Trending Assets

Top investors this month

Trending Assets

Top investors this month

Index fund investing isn't for everyone

When people talk about investing in index funds and chilling, these people only think about the US stock market index. $SPY $DIA and $QQQ have drastically outperformed the rest of the world.

Those living in America will find index fund investing to be the simplest way to make money from investing. But for those living in Japan, China, and other countries, index fund investing seems ridiculous after seeing how their country's stock market index has performed.

As I present a series of charts, remember that I took screenshots of these indices 5 months ago.

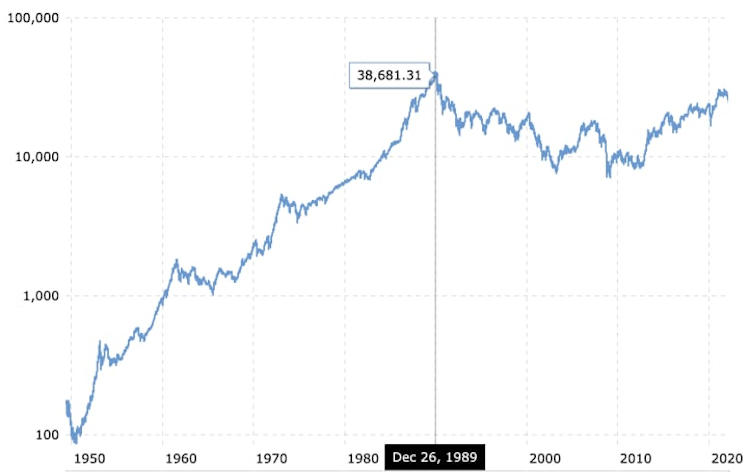

Look at Japan. The Japanese stock market, after several decades, is barely reaching its 80s bubble highs.

Now going to Europe, the European blue-chip index has been stagnant since the Dotcom bubble burst.

And here's Australia's stock market index. It took more than a decade for the country to see its index reach above the housing bubble highs.

And here's Canada's stock market. It took the pandemic recovery for investors to see the index go from stagnant to bullish.

As for the British stock index, it seemed like the country's index hasn't seen a Brexit bull or bear market. Things have been stagnant despite it.

Despite the big "China growth" story, the Hong Kong index has been stagnant.

And for mainland China, stock market index returns have been stagnant too.

Thankfully, India's stock market has seen a similar level of performance as the US stock market index.

From looking at the performance of various indices, index fund investing isn't going to guarantee positive returns within decades. For some decades, your money is staying the same and in other decades, it's growing. Being in the US, I'm fortunate to see our country's stock market index rally. But for those living in other countries like Australia or Hong Kong, index fund investing won't give them attractive returns.

I'm personally not fond of index fund investing because I know that the US could see itself having stagnant market returns over decades like how other regions of the world experienced. Instead of relying on capital gains for investment growth, I invest for income. That's why my portfolio is big on $QYLD $O $STAG and $ADC rather than stocks like $SPY or non-dividend paying stocks like $META.

www.macrotrends.net

Nikkei 225 Index - 67 Year Historical Chart

Interactive daily chart of Japan's Nikkei 225 stock market index back to 1949. Each data point represents the closing value for that trading day and is denominated in japanese yen (JPY). The current price is updated on an hourly basis with today's latest value.

Already have an account?