Trending Assets

Top investors this month

Trending Assets

Top investors this month

Top 5 Most Bought Stocks in 2023

When markets have a great year, you can bet plenty of stocks shined.

Our research uncovered many monster winning equities, in some of the most surprising areas.

Today we’ll unpack the top 5 most bought stocks in 2023.

Markets twist and turn like waves in the ocean. Up and down they go, ripping and dipping as institutional investors place their bets.

To the untrained eye, these money flows can appear as trendless cycles…but don’t be fooled.

Inside these measurable money flows are outlier stocks…the ones that tower above all others, attracting continuous capital month after month.

Each of these top stocks have three common traits: healthy sales growth, earnings growth, and institutional support.

In my experience, that trifecta is the holy grail of investing.

MAPsignals’ unique process isolates companies with these rare attributes, into a single signal…week after week in our Top 20 report.

Not only are we going to review the top 5 names this year, but I’ll also show you why having these names at your fingertips during oversold periods like in October is critical.

Let’s hop to it!

If you think the Technology sector was the only game in town, think again. Big Money investors bet heavily on the consumer space from the start of the year… and rightly so.

Up first is cosmetic retailer e.l.f. Beauty, Inc. ($ELF). This superstar stock was the most accumulated name in 2023 with 18 appearances on our Top 20 list.

When you study the fundamental profile, you’ll understand why. Sales in fiscal year 2023 grew to $578MM, up from $392MM in 2022. Revenue expectations for 2024 sit at $914MM.

The earnings picture is no slouch either. This year, EPS expectations stand at $2.44, up from $1.46 a year ago.

With growth like this, it’s no wonder it’s an institutional favorite. The stock is up a staggering +181% since its first Top 20 appearance this year:

Interestingly enough, ELF was also the most bought name in 2022. As I like to say over and over, follow the Big Money!

Let’s keep going.

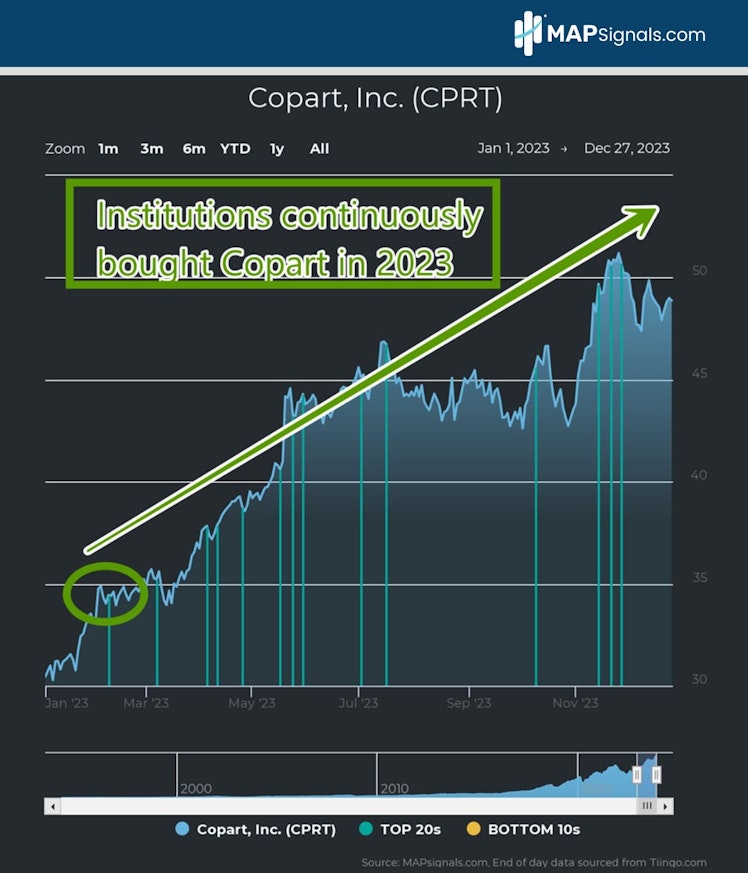

In 2nd place is well-known outlier Copart, Inc. ($CPRT). This online auctioneer website started continually appearing on our lists back in 2015.

Here’s why: The 5-year revenue compounded annual growth rate (CAGR) stands at 16.5% whereas the 5Y net income CAGR is a mind-blowing 24.3%.

Institutions flock to earnings powerhouses like Copart:

I call this pattern the stairway to heaven!

Now for my favorite part of today’s insights. If you recall, this time last year the crowd called for death to homebuilders. Rising interest rates were prophesied to crash the housing market.

The opposite transpired…revealing why understanding money flows is critical to locating tomorrow’s leading stocks.

The number 3 most bought stock in 2023 is homebuilder D.R. Horton, Inc. ($DHI). Incredibly this company has a 3Y revenue CAGR of +20.4% and a 3Y net income CAGR of +26%.

Our money flow lens captured this monster trend beginning in January:

As a reminder, each of these blue lines indicates that DHI is growing sales, growing earnings, and under accumulation. This caused the stock to rank very high in our process.

Our research stood in stark contrast of the media’s hate for homebuilders at the time…rightly so!

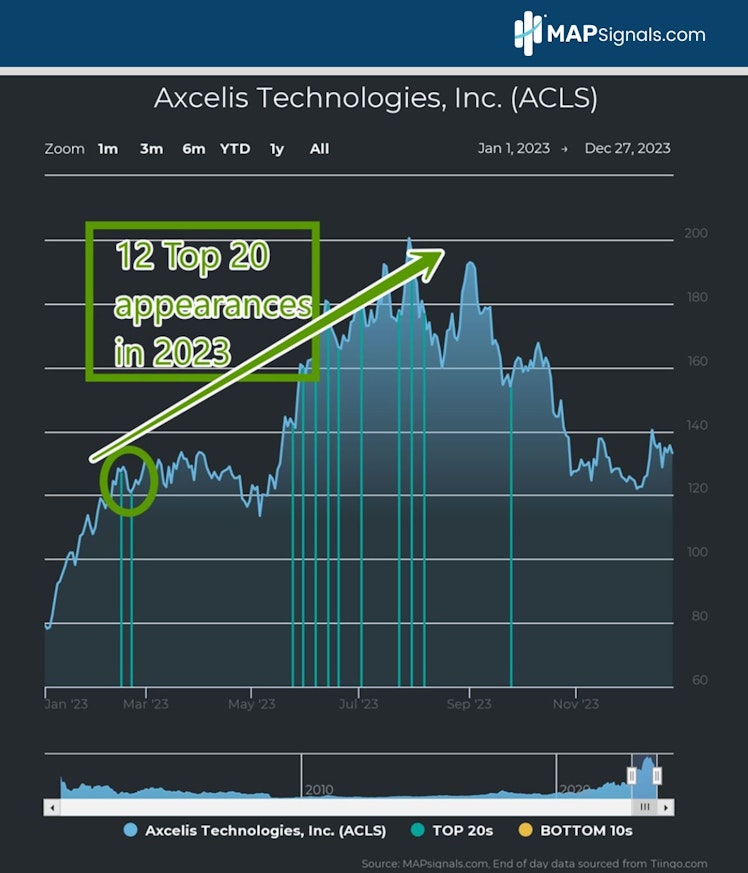

Now, for number 4. Small-cap semiconductor firm Axcelis Technologies, Inc. ($ACLS) was a prime target for healthy institutional flows.

With EPS expected to reach $7.27 in fiscal year 2023, that represents +152% growth compared to 2021. This year’s revenues are slated to eclipse $1.1B, well north of the $662MM in sales in 2021.

This name made our Top 20 list a dozen times:

Rounding out the top 5 is another homebuilding company, M.D.C. Holdings, Inc. ($MDC). This $4.1B market cap name was not a media darling. Good thing because it was quietly under heavy accumulation in our data.

This Denver-based firm, sports enviable numbers including a 3Y revenue CAGR of +20.8% and a 3Y net income CAGR of +33.2%. Now you know why it’s an institutional mainstay.

One of the strongest trends in 2023 were the unloved homebuilders…right in the spotlight of our Top 20 list:

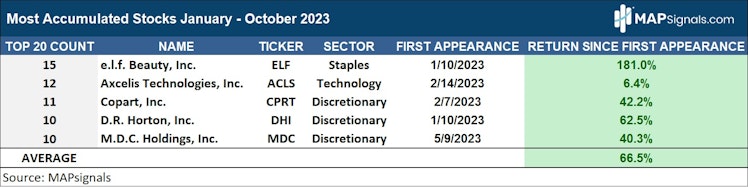

Now that we’ve outlined the most bought stocks, here’s how they performed since first showing up on our reports.

Their average gain trounced markets with a +66.5% performance…handily beating the S&P 500’s +26.58% YTD return:

These were the top recurring stocks in our data through October, which is important to note. As a reminder, our Big Money Index (BMI) was oversold back then.

We were beating the bullish drums preparing you for a ferocious crowd-stunning rally. Boy did it come!

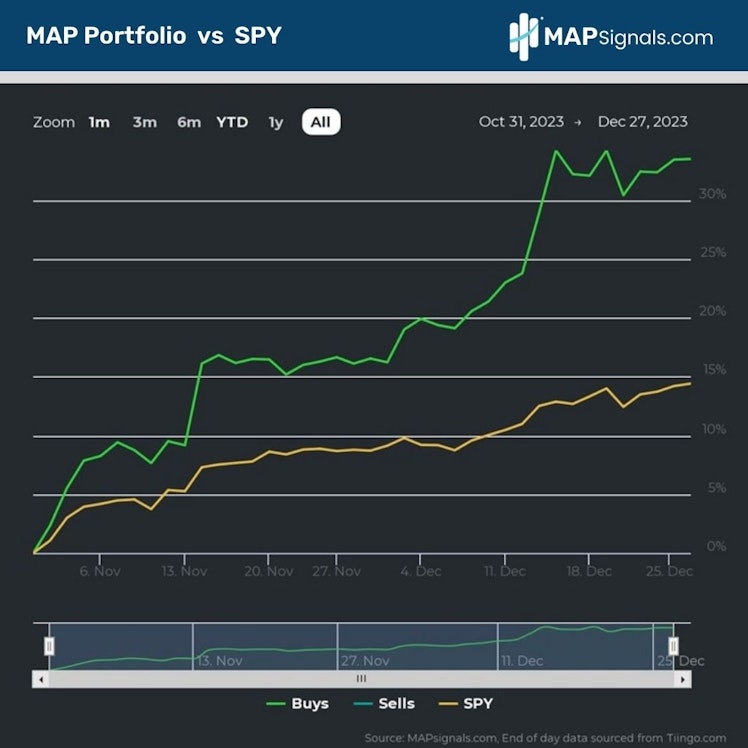

Whenever a risk-on event happens like we saw in November, large institutions bet on prior winning names. This year was a case in point.

The S&P 500 ($SPY ETF) rallied +14.41% from October 31st – December 27th. But that was no match for these 5 stocks. Equally-weighted, they returned a handsome +33.5%, more than double the index:

This showcases why following unusual money flows puts you in the driver’s seat, often at odds with the prevailing news flow.

Let’s wrap up.

Here’s the bottom line: While most pundits expected lousy returns for stocks in 2023, our research signaled healthy gains coming for equities.

The top 5 most bought stocks in 2023 included Staples, Semiconductors, and Homebuilder companies, highlighting strong participation across the board.

With 2024 around the corner, be on the right side of next year’s trends.

Interest rates are falling, earnings are accelerating, and inflation is over…that means it’s lock and load time.

If you’re a Registered Investment Advisor (RIA) or are serious about investing, do yourself a favor and get started with a MAPsignals PRO subscription.

Tomorrow’s top stocks are out there.

Use a MAP to find them!

MAPsignals

Solutions - MAPsignals

MAPsignals’ volume and price analysis tools enable investors to identify unusually large trading activities around individual stocks and ETFs. This allows traders and investors to move beyond sentiment with a more precise, predictive, and measured data analysis tool that MAPs the signals being delivered by the market’s biggest players.MAPsignals capabilities include: Read more »

Already have an account?