Trending Assets

Top investors this month

Trending Assets

Top investors this month

TA Opinion: We're at key levels, but future market direction will likely be driven by the macros

The S&P 500 index closed the week at 4,205.45, just peeking above the 4,200 key resistance level. In the absence of any "consequential" fundamental news (remember fundamentals trump technicals), we should expect some friction around these levels. If we move higher from here, I would expect the market to pullback a little and re-test that 4,200 level. This is an unsure market, there doesn't seem to be a lot of conviction in either direction among participants. We've been trading in a bit of a sideways direction these last few months in a "wait and see" market.

From a technical analysis perspective, the S&P 500 index still has an up-trending bias, trading above a rising 50-Day SMA which is in turn is trading above a gently rising 200-Day SMA. Higher lows add to the weight of evidence the trend is up, but we're restrained at the 4,200 level which has proven to be level of exhaustion for willing buyers in the past.

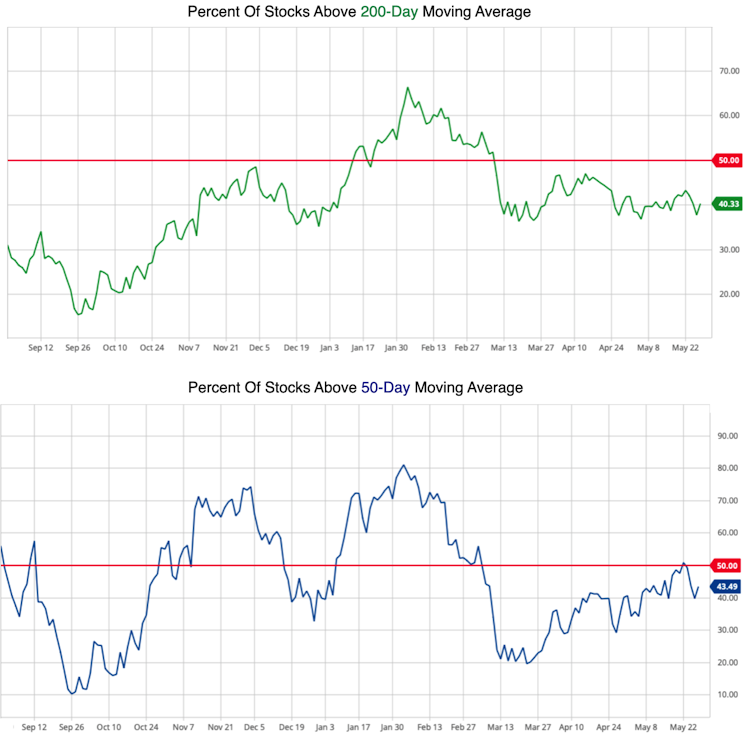

The lack of conviction in this market recovery is reflected in the percentage of stocks trading above their 200-Day SMA and 50-Day SMA remains below 50%. The market index is being fuelled by the few industry leaders while most other stocks are still struggling to get any upside price momentum.

This is a market preoccupied by news about the debt ceiling and interest rates. It's hard to know what expectations have already been priced in to the market, so technical traders are going to be cautious at current levels. If the macro news is better than market expectations triggering a significant breakout above the 4,200 level on higher volume, we could be off to the races as we look to recover back to previous all time highs. But economic commentators are expecting a rocky ride for the remainder of the year, so any rally from current levels is probably going to be a choppy, ugly, hated rally. (most market recoveries are)

This click-bait Bloomberg headline from a couple of days ago caught my attention.:

I originally thought the article headline was referring to technical traders so I was keen to find out how these technical traders have been duped given we only trade what we see on the charts. The Bloomberg article covers market predictions/expectations of Morgan Stanley’s chief US equity strategist and noted "Bear", Mike Wilson. He states:

- "We would characterise this as the bear market is continuing. This is what bear markets do: they’re designed to fool you, confuse you, make you do things you don’t want to do, chase things at the wrong time and probably sell them at the wrong time"

- "The fundamental case does not support where stocks are trading today whether it’s at the index level or at the single-stock level, and the second half is going to be choppier and probably downward in the index"

- "We think where we are is the index is telling you things are rosy and fine and the breadth is telling you otherwise. Growth is going to be a problem in the second half of this year, whether that’s an economic recession or not. We think it’s going to be an earnings recession that is way worse than what people are currently modelling"

Mike Wilson is making a clear prediction on future market direction here: "the second half is going to be choppier and probably downward in the index". Most technical traders go in the direction of the current trend. We trade what we see. The current trend is up and there's potential for overhead resistance because there's moderate conviction at best when market breadth is low. We don't really predict too far into the future, we just assume an established trend will continue ... until it doesn't. Then we change our positions to align with the new trend. When the market is choppy and trend-less, most professional trend traders step out of the market and trade some other market that is currently trending.

When Mike Wilson says "the index is telling you things are rosy and fine and the breadth is telling you otherwise", technicians already know this. We're always looking at market breadth. So the word "duped" in the headline seemed like an interesting choice. To be fair, Mike Wilson never said the word duped himself, it's probably hyperbole by the journalist to capture eyeballs (like mine). Maybe the headlines are referring to investors trading on fundamentals, not technicals ... :)

Already have an account?