Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Myth of Financial Literacy (An Opinion)

Poverty does not exist solely because there is ignorance in how to handle personal finances. I imagine that is part of it. But I think most people know perfectly well they should be saving and investing more. They don't because they can't.

People are desperate to make ends meet because the wealthy have been able to leverage their position into better opportunities and policies for themselves.

The number of people trading stocks exploded during the pandemic.

More than 10 million new brokerage accounts were opened by individuals in 2020 — more than ever in a year.

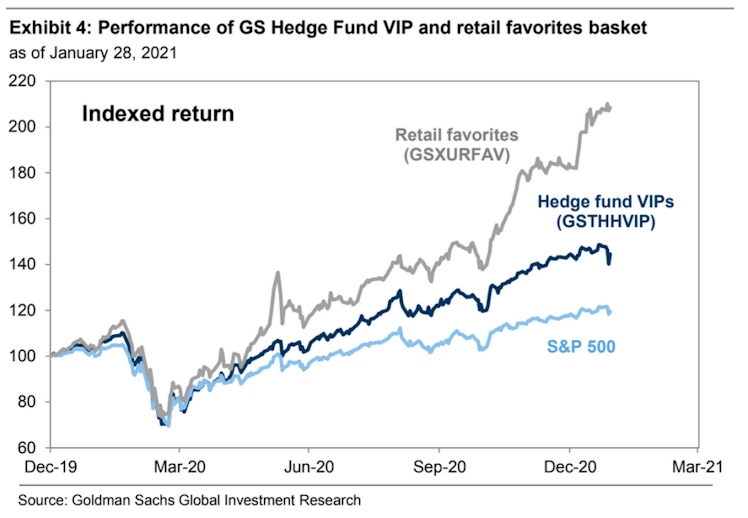

When normal people got the opportunity to invest, how did they do?

They trounced the market:

This suggests that the problem is not "literacy" or "knowledge", but means.

"Financial literacy" is a loaded term. "Literacy" is cultural— not strictly measurable. It may seems innocuous as asking: “can you read or write?...” but there's always the follow up of: “can you read or write well.”

"Can you save and invest?" Seems harmless.

But: "Can you save and invest well?" — implies “...like me and my peers, who already have lots of assets and a different opportunity set.”

Saying there needs to be more "financial literacy" is tantamount to saying 'if those people only knew what I know about finances, they'd be as well off as me."

If you knew what Jeff Bezos knows, would you be as rich as him?

Personally, I don't think so.

There's more to wealth than knowledge. There's also timing (luck), opportunities (luck), initial capital inherited from parents (luck), etc.

Normal people are "financially literate," thank you very much. Give normal people a little bit of capital, and they'll find creative ways to squeeze a company like Game Stop and make money. But you need money to make money. And normal people don't have it.

The entire concept of financial literacy is an illusion suggesting that knowledge can replace the primary concern facing normal people — they do not have enough money.

And that problem is a policy choice.

Detroit Free Press

Why new investors bought stock during the COVID-19 pandemic

New investors tend to be young, lower income, and more racially and ethnically diverse, according to a new study about investing during the pandemic.

Already have an account?