This took us out for another week. We're just getting fully recovered now.

during my vacation I noticed our market recovery seems to have spluttered. I'm sure everyone's portfolio has felt the effects. Stubborn inflation, high interest rates, prospects of another potential rate hike, wars, an unsettled political landscape ... these all contribute to poor investor sentiment. The technical analysis picture is looking a little gloomy with the S&P 500 index dipping just below the all important 200-Day SMA. The 50-Day SMA is in a downtrend showing how weak we are short-term.

We don't really want to stay below the 200-Day SMA for long. If the selling pressure continues, then we really need to see support at the 4,200 key level. If that level fails to hold, then it's less clear where buying support will eventually step in. One can only hope the investors and traders who are in "risk off" mode have already sold down their positions and the selling pressure eases. Unfortunately, these things can feed on itself. Selling pressure causing prices to fall, tipping more nervous investors into selling.

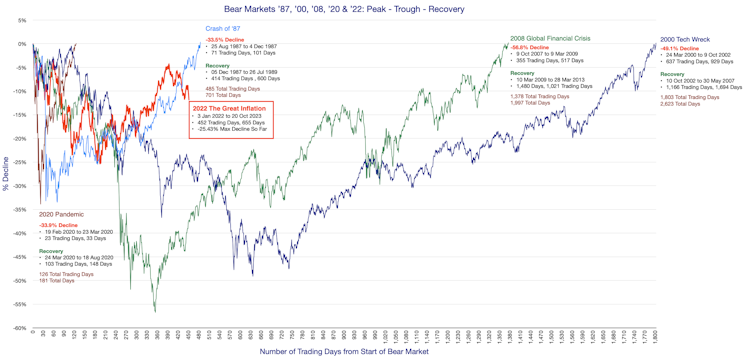

When we look at our recovery from "The Great Inflation" bear market, we've stalled. Our recovery was tracking in line with the Crash of '87, but this recent down leg seems to have dashed that hope. This is the thing about the stock market - hopes get dashed and patience gets worn down. Mr Market likes to inflict maximum pain, and if he can't do it by inflicting the deepest of drawdowns, he'll certainly make the recovery agonisingly drawn out and tiresome.

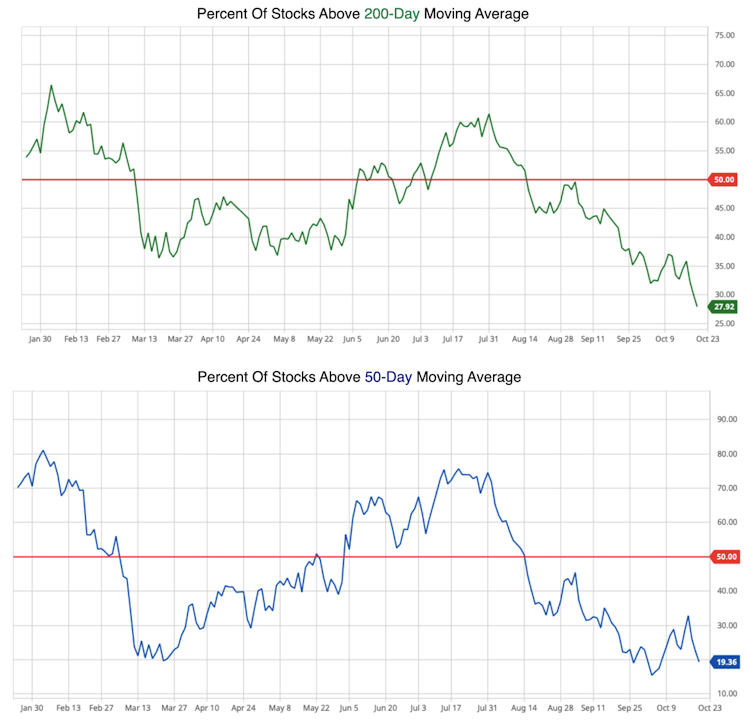

Market breadth is a stinker as well. We've always knew the market recovery was largely being led by the mega-caps. The hope was the market rally from bear market lows would eventually broaden. But the percentage of stocks above their 200-Day and 50-Day SMA has really taken a tumble in recent months.

As usual, there's not much for a long-term investor to do other than grind it out and stick to plan. Keep putting your savings to work and know the good times will ... eventually ... return. Let's say the last couple of years for investors have been excellent for "character building" !

Already have an account?