Trending Assets

Top investors this month

Trending Assets

Top investors this month

Five Below's Triple-Double

This is a preview of today's update on U.S. specialty retailer Five Below, which has seen its stock price decline by ~50% since August 2021 and trades at ~25x forward EPS (2022e). To read the complete analysis, please subscribe to the TSOH Investment Research service.

Note: Last week, I sat down with Brandon Beylo of The Value Hive Podcast to discuss the current state of U.S. retail. You can listen to the episode here.

In my initial deep dive on Five Below, I concluded with the following:

“In summary, I’m actually more confident on the future of this business than I expected to be when I first started digging in. The fact that they’ve put up strong operating results for 15+ years, and have continued to do so while adding ~500 net new units over the past 48 months, is impressive. That said, the current valuation is a bridge too far for me. I also need more time to think about the key variables to the long-term thesis (the likelihood of 2,500+ U.S. stores, international growth opportunities, etc.). Over time, particularly if we get some help from Mr. Market on the stock, I’ll revisit the Five Below story.”

Since that was published in July 2021, a few things have happened.

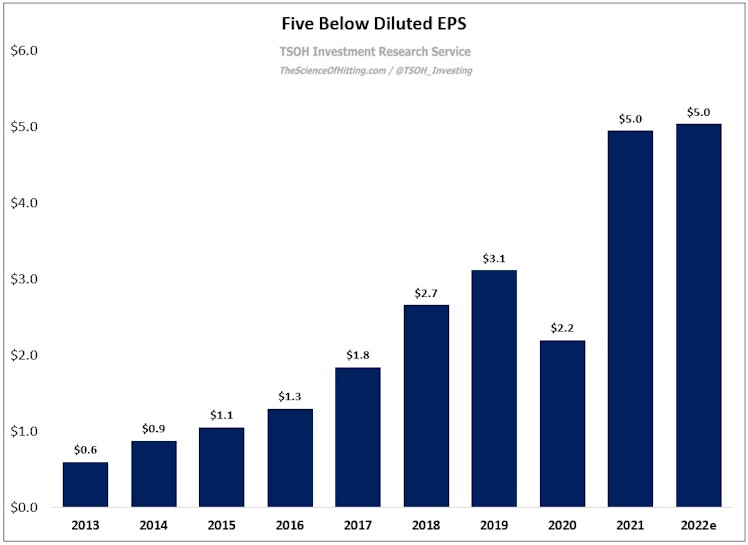

First, the stock price has struggled: On Wednesday afternoon, FIVE closed at ~$123 per share, down roughly 35% from July 2021; based on FY22e EPS of ~$5.0 per share, the stock is valued at ~25x earnings.

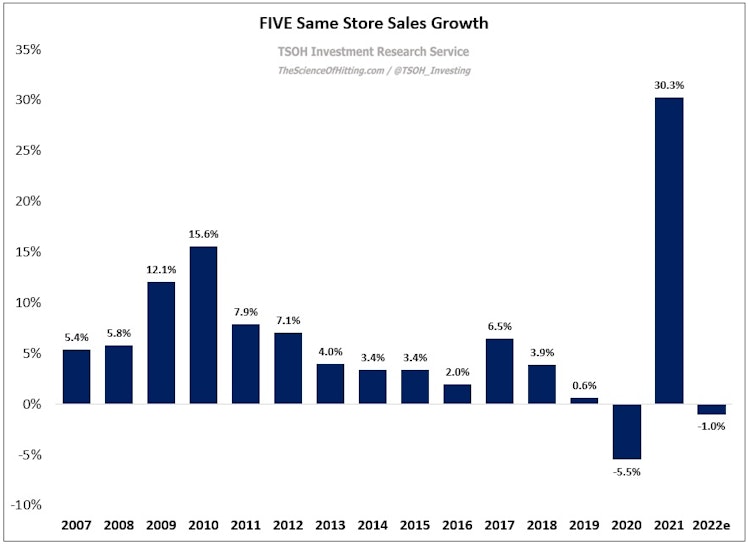

Second, 2021 was a very strong year for Five Below. Following a mid-single digit decline in same store sales in 2020, comps were +30% in 2021 (that isn’t a typo). Revenues were +45% for the year to $2.85 billion, with EPS climbing to $5.0 per share – 60% higher than 2019 ($3.1 per share).

However, as you can see below, the company doesn’t expect any EPS growth in FY22. This outcome, which includes the impact of a guidance cut following lackluster Q1 results, speaks to the concerns that Mr. Market has with Five Below. (I’ll discuss this in further detail in the conclusion).

Finally, the company held an Investor Day on March 30th. The biggest takeaway from that event is that FIVE is pursuing an aggressive growth plan over the next 5-10 years, as evidenced by the “Triple-Double” financial targets: (1) Double sales from 2021 – 2025; (2) More than double EPS from 2021 – 2025; (3) 14% EBIT margins in 2025; (4) 3,500+ stores by 2030.

Let’s focus on that last point (unit growth), because it’s the key variable for the company as they look to achieve these audacious long-term goals.

(End of preview)

thescienceofhitting.com

Five Below's Triple-Double

Note: Last week, I sat down with Brandon Beylo of The Value Hive Podcast to discuss the current state of U.S. retail. You can listen to the episode here. In my initial deep dive on Five Below, I concluded with the following: “In summary, I’m actually more confident on the future of this business than I expected to be when I first started digging in. The fact that they’ve put up strong operating results for 15+ years, and have continued to do so while adding ~500 net new units over the past 48 months, is impressive. That said, the current valuation is a bridge too far for me. I also need more time to think about the key variables to the long-term thesis (the likelihood of 2,500+ U.S. stores, international growth opportunities, etc.). Over time, particularly if we get some help from Mr. Market on the stock, I’ll revisit the Five Below story.”

Already have an account?