Trending Assets

Top investors this month

Trending Assets

Top investors this month

Portfolio Update - Keep the China Stimulus Coming

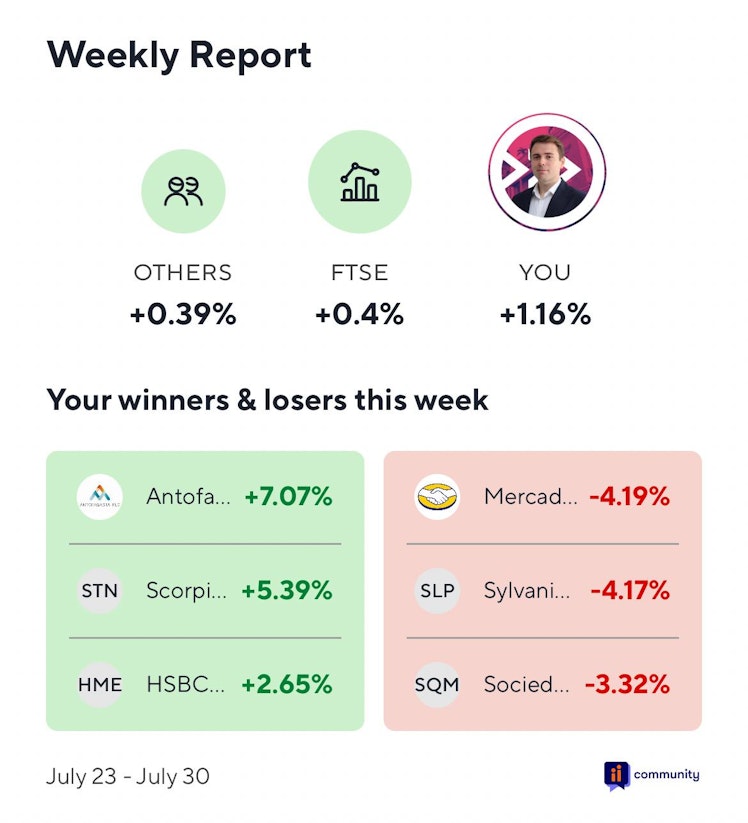

Weekly Performance Summary

A really strong this week and we head into earnings season, significantly outperforming both other users on the platform and the FTSE 100. Biggest winner was Chilean copper miner Antofagasta. There was news that the Chinese Communist Party's Politburo met to discuss support for the Chinese property market. The Chinese property market is a huge importer of steel, copper and other metals and any support for the sector would be a boon for miners globally. This pushed the Antofagasta price up to the highest it has been since February.

Over the week there was some trading in the portfolio, with two positions exited and replaced with two new positions.

Exits: Petrobras (+37.1% return), Vale (+6.0% return)

New Additions: Fresnillo, Oxford Metrics

Petrobras has been a real winner in the portfolio (and one of the largest positions) but I have chosen to exit it at this time. Although it is a great income play for an income portfolio, I feel like from a capital appreciation perspective, most of the upside has now been captured and it was time to exit. May return to it in future on some price weakness because I remain very comfortable with the fundamentals. This also helps in reducing my USD exposure.

As a UK based investor, I obviously care about appreciation in GBP terms, and as such there is FX risk in holding international assets. If UK inflation continues to be stubborn and it begins to settle in the US, financial conditions will be tightening here whilst softening in the US. Higher interest rates here vs the US could lead to GBP strengthening and an FX loss on my USD positions. Hence why I am replacing some USD denominated stocks with some GBP ones.

Fresnillo I like, it is a silver miner based in Mexico and listed in London. The stock has sold off significantly, despite a strong gold and silver pricing environment. In particular there has been a silver rally this past few weeks that the stock has not followed. There are obviously issues at the company which is why it has performed so poorly, notably operational challenges and cost issues. The company could also benefit from reshoring trends as industry moves away from China and the South Pacific back closer to the US and its neighbours. Additionally silver could play a huge part in the future battery market and as such at current pricing levels, Fresnillo looks like a strong longer term play.

Oxford Metrics is one of my first dips into microcaps and a move into a new sector for the portfolio which is currently very commodity and luxury dominated. The company is based in the UK and is a leader in 3D imaging and sensing for a whole host of uses from entertainment to medical purposes. The company anticipates growing revenue by 2.5x over the next five years. Despite being an early stage company with heavy research and development costs, the company is already profitable and primed for growth. Gross margins at close to 70%. EBITDA margins of over 20%. Return on equity of 91%. Very little debt. Currently also trading at a low P/E ratio as compared to recent history.

Already have an account?