Trending Assets

Top investors this month

Trending Assets

Top investors this month

@mansa_musa

Mansa Musa

$4.8M follower assets

10 following113 followers

C3 $AI: 'Seibelization' of Enterprise AI?

- Company Overview

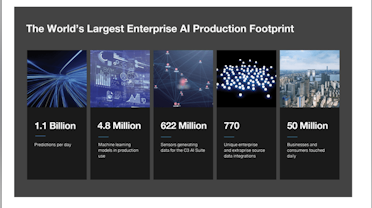

C3 AI is a leading enterprise artificial intelligence software provider that enables o$$RGANIZATIONS to simplify and accelerate AI application development, deployment and administration. Morgan Stanley leads the underwriting of the IPO and the stock debuted on the NYSE on Wednesday, December 8th under the ticker symbol AI and started trading at $109 a share. C3.ai was founded in 2009 by Tom Siebel - one of the pioneers of Customer Relationship Relationship (CRM) and the founder of Siebel Systems which was acquired by Oracle in 2006 for $5.8B. The company claims that it has the world’s most extensive Enterprise AI production footprint and that its software makes 1.1 billion predictions per day, with 4.8 million machine-learning models in use, and 622 million sensors generating data that feed into the company’s software.

For the Fiscal year 2020 ending April 30th, c3.ai generated 57M in revenue up 71% YoY and a net loss of $69M. For six months ending October 31st, 2020, the company generated $82M in revenue, an increase of 11% YoY.

- Product Differentiation

So what makes C3 AI unique? well, let say a trucking company X wants to build a route optimization AI application that would reduce delivery time and improve the fuel efficiency of company trucks. The first step would be to find a cloud vendor that would provide elastic computing and storage capacity. This can easily be provided by AWS, Azure and/or Google Cloud. Next, the company would need multiple tools and data services for data aggregation, integration, encryption, queuing, pipeline management, authentication, authorization, cybersecurity, analytics processing, machine learning models, visualization, etc. Here, the executives of company X have several options to choose from in integrating these tools and successfully build the AI app. These include:

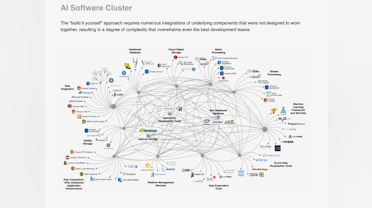

a) In-house (DIY) Development - invest in a team of developers that would use open source solutions and stitch together various programs, data sources, sensors, machine learning models, development tools and UX paradigms to eventually build a functional application. However, this approach is not only complex (as shown in the figure below) but also uneconomical and unscalable.

b) Use Cloud Vendor Tools - an alternative to the DIY approach is to assemble the various tools and services offered by the selected cloud vendor (e.g. AWS) and building a working AI platform.

The advantage of this method is that the tools would seamlessly work together since they were developed by the same cloud vendor and on the same platform. The downside, however, is that the process is exceedingly complex since it requires the writing of a thousand lines of code that's difficult and costly to maintain as well as 100+ person-days to develop and deploy. The resulting App would also run only on that particular platform and if, say, company X wants to migrate to another provider, it would be forced to start building the App from scratch again

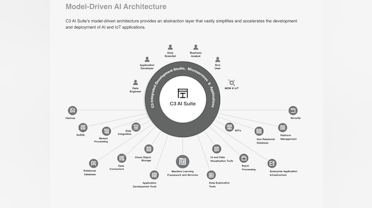

c) Use C3 AI Suite - which employs a model-driven architecture that simplifies and accelerates the development and deployment of the application by reducing the amount of code needed to write and maintain by 99% and speeds the development by a factor of 26X traditional approaches. Moreover, Applications developed with the C3 AI Suite can run without modification on any cloud platform.

This gives C3 AI a competitive advantage and is why large enterprises and entities such as Royal Dutch Shell, US Air Force, AstraZeneca, Raytheon Technologies, Microsoft and Adobe use C3 AI products to deploy artificial intelligence applications and platforms at scale.

- More on the Product & Technology

The company provides 2 primary families of software solutions that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. These are:

C3 AI Suite

The C3 AI Suite is a model-driven architecture that provides an “abstraction layer,” and allows developers to build enterprise AI applications by using conceptual models of all the elements an application requires, instead of writing lengthy code.

This helps in scaling AI across the organization rapidly, reducing costs and creating a unified platform that offers data lineage and model governance. The company claims that its AI Suite is the only end-to-end Platform-as-a-Service (PAAS) allowing customers to design, develop, provision, and operate Enterprise AI applications at scale.

C3 AI Applications

These are pre-built SAAS applications that address a range of mission-critical use cases.

These cross-industry, extensible and customizable applications include but not limited to:

C3 AI Inventory Optimization - which applies advanced AI/machine learning and stochastic optimization techniques to help optimize raw material, in-process, and finished goods inventory levels, while ensuring stock availability when and where needed.

C3 AI Predictive Maintenance - provides maintenance planners and equipment operators with a comprehensive insight into asset risk, enabling them to maintain higher levels of asset availability across their entire portfolio.

C3 AI Fraud Detection - pinpoints patterns in event data streams that identify revenue leakage or maintenance and safety issues so investigation teams can act upon a single, continuously updated and prioritized queue of leads.

C3 AI Anti-Money Laundering - an AI-enabled, workflow-centric application that uses comprehensive machine learning techniques to reduce false-positive alerts while increasing true Suspicious Activity Report (SAR) identification.

C3 AI Customer Churn Management - Enables account executives and relationship managers to monitor customer satisfaction using all available transactional, behavioural, and contextual information, and take proactive, early action to prevent customer churn with AI-based and human-interpretable predictions and advance warning.

C3 AI Energy Management - Uses machine learning to help enterprises gain visibility into their energy expenditure and prioritize actions to reduce their operational costs while lowering their carbon footprint.

C3 AI CRM - In partnership with Microsoft and Adobe, the company released an AI-powered CRM solution that end-to-end, intelligent customer engagement, real-time customer profile and customer journey management.

- Business Model

C3.ai generates revenue through two primary sources namely:

Subscription revenue - sale of subscription to the cloud-native software of C3 AI suite and C3 AI Applications. The average contract duration for these term subscriptions is 3 years and are generally non-cancelable as well as non-refundable. Another portion of the subscription revenue is generated through monthly runtime fees of the C3 AI Applications and customer-developed applications built using the C3 AI Suite, usage-based upon CPU-hour consumption. This segment represents ~86% of total revenue.

Professional Services revenue - which consists primarily of fees associated with the implementation services for new customer deployments of C3 AI Applications such as training, application design, project management, and data modelling. This segment accounts for ~14% of total revenue.

Revenue Growth rate by Segment (YoY)

Revenue growth has considerably slowed down in recent quarters, suggesting that the customers consider AI platforms as a discretionary investment that should be delayed/postponed during a recession. This is understandable since a large number of enterprises are focusing on cost containment and revenue generation rather than innovation and digital transformation.

- Key Performance Metric

Remaining Performance Obligations (RPO) - represents the amount of contracted future revenue that has not yet been recognized, including both deferred revenue and non-cancelable contracted amounts that will be invoiced and recognized as revenue in future periods. The company considers RPO as a key metric to help evaluate the health of the business, identify trends affecting growth, formulate goals and objectives, and make strategic decisions.

As shown above, the ROP growth rate has been rapidly declining since the start of the pandemic.

- Go-To-Market and Growth Strategy

The company's market entry strategy is to establish high-value customer engagements with large global early adopters, that it refers to lighthouse customers, across geographies and in a range of industries. The objective of these lighthouse customers who are usually industry leaders is to serve as proof points for other potential customers in their particular industries.

C3 ai also employs a land and expand strategy where customers tend to expand the use of the products after the initial contract and, as a result, may purchase additional applications, additional developer seats, additional software products, additional runtime usage, and additional services. For instance, the average initial contract value with the largest 15 customers was $12.8 million. On average, each of these customers has purchased an additional $26.1 million in product subscriptions and services from c3 ai to date as they expanded existing use cases and added additional use cases to their roadmaps.

- Market Opportunity

Global spending on Artificial Intelligence will accelerate over the next several years as organizations deploy artificial intelligence as part of their digital transformation efforts and to remain competitive in the digital economy. According to International Data Corporation (IDC) - a global market intelligence provider - the global Enterprise AI software market totalled $18 billion in 2020 and is expected to grow to $44 billion in 2024 (24% CAGR). C3.ai addresses this market with its AI Suite and full portfolio of AI Applications.

Moreover, the size of the Enterprise infrastructure software market which include Application Development, Application Infrastructure and Middleware, Data Integration Tools and Data Quality Tools, and Master Data Management Products totalled $63 billion in 2020 and is expected to grow to $82 billion in 2024 (7% CAGR) according to Gartner. The company offers C3 AI Suite to replace these infrastructure software products.

Lastly, Gartner reports that the size of the Enterprise Application software market across Business Intelligence, Analytics, Customer Experience and Relationship Management (CRM) segments totalled $93 billion in 2020, and is expected to grow to $145 billion in 2024 (12% CAGR). C3 AI Applications address these use cases.

- Competition

C3 AI notes that its primary competition is largely DIY, custom-developed, company-specific AI platforms and applications. This usually involves IT departments attempting to custom develop bespoke AI applications through the integration of internally developed tools, open-source solutions, and point solutions offered by independent software vendors, and/or components offered in the AWS, Azure, or Google cloud platforms.

- Ownership

The company has two classes of shares, A & B. Each of class A common stock has one vote per share, while class B has 50 votes per share. Mr. Thomas Seibel controls the voting power of all the class B shares and owns 32.99% of total outstanding shares, giving him and related entities 70.70% of the voting power.

The management team and Board of Directors, in total own 61.91% of the total outstanding Class A shares, indicating a massive skin in the game. Moreover, Microsoft and Spring Creek Capital, an affiliate of Koch Industries have recently agreed to purchase $50M and 00M of class A share through a private placement.

- Financials

Historical Income Statement

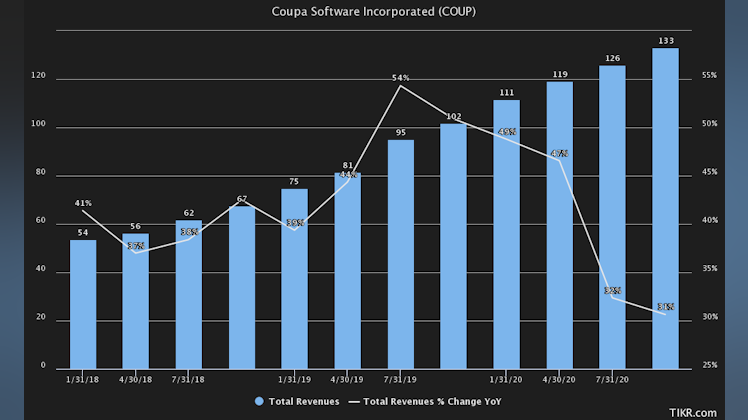

Quarterly Revenue ($M)

Revenue took a hit in the most recent two quarters as the pandemic-induced recession has severely impacted sectors such as energy, industrials and financials which are the target customers of C3 AI.

Gross Margin and Operating Expenses as % of Revenue

Historical Cash flow

- Risks

High customer concentration - the company generates a significant portion of its revenue from a limited number of existing customers. The top 3 customers accounted for 34% and 44% of FY 2019 & 2020 revenue.

Limited Brand recognition - compared to cloud platforms such as AWS, Azure and Google Cloud. C3 AI could fac

e an existential threat if these companies launch pure-play competing products.

Wow, can't believe I missed this back in December. But found it just now from the C3 compay page as I looked for memos on it. Thanks for writing this!

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?