Trending Assets

Top investors this month

Trending Assets

Top investors this month

British American Tobacco: A Great Divergence

“Maximum dismay is often met with minimum price. When no one else wants to own something, you can generally purchase it for a ridiculous price far under intrinsic value. But the concern is that there is no clear way to measure maximum dismay precisely. Awkwardly, and by definition, maximum dismay shouldn’t be reached until your own expectations collapse. Even when you’re right, it can look like you’re heading into a black hole.” - Gravitational Collapse

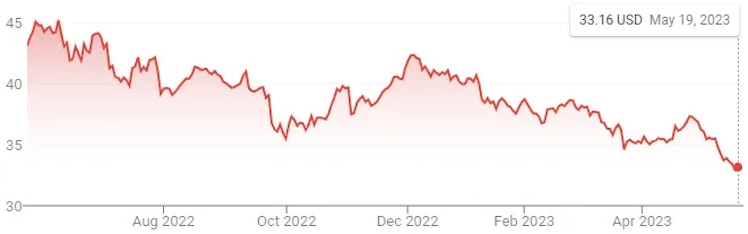

Something silly that you should never do is commit bank fraud and violate sanctions that benefit you and, say, North Korea. You would look extra silly if you were a big company that had also been including a bunch of ESG sections in your reporting to score points with institutional investors that had been growing more apprehensive towards your industry. Apparently, British American Tobacco $BTI never got that memo, because that’s exactly what they did. In late April, the United States Department of Justice (DOJ) and Office of Foreign Assets Control (OFAC) issued BAT penalties totaling $635 million dollars and forced the company into a deferred prosecution agreement (DPA). This wasn’t much of a surprise, as the investigation had been previously noted and BAT accounted for a related provision on its balance sheet. The financial impact beyond what was already accounted for won’t be all that great, but the ordeal brings into question management’s judgment.

Was that why Jack Bowles was ousted from his position as CEO on May 15th? He was head of the company’s Asia-Pacific division for a period while the sanctions violations were taking place, so that’d make sense. Or maybe it was for other inappropriate behavior. Or maybe it was the bidding of large shareholders like Kenneth Dart, or Capital Group, which as of a recent filing has accumulated a 12.98% stake. Or for personal reasons. We don’t know for sure because the company has provided few details aside from the fact that Bowles is out of the picture and the CEO position has been filled by Tadeo Marroco, the Finance Director, whose previous position is now filled by Interim Finance Director Javed Iqbal.

Tadeo Marroco worked his way up the ladder since joining the company in 1992. With a strong background in finance, this could be an opportunity for him to capitalize on - improving communications, further refining the company’s strategy, and perhaps reassessing BAT’s capital allocation framework. In February, concerning BAT’s announcement that they would be pausing share repurchases to focus on further paying down debt, I wrote:

"I am not disappointed in this change in events. First, I have to commend management for being responsible stewards of capital and acting prudently to ensure future flexibility - so long as the broad market continues to remain sour on the sector, there will be plenty of opportunities to engage in buybacks in the future."

Sour indeed.

I stand by my initial assessment and do not believe management misstepped with this move, however, buybacks begin to look better and better as the stock price grinds lower and lower.

While no one can pinpoint exactly why a stock moves in the short term, whatever market voting is going on is likely influenced by far more than the above. Some have hypothesized a longer-term headwind from capital avoiding London post-Brexit, which is the home of BAT’s primary listing. There is pointing to FX dynamics, but looking at the recent performance of GBP and USD relative to each other and other currencies suggests that falls short. I lean towards a variety of factors, though they each vary in validity. At the same time, there appear to be several positive aspects that continue to be neglected.

Menthol bans

With BAT holding the largest share of the menthol market, concerns about menthol bans in the United States are completely fair. Following Massachusetts several years prior, California banned menthol cigarettes at the end of 2022. BAT and other manufacturers looked to challenge the ban via the Supreme Court, which refused the request. Then, BAT (and others) introduced new cigarette variants containing synthetic cooling agents, which provide a similar sensation to menthol, much to the dismay of California Attorney General, Rob Bonta, who in April sent warning letters stating that these new products violated the state’s flavored tobacco prohibition laws. It was no surprise to see Reynolds (BAT) file a lawsuit a few weeks ago in California to protect the new products. From Reynolds's press release (emphasis added):

"Reynolds American Inc. (Reynolds) announced today that its subsidiary, R.J. Reynolds Tobacco Company (RJRT), has filed a lawsuit against California state officials, including Attorney General Robert Bonta, in response to the Attorney General's issuance of several Notices of Determination ("Notices") that allege certain Camel and Newport cigarettes styles are "presumptively" flavored based on their promotional materials. The lawsuit, filed in California state court, seeks declaratory and injunctive relief, including that the Notices be rescinded.

RJRT stands by its new products and believes that they comply with California state law and therefore can continue to be sold. Before introducing the products for sale, RJRT followed all applicable pre-market regulatory requirements.

The new Camel and Newport styles do not impart a distinguishable taste or aroma other than tobacco and are marketed to clearly indicate that they are non-menthol. The California Attorney General's Notices do not acknowledge the fact that RJRT's new product introductions are prominently labeled and marketed as non-menthol."

Along with state-level conflicts remains the lingering potential of a federal-level ban on menthol as a characterizing flavor in cigarettes as well as non-tobacco characterizing flavors in cigars, of which a finalized proposed rule from the FDA is expected by the fall of this year. The timeline of the finalized proposed rule includes a 1-year delay to go into effect and will undoubtedly be heavily challenged, potentially delaying further. An extra dose of skepticism should be applied when evaluating the merits of such policies, as I’ve highlighted before:

"While many groups support such measures, there is also notable resistance. 85% of menthol smokers are black, and organizations such as the American Civil Liberties Union (ACLU) have opposed a menthol ban, stating it would ultimately result in increasing negative interactions between communities of color and local law enforcement. The proposed legislation would exempt menthol e-cigarettes as the FDA evaluates separate rulings for related devices."

We also have precedents to look at. When Massachusetts enacted its menthol ban, the counties of bordering states saw a large influx in related product purchases. No surprise. Some data shows similar happening in California, with distinct volume changes in bordering Nevada. A federal-level ban would curb such dynamics, though could spur smuggling and black market activity. But when similar actions were taken in places such as Canada and Turkey, retention rates were over 95% - some over 100% - indicating that such bans are dreadfully ineffective. Anticipating timelines and estimating the quantified impacts of such actions remains difficult, and these concerns overlap pressures on adult consumers who are downtrading, as well as BAT’s substantial volume drops in 2022, exacerbated by SKU rationalization and the rollout of the TaO system.

Next-gen products

Paired with concerns about cigarettes is uncertainty relating to...

Continue reading at the link below:

invariant.substack.com

British American Tobacco: A Great Divergence

Dissecting disparities between narratives and fundamentals.

Already have an account?