Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - hard landing

Yesterday we got the qtrly update for the Fed's Senior Loan Officer Opinion Survey. The instant mkt reaction was a rapid drop followed by an equally rapid recovery. The narrative was that it was a non-event & 'only marginally worse'

However, looking through the numbers, there may be some reasons to be cautious. First of all, this survey & its various components have a 100% hit rate on forecasting a recession. Perhaps it won't happen this time around, but it is tough to bet against

The logic is quite easy-banks provide the credit that is the blood flowing through the veins of the economy. When banks shut down that flow of blood, the body will soon suffer. FinTech has not shown in can or will fill this gap

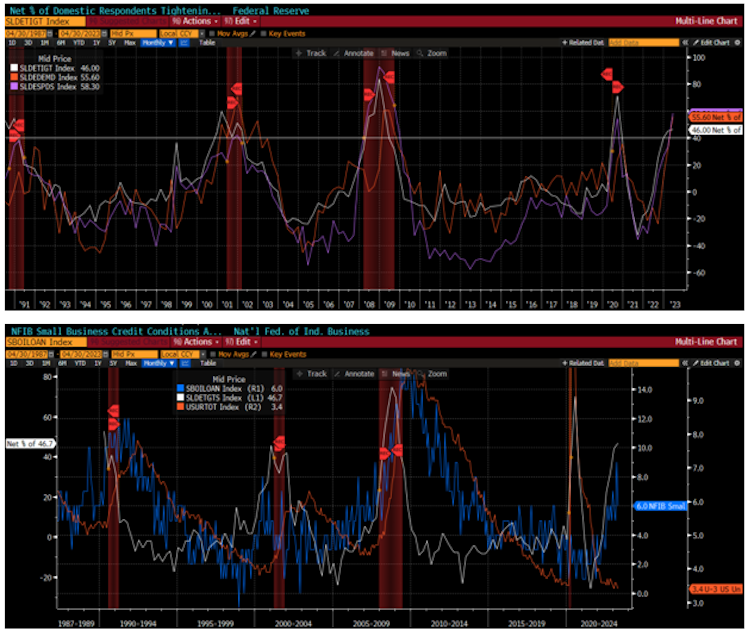

Consider the top chart today. It shows 3 different measures of credit. The white line is the % of banks tightening loan standards for large & mid size companies. Fewer deposits (or loss of deposits in most cases) means banks don't have the funds to loan out

The purple line is the spread banks are charging over the cost of credit. As the yld curve has inverted, banks margins have been crushed. Banks need to compensate by widening spreads meaning companies face higher Fed rates + wider spreads

Not surprising then is the orange line (inverted) which is the demand for loans. This line is plummeting (rising here) as the cost of the money is squelching demand for loans

I have drawn a horizontal line back for the last 35 years. Whenever we have crossed above this threshold in each of these measures, we have had a recession. Not a soft landing, but a hard landing. Sure that is only 4 data points. I will let you wager it is different this time

The bottom chart narrows in on small businesses. Small biz are 99% of the companies in the US, 65% of the job growth in the US, 50% of all jobs & 44% of all economic activity. Suffice to say small biz matters

The white line is the % of banks tightening standards to small biz. It has also moved higher. Maybe large companies - like Apple - can come to mkt with bonds & skip banks. However, small biz NEED regional banks to supply the funds & that is getting harder

The blue line is the NFIB credit availability index (inverted). It corroborates the SLOOS data. Banks are telling you it will be harder to get a loan and small biz are agreeing that it is harder to get a loan. This impacts 44% of all economic activity remember

The orange line is the unemployment rate that just came out - better than expected. You see, jobs data are lagging. Always have been. If anything it might lag even more this cycle given how difficult it has been to hire

But ultimately, if biz can't get loans, activity slows down, and ultimately people are let go. There is no debate on this. In fact, this is the transmission of policy that Jay Powell has been telling us he is counting on to slow inflation. It has been his goal. Even Jay said to ...

Stay Vigilant

#markets #economy #loans #stayvigilant

Already have an account?