Trending Assets

Top investors this month

Trending Assets

Top investors this month

$EPOL - My Worst Trade, and the Lessons learned

Poland is an interesting country. From Copernicus to Vodka and some of the oldest (and largest) castles in Europe Poland has a rather interesting history. This illustrious history is what drew me into learning more about the country in the middle of 2021. It was cheap, its GDP was rapidly rising, and some of the best companies in the world call Poland home.

After much research and deliberation, I started buying shares in the largest ETF that owns Polish companies and it turned out to be a horrible idea.

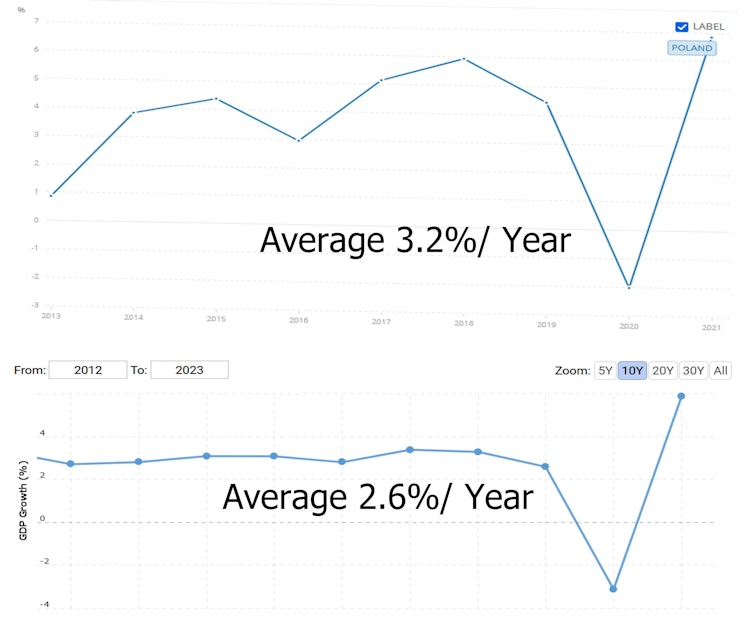

I had two main parts to my thesis. The country was growing quickly and it was cheap.

Poland is growing its GDP on average 20% faster than the rest of the world. This has also translated to the GDP per capita of the country doubling over the last 10 years.

The country was also "cheap" by traditional metrics. Looking at the historical CAPE ratio it was just above 10 when I started buying shares. Compared to the rest of the world this is dirt cheap (for reference the last time the US had a CAPE of 11 was in the 1980s).

Given these two factors I started buying shares at the $22 mark. Thankfully I only ever initiated a small position and the largest $EPOL ever got was about 3% of my portfolio.

The next couple of months was relatively quite and the ETF was mostly flat, no gains, no loses. As we headed into 2022 everything was still going well, up until the end of February. When Russia invaded Ukraine it sent a shockwave through many of the countries closest to the country. And if you don't know the country that is closest to Ukraine is Poland.

Over the next 6 months the ETF would crater over 40%, however I still would not sell. I figured if the war subsided quickly things would start to recover. But the war has not subsided but things have still continued to recover. The ETF is now 50% up from its lows and it was in the last couple of weeks as I went back through all my positions that I finally decided to sell locking in about a 35% loss on my initial investment.

In case you didn't notice the above thesis isn't very good. There is no actual reason for me to invest besides "it's cheap" or "its growing GDP quickly." Ultiamtely I figured that money would be better served bolstering a position I had done actual research in and have conviction for.

tl;dr Dont open positions because they are "cheap" or " are growing quickly" do actual research and understand what you are buying because if you don't know why you are making money you definenetely won't know why you are losing money.

Already have an account?