Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Home Sales

Stocks opened the week higher after one of the worst weeks for stocks in the last two years. The S&P 500 had its worst week in over 2 years & the DJIA had its worst week since October 2020. All 3 major averages are up at least 1.9% so far today.

Looking at economic data today, existing home sales fell 3.4% in May to an annual rate of 5.41 million, in line with expectations & the lowest reading since June 2020. Sales are down 8.6% over the past year. Further declines are expected in the coming months as higher rates figure to put a strain on prospective home buyers.

Elsewhere, the Chicago Fed National Activity Index unexpectedly plunged to 0.01 in May. The index had been expected to increase to 0.47, up from the revised April reading of 0.40. 2 of the 4 broad categories made negative contributions.

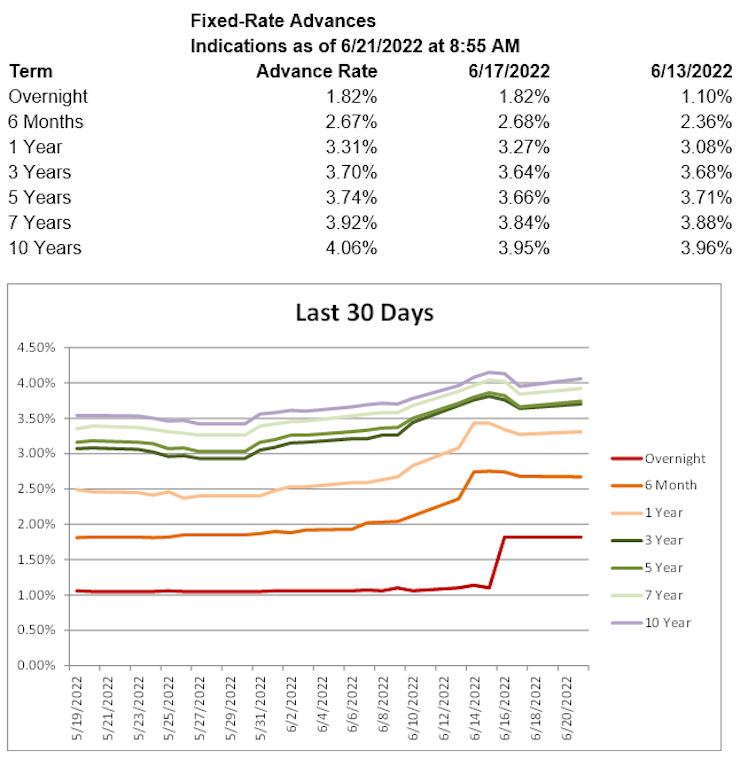

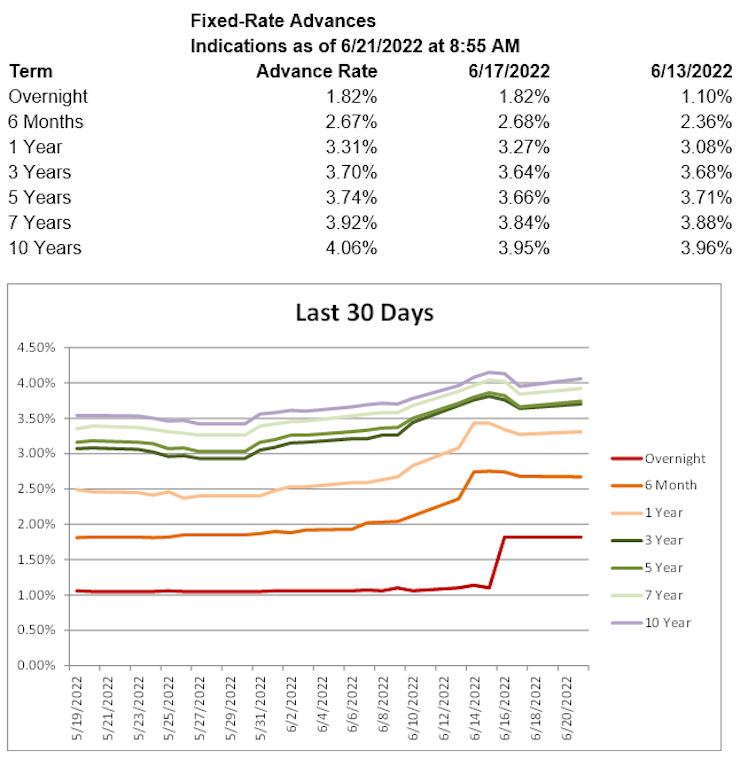

U.S. Treasury yields are higher, with the 2-year Treasury yield up 4.1 basis points to 3.21%, the 5-year Treasury yield up 4.3 basis points to 3.39%, and the 10-year Treasury yield up 6.1 basis points to 3.30%. Advance rates are higher throughout much of the curve today.

Would love to buy an affordable home! Let them drop more!

Already have an account?