Trending Assets

Top investors this month

Trending Assets

Top investors this month

@valuetowhom

Unconventional Value

$3.9M follower assets

67 following716 followers

What's Behind the Rise of $CROX?

Following up on my last $CROX Investment Idea, this post dives into the company's strategy and why it represents a repeatable source of value creation: What's Behind the Rise of Crocs? - by Tim Gallagher (substack.com)

As always, curious of your thoughts and open to feedback. Thanks for reading!

unconventionalvalue.substack.com

What's Behind the Rise of Crocs?

Understanding the brand's secret sauce

Investment Idea #2: Crocs ($CROX)

Second edition of Investment Ideas is up from a few days ago. We discuss the case for Crocs:

- Executed successful turnaround since 2014

- Durable brand characteristics

- Strong cash flow and industry-leading margins

- 9% free cash flow yield / 9x earnings

As always, would love to hear your thoughts and feedback.

unconventionalvalue.substack.com

Investment Idea #2: Crocs (NASDAQ: CROX)

Two durable brands. Capable management. Industry-leading profitability. Cheap valuation.

Interesting information, it has amazed me how they stayed popular. The valuation is also very interesting too, at such a low PE. I guess this is a time horizon move, the footwear game can be rough, as this stock has had have some very harsh drops if news isn't good. If you can get in at the right moment. I would think it can be a good run for someone.

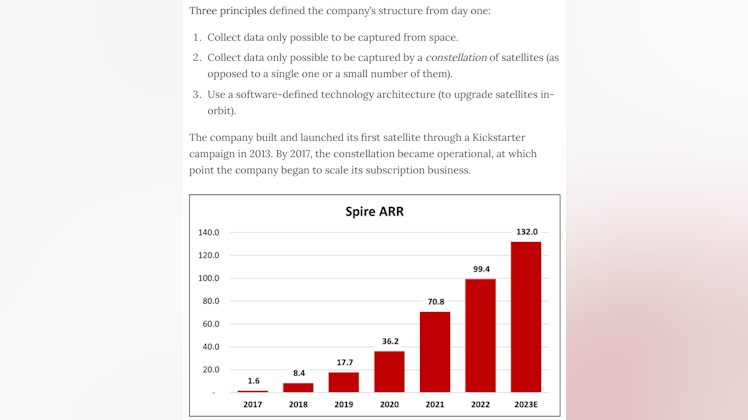

Investment Idea #1: $SPIR

I started a new, occasional segment on Substack today where I'll publish actionable ideas as I see them. I'll be tracking the returns (monthly) here. My intention is for it to serve as a launchpad for your own research. I hope you find it helpful.

First up is $SPIR, a satellite data subscription business with several unique capabilities. It currently trades at 1.2x 2023e revenue.

As always, feedback and other opinions welcomed. Thanks.

unconventionalvalue.substack.com

Investment Idea #1: Spire Global (NYSE: SPIR)

Unique capabilities in space supported by excellent long-term economics

Crazy that they started from a Kickstarter!

How I Invest

I'll keep this message short and sweet, and let you read the full post on Substack if interested.

The headline: I'm returning to a free service (a few reasons explored in the post). Thanks all for your support -- I'll continue to experiment with ways to offer value and share a unique perspective.

I talk about unconventional value (betting on change) and a few criteria that influence my assessment of a business. If interested, you can read the full article: How I Invest - by Tim Gallagher - Unconventional Value (substack.com)

Thanks again everyone. Have a great Friday/weekend :)

unconventionalvalue.substack.com

How I Invest

Unconventional Value Philosophy

Tim, it's exciting and fascinating to see you experiment and find your stride! No subscription fee adds yet another layer of meaning to your moniker, "Unconventional Value." Good luck with the job search! I'm also a huge David Gardner fan, btw.

What if $UPST is a Good Business?

Upstart is quite the controversial company. From $20 to $400 to $13, the market has absolutely no clue how to value the business. Which makes sense - if management is correct in their assessment of the long-term opportunity, the market is unfathomably large and Upstart will hold a decent chunk. If they're wrong, the business is likely to slowly fade into oblivion.

The following is an excerpt from my recent article. If you find it interesting, please share with a friend. Constructive criticism encouraged! (Not a comprehensive write up but happy to discuss the business in greater detail).

---

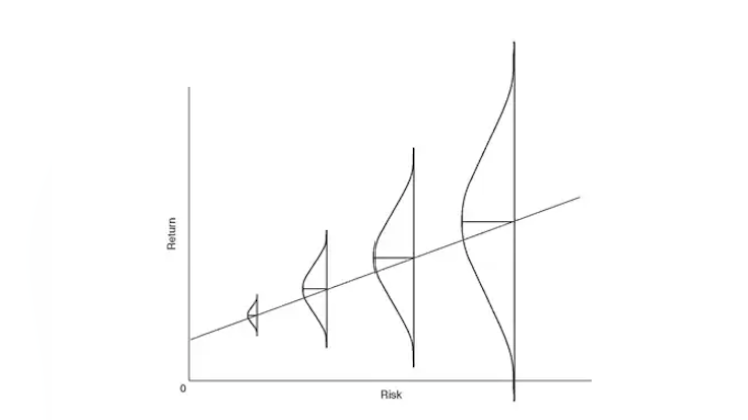

"I have little doubt investors at today’s prices will earn great returns over time. If we place Upstart in Howard Marks’ risk/reward framework, it is now on the far right: the distribution of outcomes has likely reached its widest point.

_Today’s investors could make multiples of their money, but they could also lose their shirt. In the spirit of full disclosure, my money is optimistic, but who knows if I’m any good at investing? (I sure don’t.) Either way, I’ll be around to see what happens on the other side of this credit cycle."

_

investorsperspective.substack.com

What if Upstart is a Good Business?

Good business model, great management, cyclical market.

Realized the quote starts off in the wrong way. I do NOT recommend buying Upstart unless you have independently arrived at that conclusion by your own research

My Worst Investment: $MTTR

It's tough for me to answer the question of "what is your worst investment?" because I've made so many bad ones in the brief time since I've joined this game we call investing. That said, one stands out as a particularly poor outcome, but a particularly great learning event.

Matterport is an interesting company. It sells itself as a platform for the digitization of the built world. With the current direction of the world, I loved the story, but precisely at the wrong time -- and at a time when valuation was the least of my concerns (now it is the highest of my concerns).

I bought into the company at a multiple of over 20x sales! I held it for several months and slowly came to the realization of my error. But so did the market. The stock continued to drop from where I bought it, and my mental anguish at my mistake continued to rise until I made the decision to cut the fat and recognize a lesson learned. I never lost confidence in the 10-year story, but I lost confidence that my returns would make sense given the risk.

Looking back on this experience, a few things stand out:

- Valuation matters -- a lot -- for future return expectations.

- Overpaying for a business can create a mental drag that impacts your thinking.

- Sometimes it's better to just get out, reset your thinking, and move from there.

- Don't be afraid to take a loss.

These lessons aren't universal, but they are a few things I picked up from making what I believe to be an error early in my investing journey.

@valuetowhom Thanks for the post. Very wise summary points at the end.

Obsoletive Audio

Before I dive into the piece, I just want to apologize for the lack of consistent engagement here. Been focusing a lot more on long-form writing/research and trying to discover a path to self-sustaining. Hopefully more on that later this week or next, but for now, here's the latest piece (also on $SONO), which borrows from Ben Thompson's "Obsoletion" framework.

-----------

Clayton Christenson’s theory of disruption describes the process by which low-cost solutions come to dominate markets over time:

- Incumbents ignore cheaper, inferior technologies because they don’t satisfy the needs of their most profitable customers.

- As the category matures, incumbent solutions overshoot the minimum performance demands of most customers.

- Meanwhile, the cheaper technologies (previously inferior) improve to the point where they can satisfy mainstream performance demands.

- The lowest-cost technologies become widely adopted — thereby “disrupting” the market — and the cycle begins anew.

Applying this theory to consumer audio, the natural conclusion is Amazon and Google are the disruptors. Their speakers satisfy mainstream performance standards at a significantly more affordable price than alternatives. The flaw in this argument, however, is that disruption theory is based on the lowest cost provider winning the market. Amazon and Google may offer the lowest price, but they’re far from the lowest cost provider. (“The division that houses Amazon's Alexa is on track to lose $10 billion this year alone.”)

I’d argue the two have pursued the disruption playbook to catastrophe. Sure, they ship the vast majority of smart speaker units, but they’re also structurally unprofitable and lack pricing power; the business is long-term unsustainable. The first hints are recent layoffs, many of which target hardware divisions.

Hardware is hard because experimentation is expensive, and the cost structure is variable. Amazon and Google — masters at inexpensive experimentation and building scale — are finding that scale is counterproductive if product margins are negative. In all, their foray into smart speakers has been a value destructive exercise thus far; the real world does not abide by the same cost principles as the Internet.

Obsoletion

Ben Thompson (whose work I highly recommend reading) points to another reason the attempted disruption has not panned out. The assumptions that underpin disruption theory don’t apply to consumer markets (emphasis mine):

"Christensen’s theory is based on examples drawn from buying decisions made by businesses, not consumers. The reason this matters is that the theory of low-end disruption presumes:

- Buyers are rational

- Every attribute that matters can be documented and measured

- Modular providers can become “good enough” on all the attributes that matter to the buyers

All three of the assumptions fail in the consumer market, and this, ultimately, is why Christensen’s theory fails as well."

Consumers aren’t rational because we’re not cold, calculative machines. We don’t look to satisfy a minimum performance threshold; we look for a brand with the best product experience that we can afford. Subjective user experience is more important than objective performance specifications.

Thompson continues to explain the alternative to disruption: obsoletion. Obsoletion takes a “top down” approach compared to the “bottom up” strategy characteristic of disruption. He writes (emphasis mine):

"An even cursory examination of tech history makes it clear that “obsoletion” – where a cheaper, single-purpose product is replaced by a more expensive, general purpose product – is just as common as “disruption” – even more so, in fact. Just a few examples (think about it – you’ll come up with a bunch more):

- The typewriter and word processor were obsoleted by the PC

- Typesetting was obsoleted by the Mac and desktop publishing

- The newspaper was obsoleted by the Internet

- The CD player was obsoleted by the iPod

- The iPod was obsoleted by the iPhone"

Disruption is cost-led. Obsoletion is experience-led. While Thompson applies the obsoletion framework to Apple, the same lens is appropriate for Sonos:

- Sonos also sells consumer hardware.

- Its products are more expensive than widely available alternatives.

- User experience differentiates the product, not performance specs.

- Customers stick with the brand for a long time.

- Most customers buy multiple products from the brand.

The owner of a sizable audio installation business confirmed the stickiness of Sonos products in a recent Tegus interview:

"We have found that when someone works with Sonos, understands Sonos, they understand what music they can bring into it, they never go back. It's hard to move them away from it to think about anything else, and we end up even retrofitting a lot of their other homes."

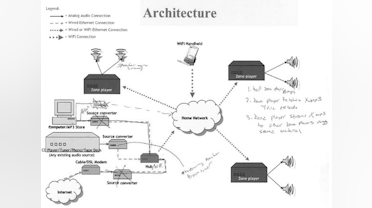

The same owner added how the Sonos architecture is differentiated (emphasis mine):

"The conventional side of audio/video forever was cumbersome and difficult to say the least in structuring and wiring and so forth because that was before the digital age of HDMI, we were doing everything with analog, while HDMI kind of transitioned us into a simplified function. And Sonos come along with a product that is for all practical intentions, a more simplified process to the same end. And it basically revolutionized what we do. It changed the way we approach systems, the way that we really design a complete product around. And Sonos started to become a lot more of our business because of the offerings and their growth in that field and category of soundbars, subwoofers, separate speakers."

Performance specs do not differentiate Sonos — plenty of speakers offer comparable sound quality. It’s the experience, and the networking architecture that enables the experience (for both the installer and the user) that defines Sonos. As I wrote previously:

"Because Sonos owns the architecture, no competitor can offer a comparable in-home sound system (read: experience) as Sonos (hence why Sonos’ stated ambition is to be “the world’s leading sound experience brand.”) Make no mistake — Sonos competes with other brands, but they offer products; Sonos offers a system."

This is an important point because it shows the differentiation is defensible; patents protect the networking architecture for the next decade plus. Also importantly, a “system” approach returns to the concept of a “general purpose” solution, as part of Thompson’s obsoletion framework.

An obsoletive technology packages multiple solutions into a single, more expensive solution. We see this in the iPhone, which packages emails, calls, music, and the Internet into one device. We also see it in Sonos, which packages speakers in the living room, kitchen, bedroom, etc. into a single listening app. And as Thompson elaborates, obsoletion has shown to be particularly effective in hardware (emphasis mine):

"A theme I have returned to frequently on this blog is the importance of distinguishing between horizontal and vertical business models – hardware and services, in mobile. It is the former, hardware, that seems most receptive to obsoletive technologies, driven by Moore’s Law. It is services, though, due to the zero marginal cost of serving customers, where disruption is a much more applicable theory. It’s Google, then, and Amazon to a degree, that are the most disruptive of companies, but primarily to other horizontal services, not necessarily to differentiated hardware that has inherent value."

From my perspective, Sonos is heading in the right direction. “Obsoletion” is an effective strategy for business-building in consumer hardware, and Sonos has spent 20 years building a brand worthy of the strategy.

Conclusion

All told, it’s clear Amazon and Google have pursued strategies of disruption. However, I think their attempt to “disrupt” audio has actually just commoditized smart speakers. In the long run, I anticipate this will strengthen Sonos’ counter-positioning as a premium, obsoletive (more expensive, more capable) solution.

Sonos’ vision is to “obsolete” traditional home audio products by packaging them into a single system, controllable from your phone. Of course, it will be difficult and take time to accomplish. But that doesn’t mean it won’t happen. Here’s what Patrick Spence had to say in his Letter from the CEO at the time of IPO (2018):

"At Sonos, we’ve learned the value of doing hard things. We’ve also learned that the hard things take time. You can’t create a new product category or a breakthrough innovation if you’re only looking three months into the future. Industry leadership requires bold ideas and lasting commitments, and we refuse to let short-term opportunism keep us from realizing long-term opportunities."

I think that’s the right way to think about it.

(END)

If you found this interesting, don't forget to subscribe at Investor's Perspective | Tim | Substack. As always, appreciate you for reading.

investorsperspective.substack.com

Unconventional Value | Tim Gallagher | Substack

Ongoing company investigations & investment ideas for the long term investor. Click to read Unconventional Value, by Tim Gallagher, a Substack publication with hundreds of subscribers.

Sonos: The Hardware Machine

After vacation and catching up on some work, I should be back to posting on a more regular schedule moving forward. Thanks to everyone who reads my analysis. I appreciate it and hope you've found it to be of value.

-----

Like Roku is an operating system (OS) for a smart TV, Sonos is an OS for a smart audio system. The competitive environment and economic model, however, differ between the two. Sonos has a virtual monopoly in wireless home audio and makes money from hardware. Roku has competition in smart TV OS and makes money from advertising.

Why does Sonos have no real competition?

It starts with the fact that any audio experience is enhanced when multiple speakers work together. Years ago (prior to Wi-Fi becoming widespread), Sonos patented the networking architecture that allows speakers to communicate directly with each other over Wi-Fi, which allows the listener to synchronize audio and control multiple speakers from one place (the Sonos app).

Because Sonos owns the architecture, no competitor can offer a comparable in-home sound system (read: experience) as Sonos (hence why Sonos’ stated ambition is to be “the world’s leading sound experience brand.”) Make no mistake — Sonos competes with other brands, but they offer products; Sonos offers a system. Today, the system is mainly in homes, but the long-term opportunity is to expand into cars and commercial settings.

Unlike audio, there is little benefit to multiple TVs working together — you can’t really change the experience with a new architecture. Roku may have a superior OS, but it competes on the same dimensions as others.

Consumer expectations for audio and TV are also different. If Sonos put ads on its speakers, nobody would buy them. But nobody bats an eye at TV ads. As such, Sonos makes money on its hardware; it sells a premium product at a premium price. Roku makes money on advertising; it sells inexpensive hardware at roughly breakeven to create scale and feed its ad network.

Audio systems and TVs are also at different stages of adoption. Until the arrival of Sonos, multi-room home audio was reserved for ultra-wealthy audiophiles — a comparable in-home sound system would have cost $20-50k to install 20 years ago because of the wiring complexity. With no existing upgrade cycle for Sonos to tap into, it has had to build the market largely from scratch. Roku, on the other hand, can tap into the existing TV upgrade cycle (accelerated by the transition to streaming), and at an approachable price point ($25), it’s not too difficult a sale.

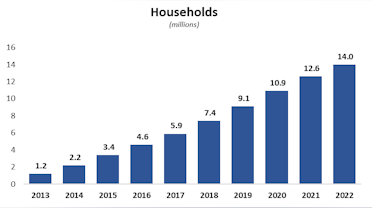

Both Sonos and Roku were founded in 2002, but Roku has ~5x the active accounts (households) as Sonos. Just six years ago, however, Roku had fewer accounts than Sonos does today. The purpose of this comparison is to frame the opportunity as Sonos sees it. Over time (perhaps a decade or more), it envisions tens of millions of homes across the world adopting smart home audio systems.

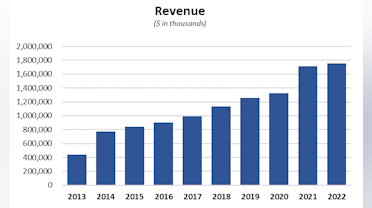

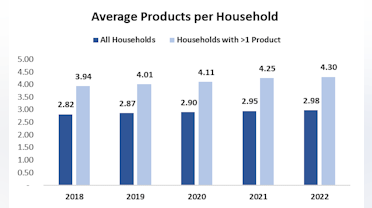

Much of Sonos’ historical growth is attributable to word of mouth (the #1 method of new household acquisition). When customers are your biggest advocates, it’s always a good sign. When those customers never leave, it’s a great sign, and when they buy more products over time, that’s how you deliver 17 consecutive years of revenue growth in an ultra-competitive industry.

In essence, that’s the Sonos flywheel: existing households bring in new households, and all households buy more products over time (and continue to spread the word to family and friends), creating a virtuous cycle.

-------

Continue reading at: Sonos: The Hardware Machine - by Gallagher (substack.com). If you enjoy my research, please consider subscribing or sharing with a friend.

investorsperspective.substack.com

Sonos: The Hardware Machine

Who's better at hardware?

Has Sonos talked about adding any software services on top of its products? I worry this could turn into a GoPro situation

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?