Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - economic growth

This week, the students in my portfolio management class are presenting their economic models, forecasting the economy for the next 6-12 months to the client whose money we managed in the class.

This is always a fun part of the semester for me. You see, at the start of the semester, when I describe the project and the approach, there is always a look in their eyes like 'you want me to do what?'

However, as I tell them, class after class and group after group has shown to be pretty good at finding the proper variables to help them forecast the direction of growth & inflation in the coming few quarters.

We don't need precision, we simply need to know direction. We want to be able to anticipate if growth will be rising or falling (as well as inflation which I will discuss tomorrow) as that will serve as a filter for us to know which assets, sectors and styles do the best.

As the presentations happen, you can start to see more confidence in the process come through. They have built their models, using a variety of approaches, and found that, yes indeed, they are pretty good at it.

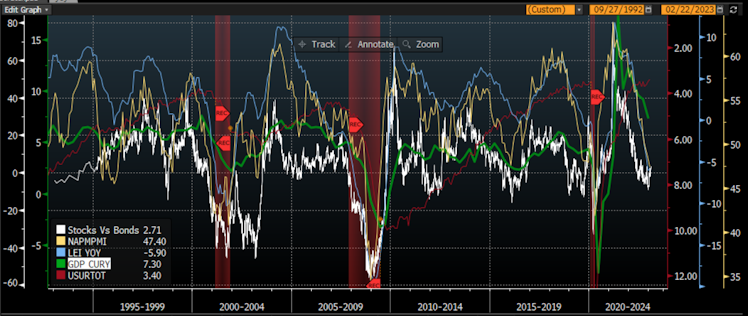

It will help them in their careers to know what to focus on. For instance, a lot of time and effort is spent in media, mainstream or social, discussing topics like GDP or jobs/unemployment. However, as we can see today, those are the most lagging of indicators.

Unemployment in red did not bottom (inverse here) until we were in a recession each time this century. In addition, GDP in green has always been a lagging indicator of real activity on the way down & the way up. It takes time for the BLS to count everything.

Instead, focus on leading variables like the ISM in yellow or the leading economic indicators in blue which includes jobless claims, hours worked or consumer confidence, all variables I saw show up independently in models yesterday.

What leads by the most? The markets. The white line is the year over year change in SPX vs the yoy change in Treasuries. The mkts anticipate even the leading indicators. You can see the underperformance into a recession and the recovery after.

While many point to the strong job mkt as a sign of a soft-landing, and I am on record as saying I think this can be a job-full recession, it is still a lagging indicator. We will be in the recession that half don't see by the time it weakens.

Heck, even the lagging GDP is weakening at this point. I suggest it is still time to ...

Stay Vigilant

#markets #investing #economy #stocks #bonds

Already have an account?