Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Solar Industry

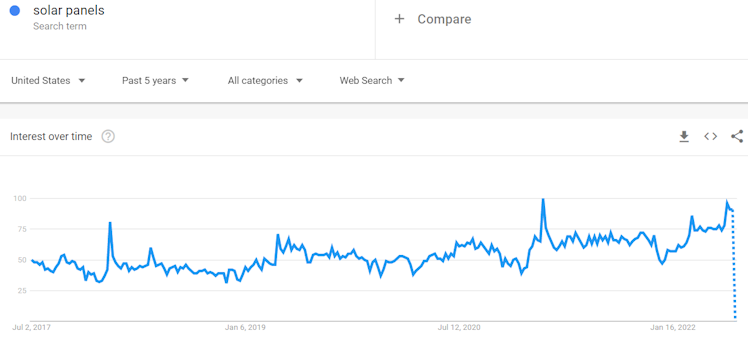

"The trend is your friend" This is something I am trying to keep in mind when deploying new capital in the middle of a bear market. The solar ETF $TAN in only down -6% YTD and is showing impressive relative strength in terms of monthly and quarterly performance as well.

To backfill a reason why it's performed relatively well is pretty intuitive. Home owners are experiencing higher electric bills from an increased cost of energy + increased usage as many are still working from home. This is favorably skewing the calculus for those wondering if they should look to lower their electric bills by installing solar panels.

This is a sector that is very ESG friendly which is a positive for fund flows & experiencing government support to increase adoption. Solar only accounts for about 3% of energy in the United States so it is reasonable to believe we are still in the extremely early innings of adoption of a megatrend. The technology for home solar is improving and is even becoming part of the building code in some places, as California will mandate solar installed on new construction as of 2023.

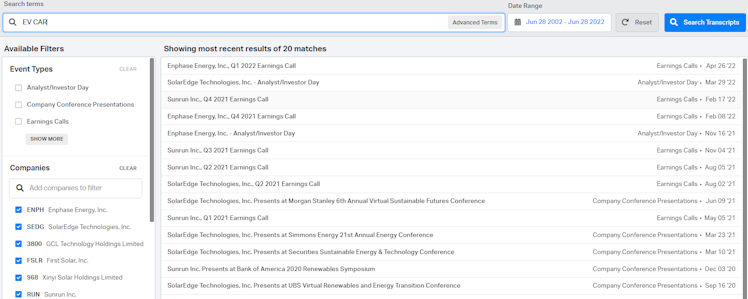

As an added bonus it appears many solar companies are indirect beneficiaries of EV Car adoption, another ESG fund flow friendly theme & government supported trend. I have yet to dig through these transcripts but it does appear that the solar industry is one of the few bright spots in the market with underlying growth drivers that benefit from the macroenvironment headwinds of higher energy prices.

YouTube

If You've Avoided Rooftop Solar Tech, You May Have Just Run Out of Excuses

Energy's Timberline Solar debuted at CES 2022 and now proves it's not vaporware.Follow @briancooley on Twitter: https://bit.ly/2THhuY0Never miss a deal again...

Already have an account?