Trending Assets

Top investors this month

Trending Assets

Top investors this month

How to Calculate Liquidity Ratios

Liquidity ratios are the lifeblood of financial health.

They help reveal a company's ability to meet short-term obligations promptly.

Let's learn how to calculate them.

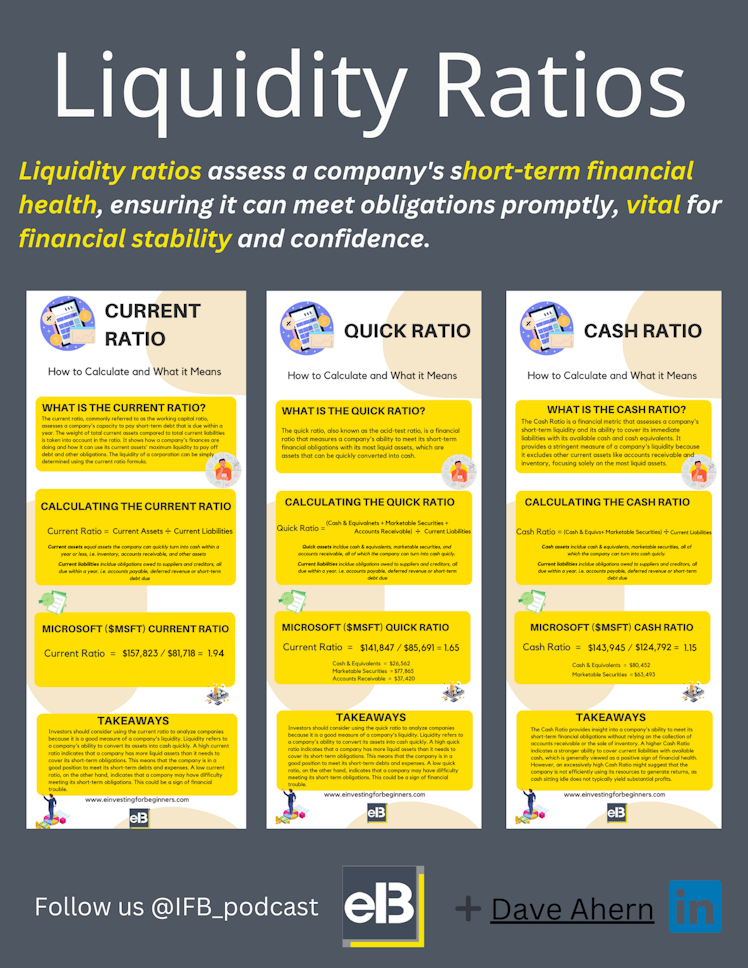

Liquidity ratios are essential financial metrics that evaluate a company's capability to satisfy its short-term obligations.

They offer valuable insights into an entity's financial health, assisting investors, creditors, and management in assessing the firm's ability to cover immediate liabilities.

In this post, we will explore three critical liquidity ratios: the Current Ratio, Quick Ratio, and Cash Ratio.

- Current Ratio

The Current Ratio measures a company's capacity to meet short-term obligations with its current assets.

It is calculated by dividing current assets by current liabilities using the following formula:

Current Ratio = Current Assets / Current Liabilities

- Quick Ratio (Acid-Test Ratio)

The Quick Ratio, also known as the Acid-Test Ratio, is a stricter gauge of liquidity as it includes cash and quivalents, marketable securities and accounts receivable. This ratio provides a clearer picture of a company's ability to meet its immediate liabilities with quick converting assets.

The Quick Ratio is calculated by dividing quick assets by current liabilities with the following formula:

Quick Ratio = (Cash & Equivalents + Marketable Securities + Accounts receivable) / Current Liabilities

- Cash Ratio

The Cash Ratio is the most conservative liquidity ratio, focusing exclusively on a company's ability to satisfy short-term obligations with its cash and cash equivalents.

Cash Ratio = (Cash and Cash Equivalents+ Marketable Securities) / Current Liabilities

So what are good ratios?

Good question.

The ideal current, quick, and cash ratios can vary by industry and company circumstances, but generally:

- Current Ratio: A ratio of > 2

- Quick Ratio: A ratio of > 1 ypically a good benchmark.

- Cash Ratio: A ratio of 0.2 to 0.5 is generally viewed positively.

Thanks for reading and I hope you find some value here.

Already have an account?