Trending Assets

Top investors this month

Trending Assets

Top investors this month

Market Breadth Review - 4th August 2022

I use a range of Measures to get my opinion on the market. I do not use headlines or FED meetings. I look at the price and participation of big money. My opinion on recessions, inflation or interest rates are meaningless. I would much prefer to look at factual information on market participation.

I have been bullish and long positions in the past month. I am still bullish until the market tells me otherwise. I will however take heed of the fact that almost every trade I do is working right now. That is the moment you need to make sure that you protect capital on any turn. I do not want drawdowns and will simply refuse to have them. I see some bases that are wedging upward in popular names. This should urge caution as they are not proper bases.

Conclusion: Short Term Overbought with Improving Breadth. Caution on new positions in the short term.

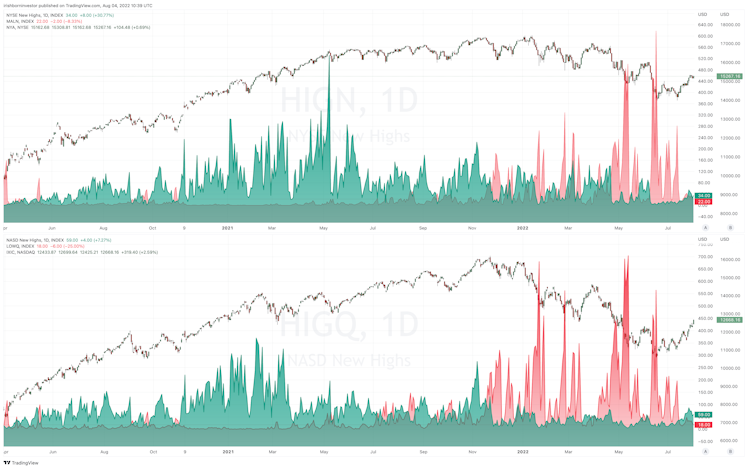

High vs. Lows

Starting with the High vs Lows (Advance Decline). This is one of the measures I quite like and is a useful tool. Note how the Lows began to spike when the market topped in November. The decline in participation was building for weeks. We are finally seeing some improvement with Highs out numbering Lows however it is very low double digit numbers. This could easily reverse. We want to see it in the 100s for any longer term proof.

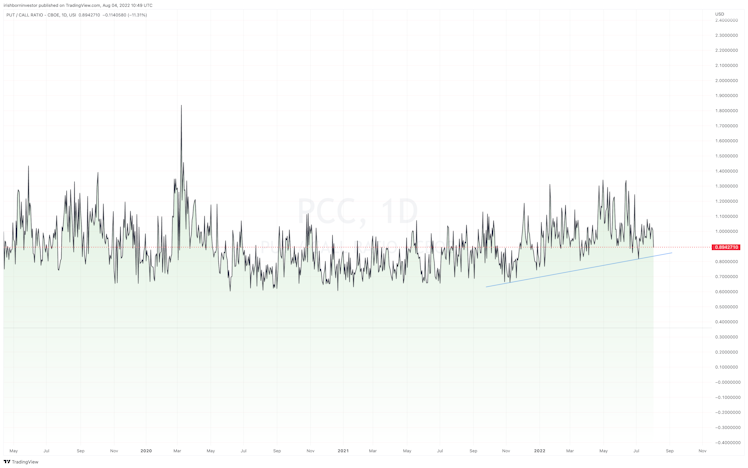

Put Call Ratio

Put Call Ratio below showing that the market is now tilting bullish however we are still making some higher lows on this for what that is worth. I saw a Goldman note this morning that Bullish Call Options were approaching the 2021 Meme Frenzy. That gives me caution here. There have been some insane squeezes in the last few weeks. Put Call hasn't shown a large spike to the 1.6 PLUS area where it has in previous crisis or bear markets.

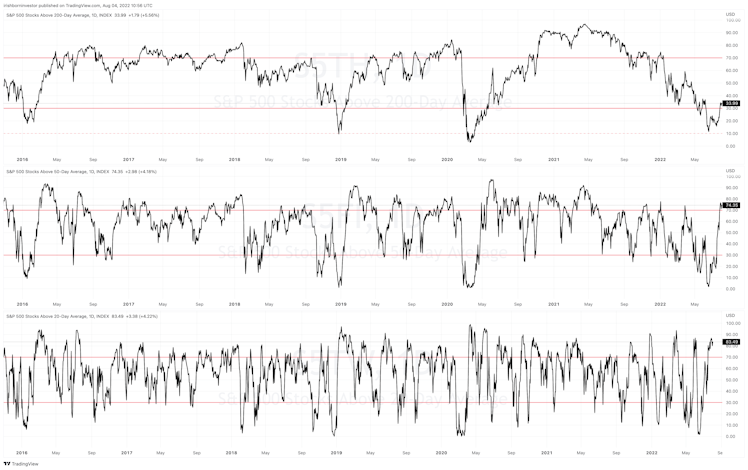

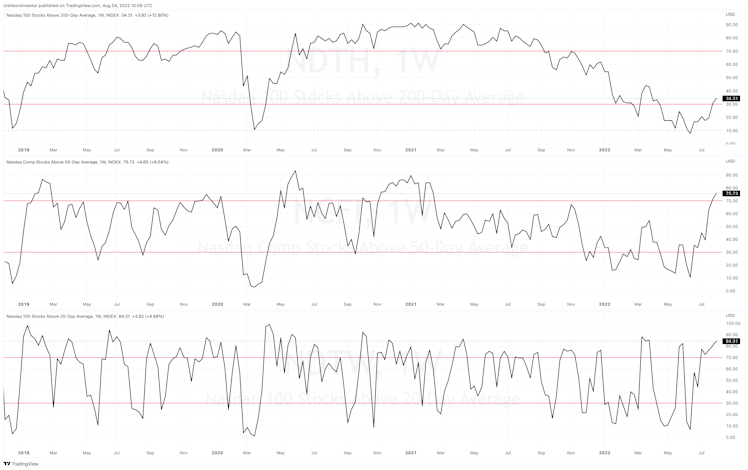

Moving Averages

Stocks above the various moving averages is improving. In my opinion we are currently overbought or very close to it in the short term. This is an important moment in how we will hold up in any potential market breather or pullback.

Already have an account?