Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - HPI & CCI

Stocks are higher today as we await the conclusion of the FOMC meeting tomorrow. The S&P 500 is headed for its best January since 2019. Both the S&P 500 and DJIA are headed for a 3rd green month in the last 4 months.

For economic data today, the S&P Case-Shiller Home Price Index (HPI) fell 0.6% in Nov and was up 7.7% YoY, down from 9.2% last month. The closely watched 20-city HPI fell 0.7% for the month and was up 6.8% YoY, down from 8.6%. The FHFA HPI fell 0.1% in Nov and prices were up 8.2% YoY.

The Employment Cost Index was up 1.0% in Q4, just below expectations of 1.1% and down from 1.2% in Q3. It was the lowest gain in a year. The Fed considers the index an important gauge of inflation.

The Consumer Confidence Index unexpectedly fell to 107.1 in Jan. The index was expected to post a small increase to 109.5. The Present Situation Index rose to 150.0, while the Expectations Index fell to 77.8. An Expectations Index reading below 80 generally indicates a recession is coming within the next year.

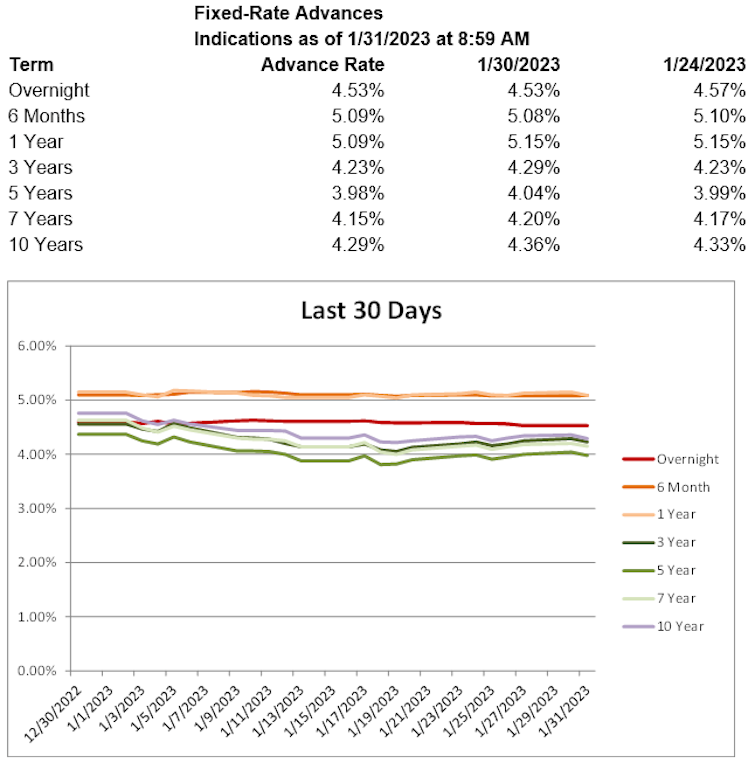

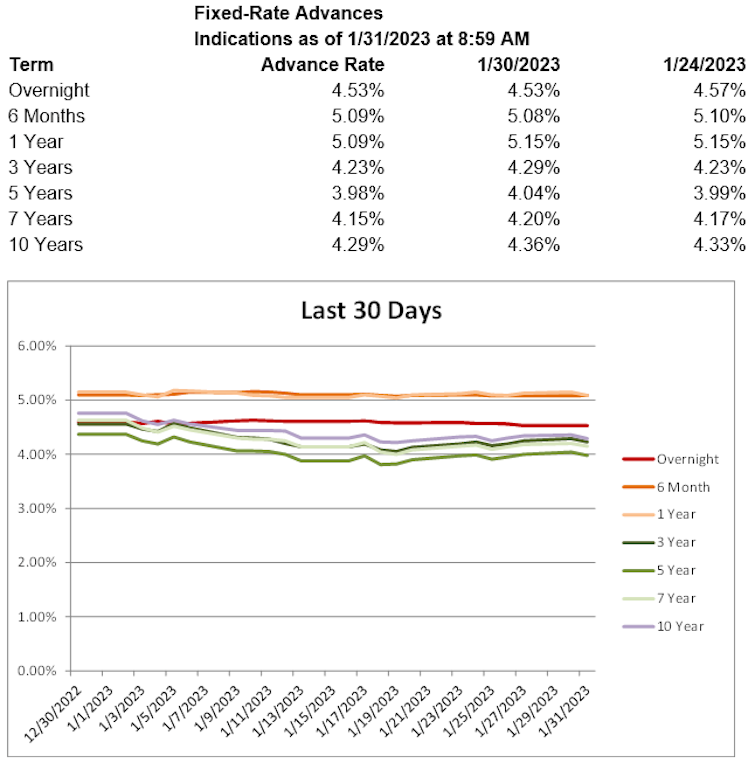

Treasury yields are lower, with the 2-year T yield down 3.9 basis points to 4.22%, the 5-year T yield down 3.5 basis points to 3.65%, and the 10-year T yield down 1.1 basis points to 3.54%. Shorter-term advance rates are mostly higher, while longer-term rates are lower today.

Already have an account?