Trending Assets

Top investors this month

Trending Assets

Top investors this month

Testing $ARKK Past Returns & Assessing Style Drift

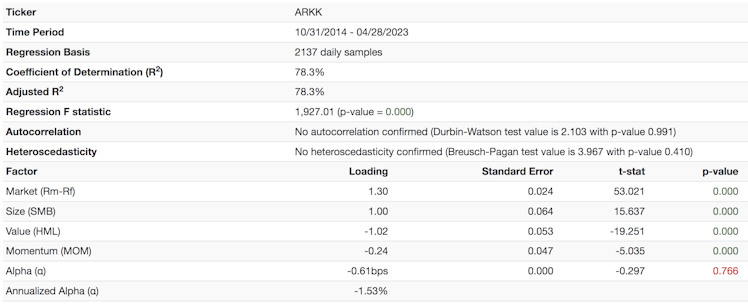

Here's a self-orchestrated regression that assesses ARK Innovation ETF's past returns. With statistical significance across all the tested factors, the following can be concluded:

1) ARK Innovation is contrarian, with the asset most likely to underperform the year after outperforming the $SPY. Moreover, ARK will seldom outperform the market in successive years.

2) ARK is 1.3 times as risky as the broader stock market and is positively correlated to the broader market, and small-cap stocks especially.

3) ARK outperforms in periods of low interest rates, low credit spreads, and an upward-sloping yield curve. Therefore, it exhibits a positive correlation to growth stocks and a negative correlation to value stocks.

Source: Author's work on Portfolio Visualizer

Already have an account?