Trending Assets

Top investors this month

Trending Assets

Top investors this month

Remember the E-Trade Commercials from the pre-pandemic times?

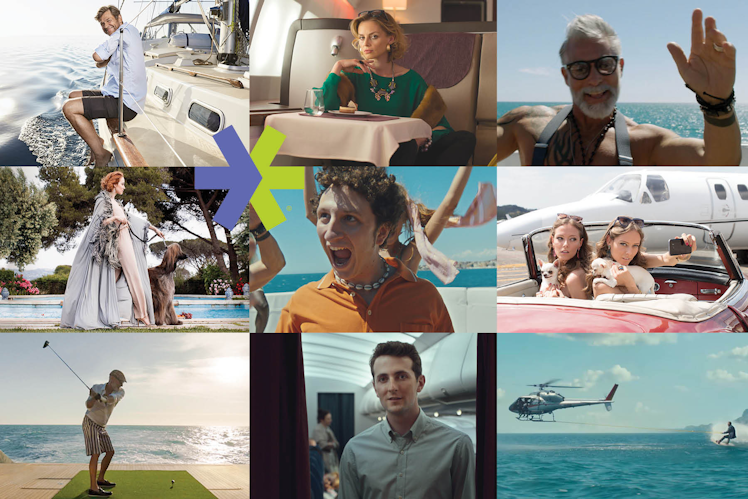

It's the year 2017. Trump got elected into office. Everyone was excited about the tax reform that will take into effect next year. Stocks are performing surprisingly well after a brutal 2016 because of Brexit and commodities down cycle. Throughout the year, E-Trade would create commercials like these:

Normally, we'd think that these commercials would signify a top in the stock market and the Great Depression soon after. But surprisingly, it didn't. Trump's trade war of 2018 overshadowed the increased profits that companies are having from the new tax cuts. By the time people calmed down from the economic ramifications of protectionism and started seeing increased domestic economic activity from it, 2019 felt like 2017 again as stocks roared once again. With everything the market has went through under Trump's first three years, it was reasonable why many of us would think that we'd enter the 2020s with immense prosperity and resilience. But then, the COVID-19 pandemic happened, the world went into lockdown, and somehow, the markets were able to rebound and end the year with bigger gains. 2021 became a continuation of the big stock market rally with meme stock mania, 2022 became a breather year for bulls, 2023 was the resuming of the bull market, and so far in 2024, markets are at all-time highs.

As I look back, I am surprised at the resilience of the markets. Even with an abundance of euphoria and unprecedented reckless trading from retail, markets continued to go higher. It doesn't feel crazy like the Dotcom bubble times where unprofitable tech stocks lead the market. It doesn't feel crazy like the Housing Bubble as people aren't bragging about having two homes and looking to get a third or even fourth home. It does feel like the Nifty Fifty bubble and it also feels like a secular bull market with an extra strong foundation.

When I think back on the whole story of $TSLA and its role in the post-GFC bull market, as long as Tesla remains elevated in valuation, the bull market continues to happen. Once the Tesla bubble pops, and I see it happening soon as competitors take market share and the legal system starts taking their cases against the company seriously, this will be the sign that the bull market is over. Tesla is the biggest evidence of euphoria in the markets and its stock collapse can be reasonably compared to the end of the post-GFC bull market.

If there's one takeaway that I can give, it's that the E-Trade Commercials, while it was a sign of euphoria in the markets, wasn't great at marketing the top of the stock market. If there's a sign that will mark the end of the bull market, it would be the Tesla bubble pop.

Already have an account?