Trending Assets

Top investors this month

Trending Assets

Top investors this month

Autohome Inc. (NYSE: $ATHM), valuation on February 2, 2022

Summary

- Stock: Autohome Inc. American Depositary Shares, each representing four Class A ordinary shares (NYSE: $ATHM)

- Market cap: $3.85bn

- Rating: Buy

- Price: $30.27

- Target: $44.75

•••

Setting the stage

Autohome Inc. is an online car marketplace in China. Through its websites, ‘autohome.com.cn’ and ‘che168.com’, and mobile applications, the company helps consumers research and buy cars. As of December 31, 2020, the company’s app had the most daily active users of all automotive service platforms in China. The company makes money in three ways:

Firstly, they sell advertisement space to automakers wanting to target the company’s large and engaged network of car buyers. They charge these advertisers daily to place ads on their websites and mobile apps. They call this segment ‘Media Services’, and it brought in $530m of revenue in 2020 by selling ad space to 92 automakers.

Secondly, they rent online shop space to dealerships and charge a subscription. These dealerships can create online stores, manage listings and promotions, and advertise to car buyers. They call this segment ‘Lead Generation Services’, and it brought in $490m of revenue in 2020 by servicing 24.5k dealers.

Finally, they charge fees for facilitating used-car sales, financing, and insurance purchases. They call this segment ‘Online Marketplace’, and it brought in $307m of revenue in 2020.

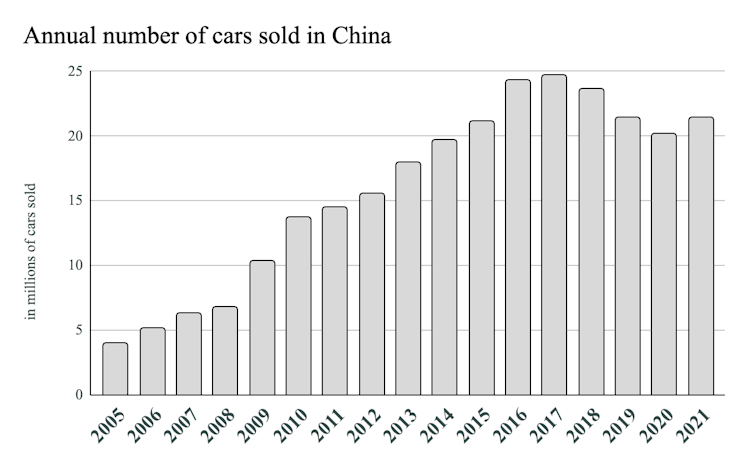

After decades of growth, China’s car market began contracting in 2018 as the government phased out tax cuts and the trade war with the U.S. smouldered. From 2007 to 2017, the number of cars sold nationally grew by 15% per year. However, in the four years since, and despite population and income growth—the national population increased by 22.5m and urban households’ annual disposable incomes increased by ¥11,016—the number of cars sold across the country shrank by 3% per year.

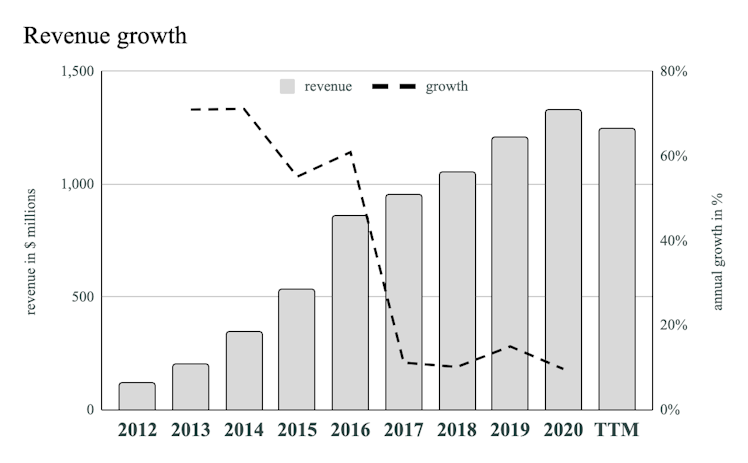

This decline in car sales hit Autohome’s top line, and the company’s growth slowed. From 2012 to 2017, revenues grew at 52% per year. But, from 2017 to September 2021, this annual growth rate shrank to 7%. Fewer car sales mean more competition for those sales, putting pressure on automakers and dealers alike. However, this could benefit Autohome. If automakers, dealers, and used car sellers compete for a shrinking pie, they will spend more on advertising.

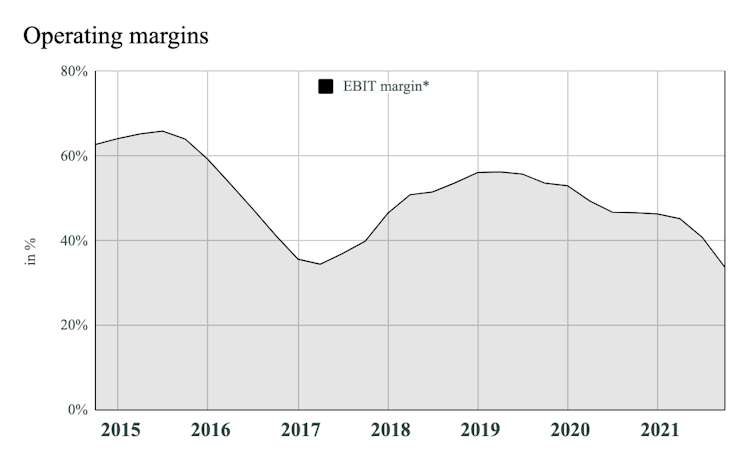

Continuing to grow the top line came at a cost. Not only were automakers and dealers competing for fewer sales, but Autohome was also too. Consequently, the amount spent on sales and marketing (”S&M”) rose. In 2017, the company spent $253m, or 27% of revenue, on S&M. This amount grew to $497m, or 37% of revenue, by 2020. While gross margins remained steady, operating margins declined as the company spent more on promoting its brand online, through traditional media, and running events like the annual Singles’ Day, AR Auto Show, and 818 Global Super Auto Show. By being an intermediary between sellers and buyers of cars, the company has two groups to attract, making brand awareness and network effects critical. Here, the company seems to be succeeding. Of the 73,000 dealerships in China, 24,000, or one-third, advertise through Autohome.

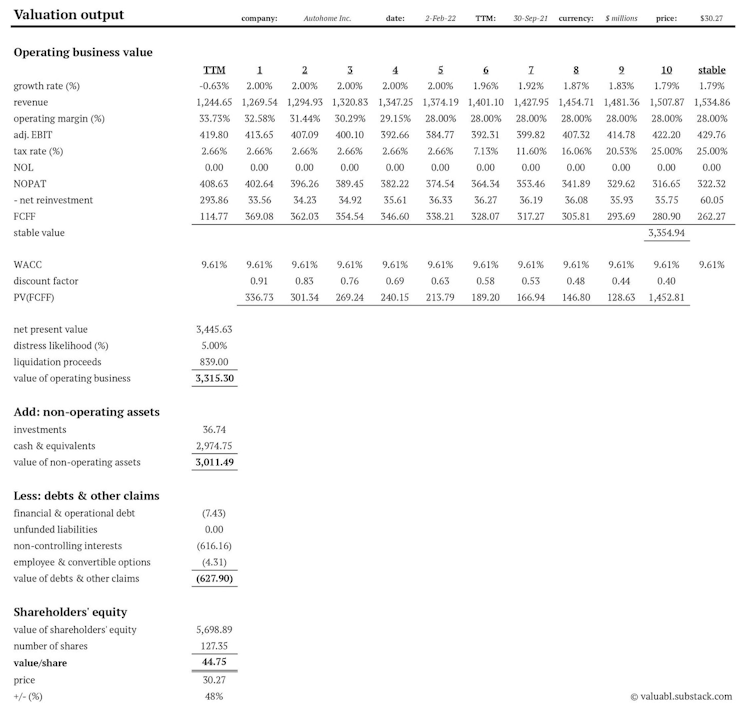

Includes capitalised R&D and S&M assets. **Using effective tax rate paid, EBIT adjustments and capital adjustments from capitalising R&D and S&M.

•••

Story & valuation

By spending increasingly large sums on S&M, Autohome Inc. will expand its share of the shrinking and increasingly competitive Chinese auto sales market. Network effects will help them attract new users and new advertisers, but this competitive advantage will be expensive to maintain. As a Chinese operation, they are exposed to additional country risk, but they have little debt and a lot of cash.

Revenue growth: Economists forecast the Chinese passenger car market to shrink from $514.8bn in 2022 to $508.8bn by 2026 at -0.3% per year. By pumping money into S&M, the company will improve its network effects and take market share. Currently, one-third, 33%, of dealerships in China use Autohome. They will expand this to 37% by 2026. I forecast the company to grow revenues at 2% per year.

Operating margins: Despite network effects, the company will continue spending more on sales and marketing to stay ahead in this increasingly competitive and crowded market. I forecast margins to decline from where they are now, 34%, to 28%.

Reinvestment: After capitalising R&D and S&M, the company has $1.68bn of invested capital and a sales-to-capital ratio of 0.74x. I forecast this ratio to be maintained as the company continues reinvesting heavily in marketing.

Cost of capital: The company is a Chinese auto-classified advertising business with an Aaa/AAA synthetic credit rating and little debt. I estimate the company’s weighted average cost of capital to be 9.61% in U.S. Dollars.

Add non-operating assets: The company has $44m worth of long-term investments and $2.97bn worth of cash, equivalents, and short-term investments.

Less debt and other claims: The company owes $7.4m, there is $735m worth of non-controlling interests, and 510,000 employee options worth $4.3m.

Each share has an intrinsic value of $44.75 and at the current price, $30.27, the investment has a 48% upside.

•••

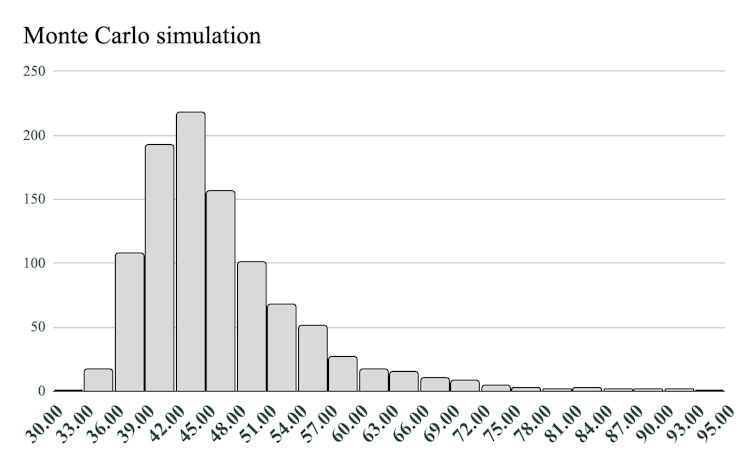

Sensitivity analysis & rating

Buy •••••• 10th: $38.47

Add •••••• 30th: $41.69

Hold ••••• 50th: $44.46

Reduce ••• 70th: $48.29

Sell •••••• 90th: $56.07

The current price for Autohome Inc. American Depositary Shares (NYSE: $ATHM) common stock is $30.27 and is below the first percentile of the Monte Carlo sample of intrinsic values. For this reason, it has a rating of Buy.

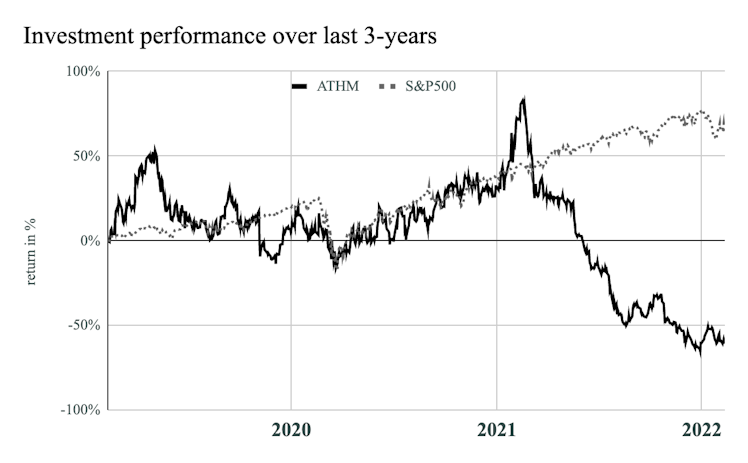

The shares are undervalued and uncorrelated with what I already own. I am adding a position to my portfolio.

Originally posted in my newsletter here.

valuabl.substack.com

Valuabl, Vol. 2, No. 4

On the cost of capital. Credit creation, cause & effect. An undervalued Chinese classifieds business.

Already have an account?