Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Portfolio Update

As you may know, I write many updates, economic analysis, and opinion pieces on my website, you can read my most recent full portfolio update here. However, it's been a while since I've shared an update on Commonstock so let's do one!

To date, I have invested $10,550 into the account the total value of all positions plus any cash on hand is $10,615.85. That’s a total gain of 0.62%. The account is up $241.52 for the week which is a 2.33% gain.

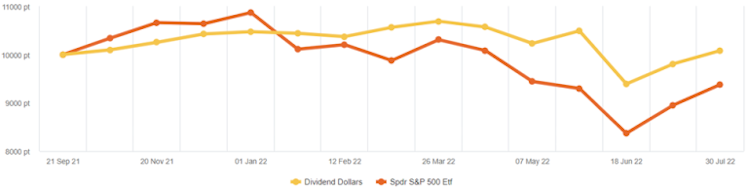

We started building this portfolio on 9/24/2021 and, even with this rough last week, when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is down -7.3% whereas our portfolio is up 0.62%! I love tracking my portfolio against a benchmark like the S&P. The above chart comes from Sharesight which makes portfolio and dividend management a breeze!

We added $200 in cash to the account this week. The trades made this week will be broken out below

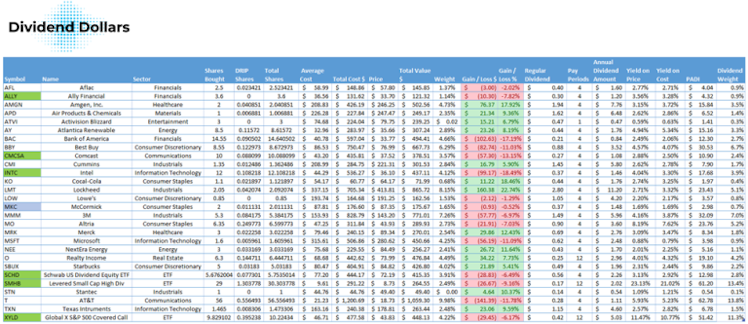

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week and the blue ones are positions that I reinvested dividends into. The positions that we added to increased our annual dividend income by $11 at a yield of 4.45%.

This week we received three dividends: $0.74 from McCormick ($MKC), $4.24 from Global X S&P 500 Covered Call ETF ($XYLD), and $2.03 from Comcast ($CMCSA).

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically. The Coca-Cola dividend was actually received last Friday, but got reinvested on the following trading day.

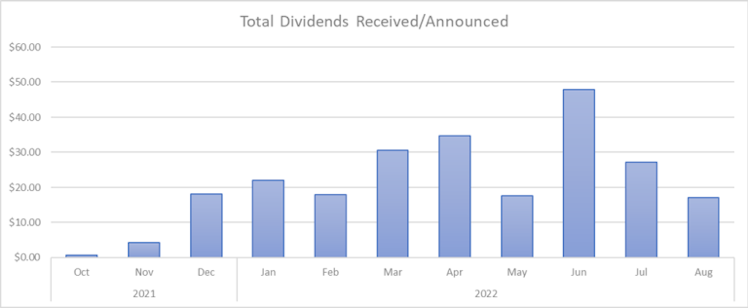

Dividends received for 2022: $197.83

Portfolio’s Lifetime Dividends: $220.75

Below is a breakdown of my trades this week!

July 25th

- McCormick ($MKC) – dividend reinvested

July 26th

July 27th

- ETRACS 2x Levered ETF ($SMHB) – added 1 share at $8.78

- Ecolab ($ECL) – sold 0.2 shares at $160.10

- $SCHD – added 0.13775 shares at $72.60 (recurring investment)

- $XYLD – added 0.230044 shares at $43.47 (recurring investment)

- Comcast ($CMCSA) – dividend reinvested

July 28th

- Comcast ($CMCSA) – added 1 share at $39.26

- Intel ($INTC) – added 1 share at $39.76

- Ally ($ALLY) – added 0.25 shares at $32.28

July 29th

- Comcast ($CMCSA) – added 1 share at $37.92

- Intel ($INTC) – added 1 share at $35.42

- Ally ($ALLY) – added 0.35 shares at $32.89

This week I mostly focused on $INTC and $CMCSA as I indicated in the last portfolio review. Both had some rough earnings misses which gave some good buying opportunities. I’m not too concerned about $CMCSA’s earnings, most segments of the business performed as expected, however economic contractions affected the business more than anticipated. $INTC is a different story. Though they were also affected by the economy, revenues were way lower than expected and guidance was not peachy at all. This poor performance was to be expected while they build out the foundry business, but the severity of it was not. I’m still bullish on the long term for both, hence the buys at the end of the week.

Dividend Dollars

Dividend Portfolio: 7/22/2022 Week in Review | Dividend Dollars

Weekly update on a long-term dividend growth portfolio from a young investor! To date it is down 1.87% and is beating SPY by almost 10%!

$AMGN and $AFL are inching towards the top of my watchlist for my January birthday buys! Will be interesting following your positions the next few months

Which brokerage are you using? Interested in the fractional shares

Already have an account?