Trending Assets

Top investors this month

Trending Assets

Top investors this month

@reasonableyield

Reasonable Yield

$23.3M follower assets

345 following740 followers

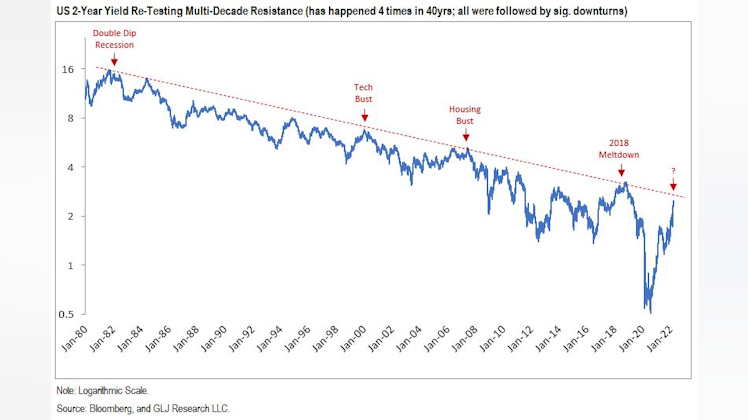

End of the Dead Cat Bounce?

I saw a good discussion here on Commonstock between @paulcerro, @meindl_jannis, @parrot and @dissectmarkets yesterday, which can be found in this link.

To which @meindl_jannis concluded, "To rely on a single indicator would be too deterministic and probably fool yourself into false certainty. However, in the context of things, it may make sense to take different things into account".

I agreed with the summation but would like to know what people think about the below chart. Same conclusion?

Loving the collaboration/exchange of ideas that led to this post!

Just looking to add some context for other beginners like myself -

What Is a Dead Cat Bounce?

A dead cat bounce is a temporary, short-lived recovery of asset prices from a prolonged decline or a bear market that is followed by the continuation of the downtrend. Frequently, downtrends are interrupted by brief periods of recovery—or small rallies—during which prices temporarily rise.The name "dead cat bounce" is based on the notion that even a dead cat will bounce if it falls far enough and fast enough.

Hasbro Reject Alta Fox's Proposal, But Investors are Taking Notice

For anyone who follows Hasbro $HAS it would appear the board is not bowled over with their proposals, laid out in their well-researched piece "Hasbro, Let Wizards Go".

Alta Fox, who owns a 2.5% stake in Hasbro, were shocked. When founder Connor Haley caught up with Yahoo Finance he would say: "We've got a world-class slate of advisors. And they are all collectively stunned at the level of entrenchment of the current Hasbro board. I think we went well out of our way to offer a beyond reasonable settlement."

But it's not just Alta Fox that are taken aback by Hasbro's refusal to listen to new ideas. Adirondack Retirement Specialists, a Meaningful Shareholder of Hasbro, had the following statement:

"We were dismayed to see media reports indicating that the current Board of Directors rejected what appears to be a step forward toward adding value for Hasbro shareholders via a very reasonable settlement proposal from Alta Fox. If true, it is troubling to us that the current directors would reject a well-researched 2.5% shareholder’s input and candidates who have records of adding value at a time when Hasbro seems to have lost the market’s confidence. The Company’s shares are at a new 52-week low point, and it has a strategy that has led the business to lag the overall market and its major competitor over the past five years. For shareholders, we insist on a strategy that prioritizes the highest and best long-term allocation of capital and resources. In our view, Alta Fox’s proposal takes shareholders toward that goal. We intend to support the entire dissident slate as we believe that would be in the best long-term interests of shareholders if a contested vote is held at the 2022 Annual Meeting of Shareholders."

I suspect that the momentum for Alta Fox's proposals has impressed current shareholders, will continue to grow, and will eventually pressure Hasbro's board into action.

Part of the proposal by Alta Fox was putting forward board members. The 5 proposed members include;

- A founder and CEO of a publicly-traded tech/software business

- A CFO who has experienced 5 spin-offs

- A professional Magic the Gathering player, and seasoned investor

- An expert in corporate strategy and;

- An operationally minded former CEO

I look forward to seeing how this one plays out.

Just for giggles, do you think Alta Fox will be successful in their activism?

30%Yes

30%No

40%Unsure

10 VotesPoll ended on: 3/30/2022

I’ll support anyone who brings back MLB Showdown. That was my childhood. Hopefully I or someone else can convince Alta Fox or hasbro to bring it back.

UnitedHealth to Buy Home-Health Firm LHC Group for $5.4 Billion

It would appear that UnitedHealth $UNH are planning to Buy LHC Group $LHCG for about $5.4B in cash, or $170 per share according to the Wall Street Journal.

"The acquisition by UnitedHealth’s Optum health-services arm, which is expected to be announced Tuesday, will add one of the country’s largest home-health firms to a portfolio that already includes doctor groups, clinics and surgery centers, as well as some home-based services."

Last year, LHC generated around $2.2B in revenues in their long-term health care business.

WSJ

UnitedHealth to Buy Home-Health Firm LHC Group for $5.4 Billion

The $5.4 billion deal marks the latest foray by a managed-care company into a category said to promise lower costs than hospitals and nursing homes.

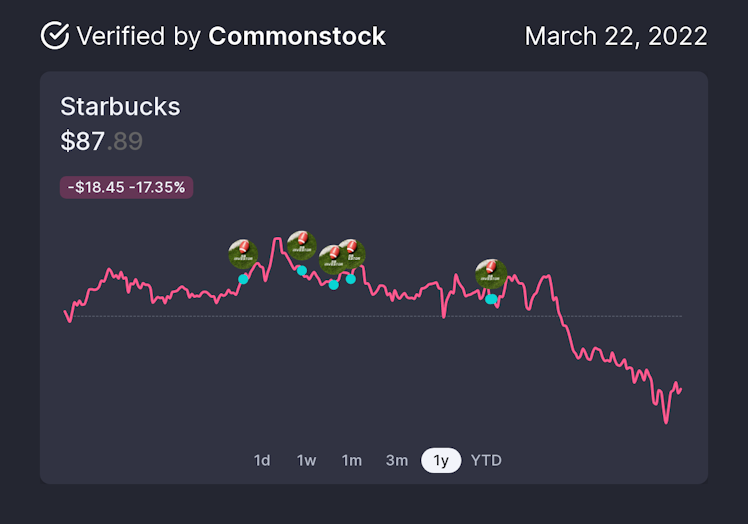

Starbucks Announce Dividend $0.49 per share

Starbucks $SBUX announce a dividend per share of $0.49, payable on May 27th, for those owning the stock from May 13th.

I suspect that the quarter after this coming quarter will be a dividend increase from $SBUX as they tend to do it once every 4-quarters.

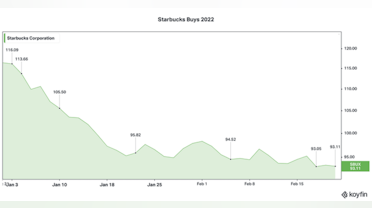

I have recently been buying up a lot of $SBUX in the $80 to $90 range, almost tripling the position size. So this dividend is going to be good!

Some context from an older Commonstock post:

"Starbucks (SBUX): The company is undergoing some tension from a recent unionisation effort. After the successful unionisation of two NY stores in December (and a third store in Memphis more recently), and the dismissal of 7 Memphis employees (for organising), this sparked a nationwide outcry, followed by over 110 stores now signing up with the intent to follow the same course of action as Buffalo. Starbucks' Q1 earnings showed that demand was strong, but that near-term margins are suffering at the hands of inflationary pressure, increased training costs, and good old supply chain disruption.

Unionisation only looks set to further dampen EBIT margins in the future but was not discussed during the call. However, management has committed to reinvestment in China, and the payment of dividends. Whilst the union possesses a threat to the LT margins of the business, and general partner morale, I do not believe it takes away from the company's status as an attractive dividend growth prospect, with attractive reinvestment capabilities to further grow their operations. At a dividend yield of 2.05%, and a rich history of dividend increases, I see this as an attractive prospect.

I have been pretty active buying up $SBUX stock this year. So far, I have bought shares on seven separate days in 2022 for an average price of $100 per share. I believe that the stock now trades at a fair valuation at around 17x 2023 EBIT, with a bountiful amount of share repurchases scheduled for the next three years, and plenty of FCF to increase dividends.

Although near-term margins look to be suffering (primarily as a result of the inflationary environment) and the China business is still lagging behind (the result of covid mobility restrictions), I think this company is priced at a reasonable valuation and is a great fixture in a DGI portfolio. I plan to continue buying in the $80-$90 range all year round."

I have since bought more at $85.28, $81.55, and $87.65 per share in March.

$SBUX is one of my favorite holdings. I am a little bummed that my position in my Roth was at about the peak right before the sell off... Cost basis in my taxable is much lower, though 😊

Dividend Investors

Hello everyone, I am noticing a lot of new faces following me today, so just wanted to say that if you are interested in dividend investing, then you can follow me :)

Some other great dividend investors here are @investor_from_nepal @thedividendpig @dividenddollars @stock.owl @dollarsandsense @scorebdinvestor and @yaninvests.

A little bit about me

I have been investing for a long time, mostly in GARP and special situations, but this year (2022) I embarked upon a project to max out my £20K annual tax-free ISA allowance (like a Roth IRA but for the UK, and more efficient) to build out a dividend growth portfolio.

I document the construction of that project portfolio right here on Commonstock, and share every purchase, dividend, and my thoughts, transparently.

Below is an example of my February Update, only two months into the project. I will be sharing my March update soon.

----------------------------------

The following text is copy/pasted from my Commonstock post at the end of February.

February Dividend Growth Portfolio 2022

As the second month of this project comes to an end, I will share my activity for February. As a reminder to readers, the first year of this project will likely be a build-out phase until I conduct the necessary research on single stocks I want to own and construct the desired weightings of the portfolio. Interested readers can find more details about this project in "Maiden Post of Reasonable Yield", and the first month's update at "January Portfolio 2022".

As a reminder, in the maiden year of this project, I am seeking to grow the annual dividend income to £350 to form a base from which to expand in the coming decade. A further reminder to any potential newcomers, the goal of this project is to max out the £20,000 annual ISA limit, and build a robust, yield-bearing dividend growth account.

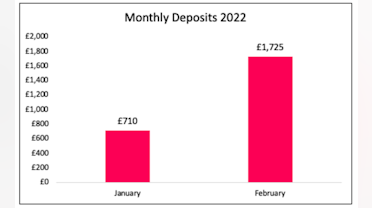

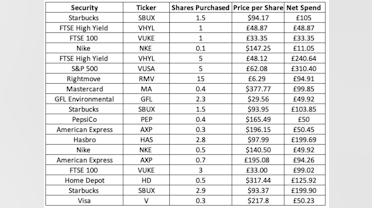

In February, £1,725 was deposited and invested, meaning a total of £2,435 has been invested this year, excluding the initial £10,000 or so that was allocated in December to create this pre-fund account and kick start this project. Thus, bringing the total value of the DGI portfolio to approximately £13,800. Dividends collected in February included a £2.69 dividend payment courtesy of British American Tobacco $BATS, as well as £2.15 from Starbucks $SBUX. I intend to report the dividend collection more thoroughly when the portfolio is built-out and generating material dividends.

Activity in February

Selling is not an activity that I intend to engage much in during the initial build-out of this portfolio, but this month I sold the position I owned in VFEM, an emerging market ETF listed by Vanguard, in wake of the uncertainty surrounding EMs. I felt the capital was better placed elsewhere. It was a small (2%) position.

This month, I opted to allocate more readily towards ETFs, in order to build up the annual dividend income (in anticipation of Q1 payments from Vanguard ETFs).

Above is a table of the purchases made during the month of February which includes new positions in; American Express $AXP, Home Depot $HD, Hasbro $HAS, Rightmove $RMV, American Express $AXP, and Mastercard $MA as well as additions to pre-existing positions.

Some commentary on a select few of the names I have been adding to this month.

Starbucks (SBUX): The company is undergoing some tension from a recent unionisation effort. After the successful unionisation of two NY stores in December (and a third store in Memphis more recently), and the dismissal of 7 Memphis employees (for organising), this sparked a nationwide outcry, followed by over 110 stores now signing up with the intent to follow the same course of action as Buffalo. Starbucks' Q1 earnings showed that demand was strong, but that near-term margins are suffering at the hands of inflationary pressure, increased training costs, and good old supply chain disruption.

Unionisation only looks set to further dampen EBIT margins in the future but was not discussed during the call. However, management has committed to reinvestment in China, and the payment of dividends. Whilst the union possesses a threat to the LT margins of the business, and general partner morale, I do not believe it takes away from the company's status as an attractive dividend growth prospect, with attractive reinvestment capabilities to further grow their operations. At a dividend yield of 2.05%, and a rich history of dividend increases, I see this as an attractive prospect.

I have been pretty active buying up $SBUX stock this year. So far, I have bought shares on seven separate days in 2022 for an average price of $100 per share. I believe that the stock now trades at a fair valuation at around 17x 2023 EBIT, with a bountiful amount of share repurchases scheduled for the next three years, and plenty of FCF to increase dividends.

Although near-term margins look to be suffering (primarily as a result of the inflationary environment) and the China business is still lagging behind (the result of covid mobility restrictions), I think this company is priced at a reasonable valuation and is a great fixture in a DGI portfolio. I plan to continue buying in the $80-$90 range all year round.

Hasbro (HAS): Hasbro has long been a poorly managed enterprise, milking their high-margin 'cash cow' business, the Wizard of the Coast, home to popular trading card and community games, Magic the Gathering and others. Of late, shareholder activism has taken place (read here), and this created an attractive potential catalyst for the business, in light of the activist proposing a spin-off for this WOTC unit. Whilst the consolidated business yields 2.78%, I agree with the case study shares above, in that both the WOTC and RemainCo will be better businesses when separated. If the deal goes through, the HAS stock will endure a forced re-rate, at which point I may consider selling. Should I hold until the spin-off period, I am more so inclined to sell the WOTC business, and keep the RemainCo, under the condition that things actually improve without their cash cow, and the business becomes a more prudent capital allocator. One can dream.

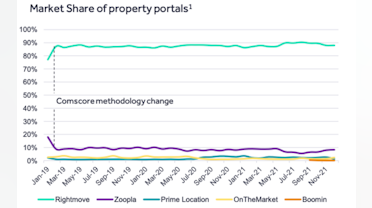

Rightmove (RMV): Rightmove, a UK-leader in the rental and home listings space, is a high-margin, market leader that has now emerged from the pandemic. After cancelling dividends in 2020, the company is now back on track paying semi-annual payments. While I adore near-monopoly-like businesses, Rightmove faces a great deal of competition but has the capital superiority to ensure they remain on top, building on top of their already market-leading product. For the FY21 year, revenues are back up to £305M (£205M FY20, £289 FY19), with site traffic at all-time highs, and advertisers and ARPA now showing signs of recovery. Operating margins (74%) are now back to pre-covid levels. Coming out of the tumulous 2-years, Rightmove continues to have a ~90% market share of property rental.

Home Depot (HD): A business I have been watching for some time. After a post-earnings rout of share price, I decided to initiate a small position. A strong Q4, with weak guidance and a 15% dividend hike, meaning HD's shares trade at a 2.36% forward yield. While the guidance is weak, I am not a bottom-timer and am happy to own (and add) to this business for years to come.

Home Depot has shown consistent revenue growth, a history of dividend growth, and has managed to do so whilst continuing to grow free cash flow and maintain a healthy payout ratio for their dividend. From 2012 through 2021, dividends have grown by a CAGR of 20%.

Mastercard (MA) and American Express (AXP): I am not gifted at the financial analysis of banks, payments businesses, and the like. To compensate for this, I tend to basket exposure to this industry, namely with Visa, Bank of America, and now American Express and Mastercard. Picking between the rails of modern finance (Visa, Mastercard) is too difficult for me, so I choose to own both. Moreover, American Express, a company I have long followed, is slightly differentiated with respect to the quality of their consumers, and Bank of America (alongside JP Morgan) is one of the top 2 banks in the States, and both have excellent CEOs. I don't currently own JP Morgan but may do in future after I spend time revisiting the business after a few quarters of absence.

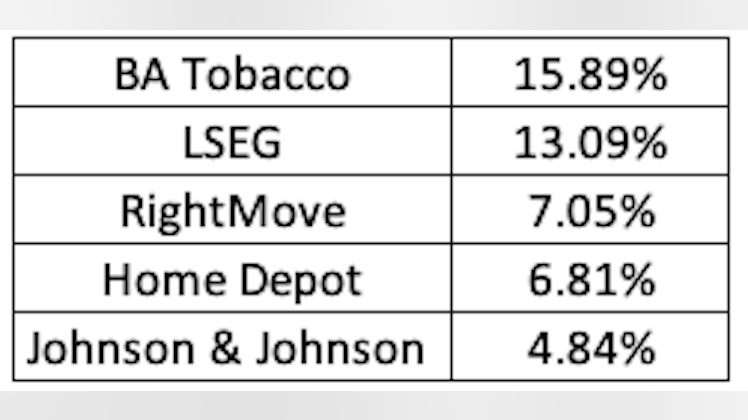

As things stand, here is a table of the current holdings.

In the future, I intend to continue researching new companies and may add more. I am particularly interested in gaining REIT exposure in the coming quarters. The goal for this year is to bring the composition of individual stocks closer to a 50% weight and max out the ISA allowance for the next tax year, which begins in April. Thus, by the end of this year, the portfolio should more than double, reaching close to £30,000 - £35,000 depending on the timing and sizing of deposits. The following year, it should near-enough double once more. I thank you for following me on this journey.

That will be all for this month.

Thank you,

R.Y

Thanks for the mention! Glad we can learn from each other on this platform!

Berkshire Hathaway to Buy Alleghany for $11.6B

Looks like Mr Buffett is tipping his toes into the stock market, buying an insurer named Alleghany, a company that Buffett has apparently spent 60 years observing. $BRK.B $Y

"Berkshire said it would pay $848.02 a share for Alleghany, a premium of about 25% to Friday’s closing price of $676.75 and a multiple of 1.26 times the New York-based company’s book value at the end of 2021. Berkshire, whose operations include an array of companies including insurer Geico, said it expects to complete the acquisition by the end of the year."

Founded in 1929 by railroad entrepreneurs Oris and Mantis Van Sweringen, New York-based Alleghany operates mainly in property and casualty reinsurance and insurance through subsidiaries and investments. Alleghany was transformed from a largely railroad holding company into an insurance and investment firm by Fred Morgan Kirby II. The company's board is currently led by Jefferson Kirby.

Good article on this acquisition here.

Reuters

Warren Buffett ends drought with Berkshire's $11.6 bln Alleghany purchase

The 91-year-old billionaire had bemoaned a lack of good investment opportunities.

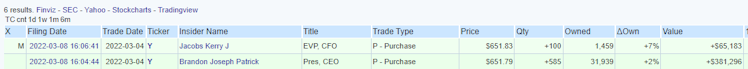

what a timing for insider trading 🤔

CEO and CFO to buy shares 2 weeks ago, just before they accept Buffett offer. Shameless

Buybacks Still Only 0.67% of S&P Market Cap

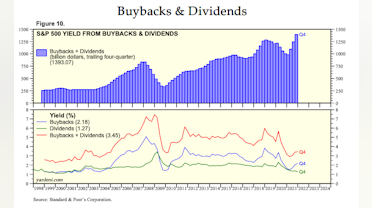

Share buybacks and dividends amounted to $1.4T over the trailing four quarters, the highest level we have seen both on the below chart, and historically. The trailing average yield on dividends is 1.27%, with a 2.18% yield on buybacks, amounting to a combined 3.45% for the S&P 500.

What might interest you, however, is that buybacks are still only 0.67% of the S&P 500 market cap, sitting below the average since 2005.

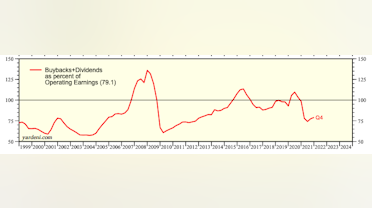

If we take buybacks & dividends as a % of operating earnings over the same time period, it's currently sitting at 79.1%, still well above the post-tech-bubble lows and the GFC period.

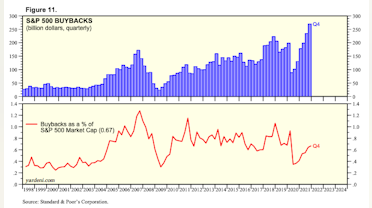

Going back to Q4 buybacks, it has been reported that S&P companies spend $270.1B buying back shares in this period, up from the $234.6B in Q3 and $130.6B in Q4 of 2020. For the full year 2021, buybacks hit a record $881.7B, up from $519.8B in 2020 and $806.4B in 2018.

Sam Ro, from the Tker, said the following related to this record level of buybacks, and the fact that as a % of S&P 500 market cap, it still remains pretty small:

"All that said, it’s not obvious that buybacks are distorting the stock market more so today than they might have historically. That’s because the value of the stock market has been climbing at a similar pace as buybacks.

While 0.67% is not nothing, it’s not particularly large either. The relatively small scale of buybacks in the market is echoed by their relatively small impact on earnings per share.

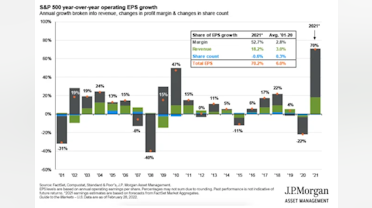

JPMorgan Asset Management (JPMAM) decomposed S&P 500’s earnings per share (EPS) down to its growth drivers: revenue, profit margin, and change in share count.

If buybacks were having a material impact on earnings per share, then the impact of the change in share count would be significant.

However, JPMAM’s analysis found the change in share count actually had a modest net negative impact on EPS in 2021. From 2001 to 2020, on average the change in share count was responsible for just 0.3% of the 6.0% EPS growth during that period."

"However, it’s possible that buyback activity may have a greater impact on EPS this year with stock prices having fallen significantly".

am.jpmorgan.com

Guide to the Markets

The J.P. Morgan Guide to the Markets illustrates a comprehensive array of market and economic histories, trends and statistics through clear charts and graphs.

Amazon Closes $8.5 Billion Acquisition of MGM

It appears that Amazon $AMZN has closed their $8.5B acquisition of MGM.

"The pact was first announced in May and has been winding its way through the regulatory process. Per Amazon, “The storied, nearly century-old studio—with more than 4,000 film titles, 17,000 TV episodes, 180 Academy Awards, and 100 Emmy Awards—will complement Prime Video and Amazon Studios’ work in delivering a diverse offering of entertainment choices to customers.”

Can't wait to be flying first class on "Amazon Air" in the future because I decided to invest in them

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?