Whale Dive Q2 - Part 1

13-F, Stock Market Whales, Sector Allocation, Ray Dalio, China

Dear Fellow Investors,

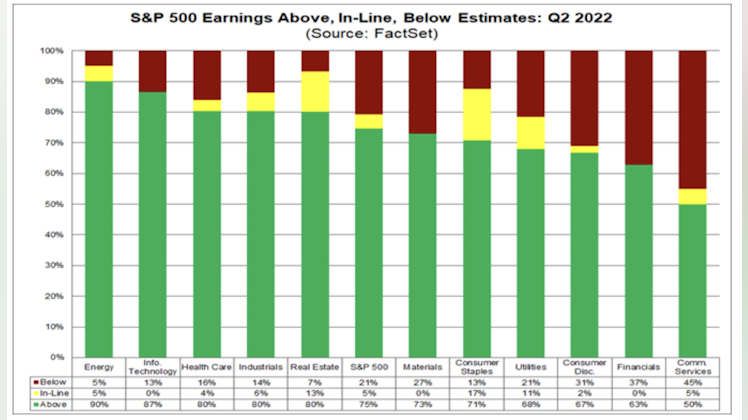

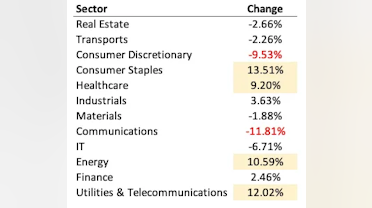

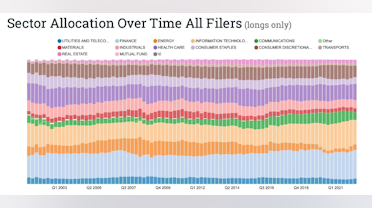

During Q2 of 2022, there was a notable increase in sector allocations towards the Utilities & Telecommunications, Consumer Staples, Energy, and Healthcare sectors, with Finance currently being the second largest sector in terms of the total allocation, only behind Information Technology.

The allocation in the IT sector declined during the quarter from 21.16% to the current 19.74%. The reduced allocations in the IT sector are not a surprise given the tech sell-off in the past few months as the FED became more hawkish, limiting the hyper-growth expectations of many IT companies. The increase in the Finance and other defensive sectors reflects funds' strategy to preserve capital by increasing allocations to companies with a low-interest rate risk.

So, in today's analysis, we dive into holdings of some funds that have recently filed their 13-Fs. (Tables extracted from Whalewisdom)

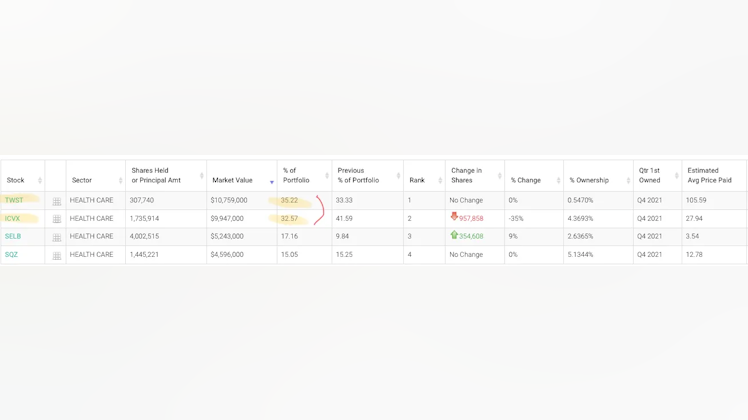

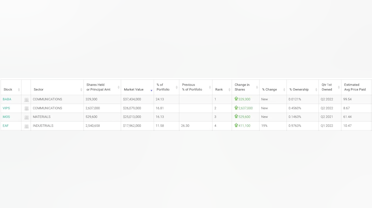

TORQ CAPITAL MANAGEMENT (HK) LTD

Registered Investment Advisor based in Hong Kong | AUM: $155.1 million | Largest Holding: BABA 24.13%

Torq Capital Management Ltd is heavily invested in communications, with 44.19% of the portfolio allocations in the sector. The fund's investments in the communication sector came about in the last quarter, Q2 2022, as the fund purchased 329,300 shares of BABA 0.36%↑ , which now constitutes the single-largest holding of the fund, followed by VIPS -4.04%↓ 2,637,000 shares equal to a market value of $26.1 million.

Both the companies are Chinese, currently trading at attractive forward-based multiples, which might be a reason why the fund has opened new positions in the stocks in the last quarter. However, BABA has been on a downward trajectory ever since the Chinese crackdown against its top man Jack Ma started in 2020.

However, the stock may be near its lows now, with the Chinese government now making efforts to revitalize the economy. VIPS also seems like a value bet for the fund, with the company trading at a forward P/E of 8.4. In addition, the company has a ~$1 billion buyback program in place and sufficient liquidity on the balance sheet, reducing downside risks.

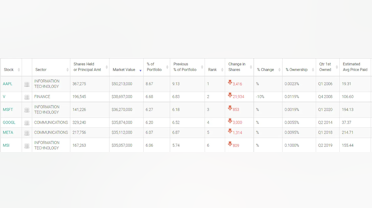

WEDGEWOOD PARTNERS INC

Advisory Firm | AUM: $838.1 million| Largest Holding: AAPL 8.67%

Wedgewood Partners Inc remains well-diversified across various sectors, including IT, Communications, and Finance. The fund’s biggest holding remains AAPL -2.32%↓with 367,275 shares equaling a market value of $50.2 million, followed by V -2.15%↓with 196,545 shares with a market value of $38.7 million.

Even though the fund reduced its position in V significantly during the last quarter (cutting down 10% of the position), it has been holding the two stocks for over a decade. It is up significantly in both these positions (based on the estimated avg price paid).

Wedgewood Inc increased its holdings in PYPL -2.95%↓ , POOL -1.78%↓FRC -2.05%↓, WBD -1.36%↓ , and ODFL -2.84%↓. While completely cutting off its holdings in TPR -2.62%↓, VUG -2.53%↓, TD 0.09%↑, XOM -0.60%↓, and SBUX -3.13%↓.

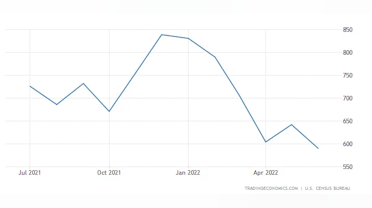

Although XOM is up 54%, the fund got rid of all its holdings in the stock. This may be because of the deteriorating macro-environment with a slowdown in China and monetary tightening in the U.S. A possible Iran nuclear deal will also add more supply, bringing down oil prices.

The fund's conviction in growth stocks remains intact as the holdings in the IT sector account for 31.02% of the total portfolio even amidst a tech sell-off with the ongoing monetary tightening. The fund exposure is primarily in large-cap companies listed in the United States, with the average capitalization of companies in the portfolio equaling $445 billion.

BRIDGEWATER ASSOCIATES, LP

Hedge Fund | AUM: $235.5 billion | Largest Holding: PG 4.11 %

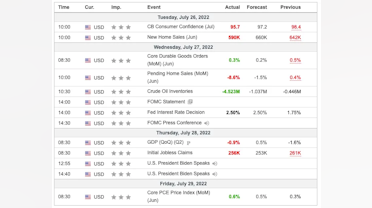

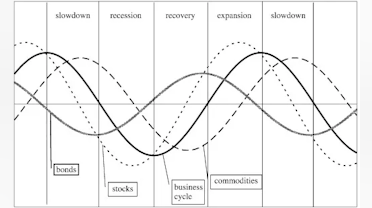

Ray Dalio's fund, Bridgewater Associates LP, focuses on diversification of risks, with its biggest exposure PG -2.36%↓ only constituting 4.1% of the total portfolio with a market value of $970 million. The fund is heavily invested in the consumer staples sector, constituting 25.07% of the total portfolio. The high exposure to the sector reflects Ray Dalio's strategy of generating long-term returns regardless of business cycle changes.

During the last quarter, the fund dramatically reduced its exposure to Chinese large-cap equities, with it completely getting rid of such as BABA and JD, which the fund was holding from Q2 2018. In addition, Chinese companies have been facing de-listing fears in the US which may have prompted the fund to get rid of its holdings of Chinese companies.

However, Bridgewater increased its holding in NIO during the previous quarter by adding 202,598 shares of NIO in Q2, bringing the total to 5,526,122 shares with a market value of $120 million. Bridgewater Associates’ major investments are focused on large-cap US companies.

Conclusion

While most investors are playing the waiting game, observing central banks and their next move, it is pertinent to keep eyes wide open to see shifts and trends that are likely to persist in the future. In addition, while most retail investors focus on detecting the actions of large funds, it is equally important to keep track of small and concentrated funds to get lucrative investment ideas.

Thank you for reading till the end. We hope the article was helpful for you.

Kind regards.

Yiannis Zourmpanos.

I love this as a segment, whale dives.

What value do you mostly find in observing the delayed movements of other investors?