Uber is bigger and stronger

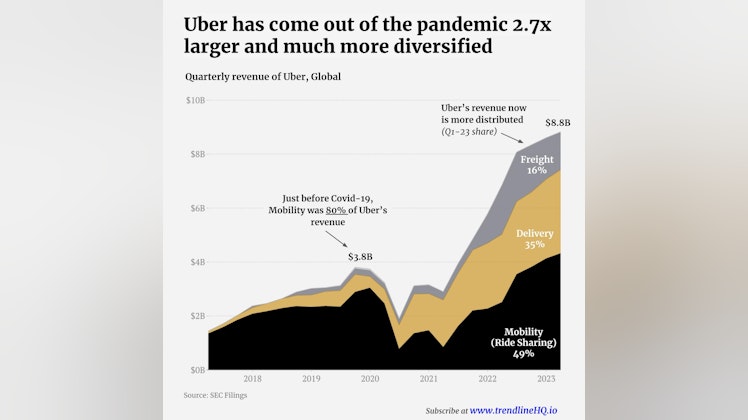

Pandemic (Covid-19) post existential threat to Uber. It was over-reliant on Ride sharing (Mobility) at that time, which plummeted overnight due to lockdowns.

Fast forward to 2023, and it is bigger and more diversified:

- Total Revenue is 2.7x larger (Q1-23 vs. Q1-20)

- Mobility (Ride sharing) has also grown by 75% over 3 years (Q1-23 vs Q1-20) but is now only ~50% of total revenue.

- Delivery and Freight are now meaningfully large businesses - $3.1 billion and $1.4 billion in Q1-23 revenue, accounting for the other half of Uber’s revenue.

You can read more here

Companies that started trimming expenses early and worked toward profitability are now in a much better spot. Uber did this by cutting ~14% of its workforce in 2020. Tough to do, but it has paid off big time.