Long VG: API business (Nexmo) alone worth double entire value today.

During its earnings call next week (2/18) the company will announce the conclusion of the strategic review of its Consumer segment. A sale of the segment would initiate a substantial re-rate of the business, as RemainCo would be a pure-play business communications software company growing high-teens / low-20s (vs. MSD today w/ declining Consumer segment). RemainCo will have two segments: Application Services (UCaaS & CCaaS) and API Services (CPaaS). I believe the API segment alone is worth double the current market cap today.

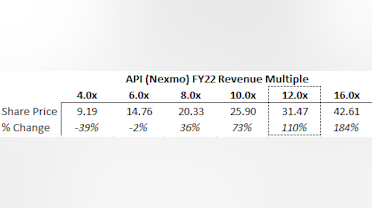

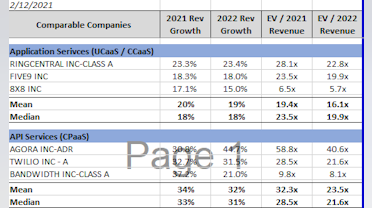

As the clear #2 player in the API market to TWLO, Vonage API (formerly Nexmo) has a strong competitive position in a market that Mordor Intelligence expects to grow 34% annually through 2026. If VG API can grow at least 30% over the next two years, I believe the segment should trade between peers TWLO (21.6x) & BAND (8.1x), at around 12x. Attributing no value to the rest of the company (including the proceeds for the Consumer business), this yields over 100% upside to the current price.

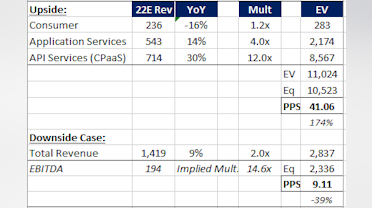

Assuming net proceeds of $285M for Consumer (sell-side believes between $300-$350M) and attributing a 4x multiple for the Applications business (discount to peer EGHT) yields 175% upside to the current price.

Even if the company decides to keep the Consumer segment the stock will have a chance to re-rate through increased segment-level profitability disclosures and medium-term targets (promised on Investor Day 3/15), and a turn-around in the underachieving Applications segment.

I believe the downside is ~40%, assuming no Consumer sale and a FY22 revenue multiple of 2x, in-line with the lower-range of its historical multiples.

Wow, great write-up!

Regarding Mordor Intelligence's expectations to grow 34% annually through 2026- Do they have a publicly available report/memo we can look at? Or is their analysis only available to institutions / behind a paywall?