Trending Assets

Top investors this month

Trending Assets

Top investors this month

Earnings Brief: A Quick Review

Here’s the $BKNG extract:

- Booking delivered an impressive quarter, boasting a 21% revenue increase and 44.7% adjusted EBITDA margin, 80 basis point improvement compared to prior year, demonstrating the Company’s ability to grow profitably. The travel industry's resilience was evident in robust growth in Room nights and Gross Booking Volume (GBV). Glen Fogel's optimistic outlook for strong growth in Q1 2024 further solidified confidence.

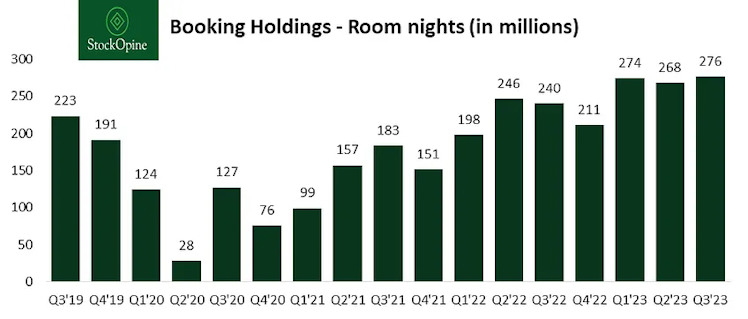

- Room nights hit a record 276 million, with a 15% growth, while GBV surged by 24% to $39.8 billion. Both metrics showed acceleration from the previous quarter.

- Direct Bookings generated over 50% of room nights compared to 45% in Q3’22, a significant achievement. According to Fogel, a remarkable 18 percentage point increase was achieved since Q3 2019. Direct bookings offer various advantages, fostering customer relationships, building loyalty, and potentially being margin accretive due to reduced spending on performance marketing.

- The company also excelled in Payments, with Booking. com processing 51% of gross bookings through its payments platform in Q3’23, up from approximately 40% in Q3’22 and 48% in Q2’23. This trend not only demonstrates effective execution but also contributes to improving the cash operating cycle.

- Looking at Alternative Accommodation, Booking accomplished a 24% YoY growth in room nights, surpassing Airbnb’s growth of 14% YoY!! Meanwhile, the company also expanded its supply, with global listings reaching around 7.2 million, reflecting a 9% year-over-year increase.

All in all, this was an outstanding quarter for Booking Holdings.

www.stockopine.com

Earnings Brief: A Quick Review

In this earnings brief we cover PayPal, Booking Holdings and Diageo.

Already have an account?