Trending Assets

Top investors this month

Trending Assets

Top investors this month

Alphabet: Unveiling YouTube and Cloud Services

The below is an extract of the latest write-up released in our newsletter. In this write-up, we cover $GOOGL and we dive deep into YouTube and Google Cloud, concluding the article with a DCF and sum of the parts valuation.

For the full write-up you can click here --> Alphabet: Unveiling YouTube and Cloud Services

A share, a like or a subscription really helps to grow our community. 🙏

-------------------------------------------------------------------------------------------------------------

1.Introduction

The stock: Alphabet’s market cap as of 10th of October stands at $1.75T with a 52-week low of $83.34 and a 52-week high of $141.2, whereas it currently trades at $138.1 with year to date returns of 56.5%. Analysts have a 12-month target price of $152.4 representing an upside of 10%.

Valuation: Alphabet trades at a TTM EV/EBITDA of 18.2x (5-Year average of 18.1x), a TTM Price / Earnings of 29.6x (5-Year average of 27.5x) and a FCF/EV yield of 4.3% (5-Year average of 3.8%).

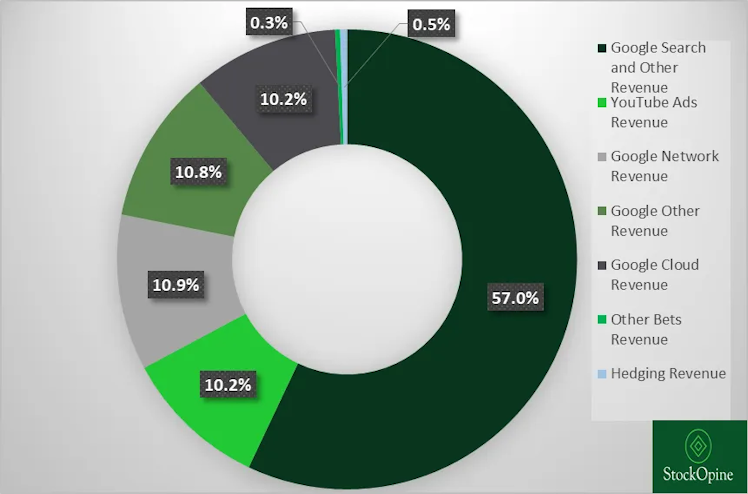

Segments: Alphabet has 6 reporting business lines with the ‘Google search and other’, ‘YouTube Ads’ and ‘Google network Member’s’ representing the Google advertising business which accounts for 78% (or $226.2B) of its TTM revenues.

Source: Stratosphere.io (use coupon code STOCKOPINE for a 25% discount), StockOpine analysis

Google Other accounts for 10.8% or $31.2B and includes revenue from Google Play, Hardware (e.g. Pixel phones), and YouTube non-advertising, including YouTube Premium and YouTube TV subscriptions while Google Cloud which includes Google Cloud Platform and Google Workspace accounts for 10.2% or $29.7B.

What’s hot: Various news stories are circulating, including allegations from the Department of Justice that Google's search division maintained a monopoly by making annual payments of ‘$10 billion to secure its search engine as the default choice on mobile devices and web browsers’. Additionally, Amazon has made a significant investment of up to $4 billion in Anthropic, an AI company similar to OpenAI. Anthropic has chosen Amazon Web Services (AWS) as its primary cloud provider for mission-critical workloads’. This deal seems like a setback for Google Cloud, even though it appears to have been in the works before Anthropic encountered performance issues with Google Cloud. Alphabet's ownership of approximately 10% of Anthropic with around $300 million in funding makes this cloud deal quite perplexing, especially considering that gen AI is expected to be a major driver of the Cloud market.

Google Bard is Google's weapon in the AI arena, utilizing the Language Model for Dialogue Applications (LaMDA) for training while it also relies on the Pathways Language Model 2 (PaLM 2) to power advanced features such as coding and multimodal search. 'Gemini,' a new AI system, is a competitor to OpenAI's GPT-4.

Even though there are ongoing debates about which tool will ultimately prove to be superior, it's essential to recognize that AI is poised to become a key technology in our everyday lives. Its applications could be diverse, and there may be multiple winners in this space. Alphabet, certainly has the foundational strengths to excel, whether as a Cloud provider, an AI innovator, or both.

Without further ado, let’s jump into YouTube.

2.YouTube

In the modern digital landscape, YouTube has risen to become a household name, offering a mix of content that caters to audiences of all ages and interests. Founded in 2005, YouTube has come a long way from its beginnings as a platform for individuals to share their personal videos to an astonishing reach and impact that extends beyond entertainment such as education, music and business.

YouTube's long-term growth strategy has 4 pillars, which were shared by Phillip Schindler, Chief Business Officer at Alphabet.

“And to support this growth, we're focused on, number one, Shorts; number two, engagement on CTV; number three, investing in our subscription offerings; and number four, a longer-term effort to make YouTube more shoppable.”

User base

Understanding the YouTube phenomenon begins with an understanding of its user base. The platform's largest demographic consists of users aged between 25 and 34, however, no generational boundaries appear to exist. India with an estimated 574 million users stands out as the largest market for YouTube though it’s worth noting that most traffic comes from the US (~250 million users).

In total, YouTube has over 2.7 billion monthly users, ranking second only to Facebook (3.03 billion users). WhatsApp and Instagram of Meta secure spots 3 and 4 with 2 billion users each.

Source: Global Media Insights, Meta filings, backlinko for TikTok, StockOpine analysis

Other interesting YouTube statistics regarding its scale and network are the 51 million channels (a hub for content creators), the +2 million creators making money on YouTube (as of Q3’21) and the fact that it accounts for ~25% of global mobile traffic (more statistics can be found here).

Its creator-centric approach fosters a thriving ecosystem where content creators and viewers mutually benefit from each other's presence. As more creators join the platform, they attract diverse audiences, which, in turn, becomes increasingly appealing to advertisers. This virtuous cycle fuels YouTube's ongoing expansion, making it an ideal platform for advertisers.

Phillip Schindler, Chief Business Officer at Google, highlights the platform's effectiveness, stating, “Looking at YouTube holistically, according to our measurement partners, Nielsen, TransUnion and Ipsos MMA, YouTube delivers higher ROI than TV and other online video on average.”

In Q1’23 it was reported by Phillip Schindler that ROI was 40% higher than linear TV and 34% higher than all other online video.

--END OF EXTRACT-- That's just a glimpse

Hope you enjoyed this extract! If you did, consider signing-up and/or share it with friends. Your support will be appreciated.

📢 The rest of the write-up covers in detail the YouTube financials, Beyond Ads, The Creator Ecosystem and analysis of Google Cloud, such as Google Workspace, Landscape of Cloud computing and many more.

-------------------------------------------------------------------------------------------------------------

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision.

Official GMI Blog

YouTube Statistics 2024 [Users by Country + Demographics]

Gain valuable insights into YouTube users statistics for 2024. Explore key metrics and emerging trends shaping the platform's user landscape.

Already have an account?