iHuman Is Inhumanly Undervalued

Summary

- iHuman is the education app leader in the world's largest app market.

- The company had its most profitable quarter ever, while its enterprise value remains negative.

- In July, iHuman's international STEM apps brand was launched and existing popular apps were released in Google Play stores worldwide.

iHuman's (NYSE:NYSE:IH) share price has declined by more than 90% since its peak of around $28 in November 2020, to less than $1.90 recently. This has resulted in iHuman's enterprise value turning negative while fundamentals have been improving. iHuman's negative enterprise value is mainly due to a combination of high cash reserves, low debt, and a low market cap. Net income performance has been improving for the past three quarters and is now at record levels, while operating expenses have declined dramatically and are now near two-year lows.

The market has also not priced in the launch of internationally focused brand Bekids and the release of existing popular apps in Google Play stores globally. iHuman's price to sales ratio of 0.7 is less than 10% of Duolingo's (DUOL), a listed competing educational app maker. The market has also heavily discounted the fact that iHuman is the educational app leader in one of the world's fastest growing and largest app markets. As iHuman continues to be profitable and gather more attention, its stock price should rise. Therefore, I rate this stock a buy.

Business Model

iHuman makes educational apps for children. These apps span many categories, including reading, Chinese language learning, coding, and more. Revenue is primarily derived from subscriptions to these apps, although a one-time lifetime access purchase is also available. iHuman Chinese is iHuman's flagship product. It was launched in 2016 and, in 2021, generated 65% of all revenue. The 2021 annual report revealed that most of iHuman's revenue is generated in China.

On Sensortower, an app intelligence platform, it can be seen that iHuman apps are highly rated. In the Chinese Apple app store, iHuman Chinese has an average rating of 4.8 across more than 830,000 reviews. The lowest rated iHuman app is iHuman Exercise, which received an average rating of 4.1 across 235 reviews.

Market and developments

As the market leader in China's education app industry, iHuman is well positioned to reap rewards from growth in China's app industry. China's app market, already the largest in the world, is projected to grow at a CAGR of 9.65% to reach a revenue of USD$226 billion in 2026. This is almost 50% larger than second-placed U.S., whose app market is projected to generate a revenue of USD$151 billion in 2026. Category specific trends are even more positive, as demand for education apps and language learning apps is expected to grow at CAGRs of 24% and 15% in 2022-2027, respectively.

In July 2022, iHuman launched the Bekids suite of apps targeting the children's STEM market. Bekids Coding is an international port of the popular iHuman Coding, and will be the primary app in the Bekids suite. Also in July, iHuman's most popular apps - such as iHuman Chinese and iHuman PinYin (launched as GoPlay Chinese) - were released in Google Play stores internationally. These initiatives are expected to further drive international revenue.

KPIs

iHuman app KPIs have been improving since its IPO. On a yearly basis, monthly active users (MAUs) and paying users (PUs) have continued to climb, reaching 18.2 million and 1.51 million, respectively. Average revenue per paying user also increased year on year, climbing 2.1% to USD$21. In the China Apple app store, the iHuman flagship product, iHuman Chinese, is the undisputed champion in the education category. According to Chinese app intelligence company Qimai data, iHuman Chinese ranked within the top 10 grossing applications in the past five years, and held the top grossing education app crown for the same period of time.

Financial Analysis

In Q2 2022, iHuman made the most net income ever, growing 66% on a quarterly basis to USD$3.3 million. Net margin improved for the third quarter in a row to 9.45%. This improvement in net margin was not the result of an increase in revenue though, as revenue was mostly unchanged at USD$34.4 million. Instead, the improvement in net margin was the result of sharp cuts to R&D and sales and marketing expenses.

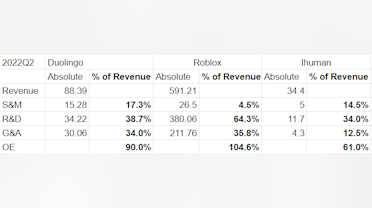

On a quarterly basis, R&D expenses decreased substantially to USD$11.7 million, while sales and marketing expenses decreased to USD$4.7 million. Compared to other listed app makers such as Roblox (RBLX) and Duolingo, iHuman's operating expenses as a percentage of revenue are lower, suggesting that the company is more efficient at managing costs. Gross margins have consistently remained at around 70%, suggesting that there is plenty of room for iHuman to be profitable.

IH's balance sheet is healthy with cash of USD$127 million while total debt is only USD$2.7 million. The largest liability item is deferred revenue, at USD$47 million. My only concern is that there is more than enough cash to sustain the business for many years and that this has been the case for many quarters now. Like many other Chinese ADRs, IH's large cash holdings and low market cap have resulted in a negative enterprise value.

Valuation

To value iHuman, we will compare it to language learning app Duolingo. This is an appropriate comparison because both companies are listed app makers whose apps are in the education category of app stores. According to Sensortower, in the top grossing education app category, Duolingo was ranked 1st and 10th in U.S. and Chinese app stores, respectively. Duolingo has had a longer runway than iHuman, though, as its apps were released in 2012 vs. 2016 for iHuman's earliest app, iHuman Chinese.

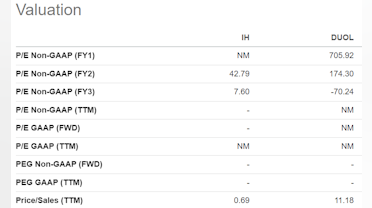

On a TTM basis, Duolingo generated a net income loss of USD$74 million on a revenue of USD$306 million, while iHuman generated a net income loss of USD$1.67 million on a revenue of USD$145 million. Duolingo's revenue is more than twice that of iHuman's, but that would not be obvious by looking at their price/sales ratios. Duolingo's price/sales ratio is more than 10, whereas iHuman's is 0.7. This suggests that there is a possibility of a large upside if iHuman's price/sales ratio converges to even half that of Duolingo's.

Risks

- Delisting

On May 26, iHuman was included in the HFCAA's conclusive list of issuers, raising delisting fears. While Washington and Beijing have since reached an agreement allowing U.S. auditors to inspect China-based accountants, there remains a possibility that the inspection might fail and the ADR gets delisted. To avoid this scenario, it is quite likely that iHuman will follow in the path of other Chinese ADRs, such as NIO and Li Auto, and pursue a listing on the Hong Kong stock exchange.

With its generous cash reserves, it is unlikely that iHuman will need to raise more cash through a primary listing on HKEX. Instead, a secondary listing by way of introduction will be the likely outcome. Listing by way of introduction will require iHuman to meet some listing requirements. The most feasible listing requirement will be for iHuman to make a profit in the most recent year of not less than USD$2.6 million, and with respect to the previous two years, an aggregate profit of not less than USD$3.8 million. While iHuman had its most profitable quarter recently, consistent profitability will be required over the next few quarters to safely meet listing requirements.

- Global macroeconomic headwinds

In China, a meltdown in its property market and repeated COVID-19 lockdowns are likely to reduce the economic growth rate to just 2.8%, much lower than the domestic target of 5.5%. This does not bode well for iHuman, as the majority of its revenue is generated in China.

Outside of China, global headwinds threaten iHuman's international expansion efforts. In Europe, an energy crisis and runaway inflation are adding to recession fears. In the U.S., interest rate hikes are raising the probability of slowing economic growth and recession.

Conclusion

If there were not a threat of delisting, it is quite possible that iHuman's share price would be substantially higher than it is now. iHuman is the education app leader in China, the world's largest app market. iHuman will also benefit from fortuitous trends in the education and learning app industries, which are projected to grow by 24% and 15%, respectively.

On the business level, iHuman has succeeded in trimming operational expenses dramatically to achieve its highest net income yet. The launch of a new brand focused on STEM apps, and the release of existing apps in the Google Play store internationally should add additional streams of revenue. Because of iHuman's small market cap and lack of analyst coverage, positive developments are not disseminated as thoroughly as they should be. iHuman's negative enterprise value and tiny price/sales ratio, relative to other app makers, make for an asymmetric bet that should pay off handsomely in the future.

Hey China Investor, welcome to Commonstock :)