Conversation with a loan officer

One of my clients today was a loan officer and he said for the rates to go down, unemployment has to go up.

So when there’s less people working, the rates go down? That’s weird. It’s all about supply and demand and the way the economy works is a little weird.

We also talked about how most people can’t buy a house right now and that the institutions like BlackRock and vanguard are buying entire communities to rent them out.

Thoughts? What do you think needs to happen for the interest rates to go down? What’s your prediction for the rest of 2023 and the beginning of 2024? Will this get worse before it gets better?

It's a little more complicated than a simple relationship between interest rates and unemployment. If you think about the post-GFC period between 2011 - 2019, we had low unemployment and very tepid inflation which allowed the Fed to keep interest rates low (some say too low for too long).

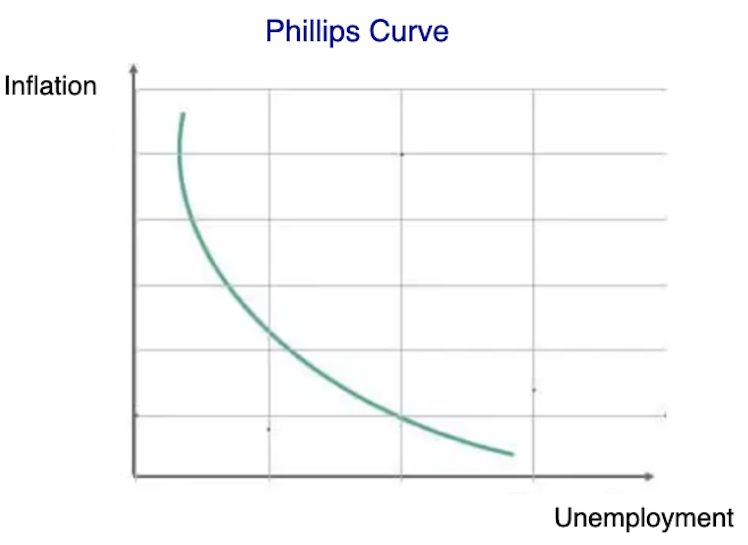

The correlation between interest rates and unemployment comes from traditional "Phillips Curve" thinking which is now considered by economists to be too simplistic a model. Interest rates are a function of inflation. When inflation is high, we have to increase interest rates to cool down the economy. When the supply and velocity of household discretionary spending outstrips the available supply of goods and services, inflation can be the result because we're bidding up the prices of goods in limited supply (demand-driven inflation). On the other side of the coin, when the supply of goods is constrained and workers are demanding higher wages, we get supply-side inflation. Both supply and demand-driven inflation are related because it can be like a dog chasing its tail. Workers demanding higher wages because of inflation, thereby driving more inflation.

The inflation we've experienced this last couple of years has primarily been supply-side inflation. Coming out of the Covid pandemic, you just can't ramp up manufacturing and raw material supply at the drop of a hat. But people coming out of lockdowns had a pile of money saved up to spend and they wanted to party. So demand outstripped the sluggish availability of supply. Raw material costs exploded and this had to be passed on to the consumers. You would've noticed this during a trip to the supermarket after the pandemic and saw plenty of empty shelves. We just couldn't ramp up manufacturing operations fast enough. Now we're at the point where workers are demanding higher wages in response to inflated living costs that were originally caused by supply constraints.

We don't necessarily need to go into a recession and/or see unemployment rise higher to see a moderation in inflation. Inflation can come down if we can increase productivity and produce the supply of goods and services to meet the demand. Technology is generally deflationary because it improves productivity and yields.

Obviously higher interest/mortgage rates are going to bite into discretionary spending, so an increase in productivity in the output of goods and services could be met halfway by a moderation in household spending. This would lower inflation and the Fed can then lower interest rates. This can all happen while the unemployment rate remains unmoved.

Effectively, there are many variables sitting between interest rates and unemployment and any one of them can produce the moderation of inflation and interest rates that we're looking for without an adverse increase in the unemployment rate.