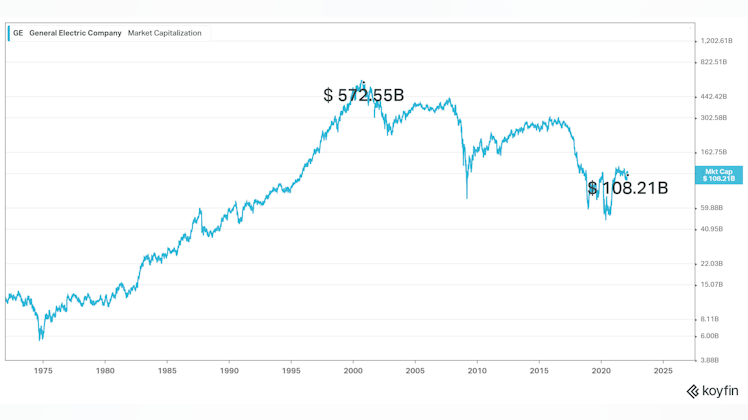

"The history of

$GE makes you realize that at scale,

capital allocation determines the outcomes$AAPL buyback program, for example, is among best allocation / $ investments decisions ever

GE by contrast destroyed $500B+ of market cap. Twice Enron, Worldcom, and Lehman combined"

There is a really fun book called

Billion Dollar lessons that talks about how companies lost billions of dollars. Some stories feel a lot like Ex-Post explainers as to why things didn't work out but the authors also try to include objectively why a certain decision looked good at the time. I really recommend this book to anyone interested in business stories/ history.