Trending Assets

Top investors this month

Trending Assets

Top investors this month

Axie Infinity ($AXS.X): The "Crypto-Meets-Pokemon" Game

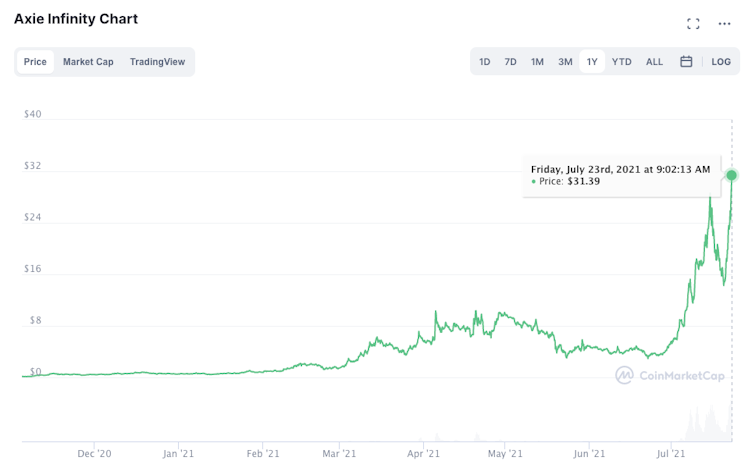

With Axie Infinity up 35% this morning, I thought I'd repost this great synopsis of what it is from the "Coinbase Bytes" newsletter

(Disclaimer: I probably wouldn't chase here, this FOMO rally feels unsustainable)

from Coinbase Bytes:

In the last week, Axie Infinity — a crypto-meets-Pokémon game in which players raise, battle, and trade cute NFT pets called Axies — generated roughly $40 million in revenue, more than all of Ethereum's gas fees in the same period. As the broader crypto market struggles, Axie and its two native cryptocurrencies have been booming. So what's driving the popularity?

- Vietnamese developer Sky Mavis launched the game in 2018, and it got a boost from investors including Dallas Mavericks owner Mark Cuban and Reddit cofounder Alexis Ohanian in May. It runs on the Ethereum blockchain, with most in-game transactions supported on a speedy, bespoke sidechain called Ronin, which Sky Mavis designed to have lower fees.

- To start playing, you need to buy at least three Axies from the game’s marketplace. Sky Mavis takes a 4.25% cut of all the Axies, virtual real-estate, and other items users sell each other.

- Players can also “breed” new Axies, which costs some of the game’s two native cryptocurrencies: Axie Infinity Shards (AXS, which is also a governance token that gives holders a say in the future of the game) and Small Love Potion (SLP, awarded to players for spending time in the game).

- Axie Infinity has a "play-to-earn" model — and it can be legitimately profitable for some users. Rare Axies can sell for as much as 30 ETH, and desirable real estate in the fictional world of Lunacia can go for nearly 270 ETH. The game also rewards hardcore players with as many as 200 SLP a day — often worth over $50 at recent weeks’ prices.

- Axie Infinity has more than half a million daily players, according to Coindesk, with around 60% hailing from the Philippines. Why? In part, because chronic underemployment has long sent millions of the nation's citizens to work overseas. Now some younger Filipinos are wondering if it might be better to stay home and grind in a virtual universe.

- Both AXS and SLP can be traded on many exchanges — and as the game’s popularity has spiked, prices have taken a wild ride. On Monday, AXS lost nearly half of the 971% surge it had been gaining for the previous three weeks. Still, prices remain up for the year. And game revenue tops virtually all other crypto protocols, dwarfing popular DeFi apps like Aave, Sushiswap, and Compound combined.

Why it matters… Some critics have noted that Axie Infinity's marketplace fees are many times higher than those charged by most crypto apps — a compelling business model that’s already giving rise to competitors. But because the bulk of revenue does go to players, “play to earn” might be more than just a slogan. It might even be the start of a new crypto-powered relationship between work and play.

Cointelegraph

Axie Infinity (AXS) axes almost half its value following 971% bull run

The governance token earlier rallied exponentially despite dull price actions in the broader cryptocurrency market.

Already have an account?