Trending Assets

Top investors this month

Trending Assets

Top investors this month

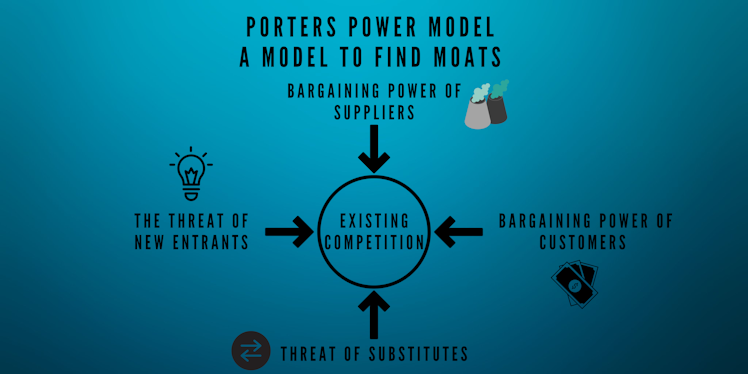

Porters Power Model - A Model to Find Moats

An model to identiy moats and better understand a companies position in the value chain

Porter's five forces model is a tool that helps businesses to understand the competitive environment in which they operate and develop an understanding of how attractive the industry or market is. It was developed by Michael Porter, also known as one of the greatest minds in business management. The model was initially designed to help airlines compete with other carriers in an increasingly complex global marketplace. However, the model has been applied to industries beyond commercial aviation, including healthcare, telecommunications, and retailing.

Porter’s model was created to provide a framework for assessing the attractiveness of an industry. It is designed to help companies decide where to compete and where not to compete. This can be done by determining whether the firm has an advantage over its competitors or if it should focus on niche markets instead.

The theory also helps companies determine their strategic positioning, which

impacts resource allocation decisions and competitive strategy development.

Porter’s five forces model is a framework that helps businesses determine the profitability of an industry and the likelihood of achieving a competitive advantage within that industry. Michael E. Porter developed the five forces model and provides an outlook for analyzing an industry's attractiveness and position in other sectors.

The five forces are:

- Existing competition

- The threat of new entrants

- Threat of substitutes

- Bargaining power of customers

- Bargaining power of suppliers

Existing competition - How does it look against the existing competition? Is the market fragmented, or has one clear leader?

Competitive rivalry is a measure of the extent of competition among existing firms. There are several competitive moves that may limit profitability and lead to competitive activities (Dhliwayo, Witness 2022). These actions include price cuts, increased advertising expenditures, and investments in service/product enhancements and innovation. A company's competitiveness is primarily determined by the intensity of its competitive rivalry in most industries. Having an understanding of industry rivals is vital to successfully marketing a product. A product's positioning is determined by how the public perceives it and what distinguishes it from its competitors. An organization must monitor the marketing strategies and pricing of competitors, and any changes should be addressed promptly.

Competition among competitors is fierce, and industry profitability is low due to the following factors:

- Sustainable competitive advantage through innovation - Innovation is the main driver for growth and the main weapon against the competition, an new innovation can result in being the market leader in a year. Look at the semiconductor market, being late with next-gen chips can make you lose a quite significant market share.

- Competition between online and offline organizations - Online and offline is an everyday competition and some are merging into omnichannel trying to make the online and offline experience seamless. Brick and mortar have its benefits and online has its.

- Level of advertising expense - Advertising can be a way to increase market share, meanwhile, it also increases the market.

- Powerful competitive strategy - A classical Porter’s topic is the low-cost provider versus differentiation. Differentiation mostly results in being niched in a market and should enable the company to have higher margins in the long run than the low-cost provider. However, the low-cost provider could price pressure out other companies which have a higher costs basis and be very dominant in a market (economies of scale).

- Firm concentration ratio - Depending on the market is fragmented or closer to oligopoly affects the market’s dynamics. Can also be an opportunity for a company to consolidate the market.

Threat of new threats - As new entrants seek to gain market share, they pressure existing organizations. This puts pressure on prices, costs, and the rate of investment needed to sustain a business within the industry. If new entrants enter a new market from an existing one is, the threat exceptionally high as it can leverage the existing expertise, cash flow, and brand identity, which pressures the current company’s profitability.

Barriers of entry will reduce the threat of new entrants. Meanwhile, if the barriers are low, it will be the opposite, and new entrants can flood the market. Michael E. Porter lists seven major sources of barriers to entry.

- Supply-side economies of scale – spreading the fixed costs over a larger volume of units, thus reducing the cost per unit. This can discourage a new entrant because they either have to start trading at a smaller volume of teams and accept a price disadvantage over larger companies or risk entering the market on a large scale to attempt to displace the existing market leader.

- Demand-side benefits of scale – a buyer's willingness to purchase a particular product or service increases with other people's desire to buy it. Also known as the network effect, people tend to value being in a 'network' with a larger number of people who use the same company.

- Customer switching costs – these are well illustrated by structural market characteristics such as supply chain integration but also can be created by firms. Airline frequent flyer programs are an example.

- Capital requirements – to set up a business requires a certain amount of capital to get

going and to deliver a product before any revenues can be produced. Clearly, the Internet has influenced this factor dramatically, and Websites and apps can be launched cheaply and easily as opposed to the brick-and-mortar industries of the past.

- Incumbency advantages were independent of size - for example, customer loyalty and brand equity.

- Unequal access to distribution channels – if there are a limited number of distribution channels for a particular product/service, new entrants may struggle to find a retail or wholesale channel to sell through as existing competitors will have a claim on them.

- Government policy includes sanctioned monopolies, legal franchise requirements, patents, and regulatory requirements.

Threat of substitutes

A substitute product uses a different technology to solve the same economic need. Examples of substitutes are meat, poultry, and fish; landlines and cellular telephones; airlines, automobiles, trains, and ships; beer and wine; and so on. For example, tap water is a substitute for Coke, but Pepsi is a product that uses the same technology (albeit different

ingredients) to compete head-to-head with Coke, so it is not a substitute. Increased marketing for drinking tap water might "shrink the pie" for both Coke and Pepsi. In contrast, increased Pepsi advertising would likely "grow the pie" (increase consumption of all soft drinks) while giving Pepsi a larger market share at Coke's expense.

Potential factors:

- Buyer propensity to substitute - This aspect incorporated both tangible and intangible factors. Brand loyalty can be essential, as in the Coke and Pepsi example above;

however, contractual and legal barriers are also practical.

- Relative price to performance - If the product has the same performance as a substitute that solves the same need, it comes down to price.

- Buyer's switching costs - The mobility industry well illustrates this factor. Uber and its many competitors took advantage of the incumbent taxi industry's dependence on legal barriers to entry, and when those fell away, it was trivial for customers to switch. There were no costs as every transaction was atomic, with no incentive for customers not to try another product.

- Perceived level of product differentiation - It is a classic Michael Porter in that there are only two primary mechanisms for competition – lowest price or differentiation. Developing multiple products for niche markets is one way to mitigate this factor.

- Number of substitute products available in the market - If a number of substitute products satisfy the same need, it will be easy to jump from one substitute to another if the performance, price, or any other characteristics are worse compared with the substitutes.

- Ease of substitution - If the substitution is done with ease and the friction is minimal, the change will be more probable.

- Availability of close substitutes - Back to the example of soft drinks, if tap water becomes more available and tastes better, it will affect the soft drink market as a whole.

Bargaining power of customers

The bargaining power of customers is also described as the market of outputs: the ability of customers to put the firm under pressure, which also affects the customer's sensitivity to price changes. Firms can take measures to reduce buyer power, such as implementing a loyalty program. Buyers' power is high if buyers have many alternatives, and it is low if they

have few choices.

Potential factors:

- Buyer concentration to firm concentration ratio - With an inequality between buyer and firm, either would part get power over the other. Creating an oligopoly or a monopoly if the firms in the market get a low degree of bargaining power.

- Degree of dependency upon existing distribution channels - Consumers’ product companies are highly dependent on retail stores such as Walmart, Costco, or other retailers; leaving the shelf of some of them would positively affect the market position and revenues.

- Bargaining leverage - Particularly in industries with high fixed costs as they can’t play a

chicken run with the suppliers as the margins are so small.

- Buyer switching costs - How easy can a buyer start doing business with another company? is the supply chain integrated or is it just redirecting a truck to another location?

- Buyer information availability - Is the information about a product available easily? Within B2C is information more available than ever thanks to the internet and comparing sites. Meanwhile, the information about B2B is a lot more unavailable as many have specific prices and deals customized to its customer.

- Availability of existing substitute products - Some products’ economic need is easily satisfied by another product. For example, the need for a movie is entertainment, which also a video game, dinner, theater, concerts, and board game can satisfy.

- Buyer price sensitivity - Many products have a very high tolerance for price increases

meanwhile some products actually go up in demand with price increases. Important to look at the price dynamics.

- Differential advantage (uniqueness) of industry products - how unique is the product and how important is this uniqueness? Can any other bag give the same satisfaction as a Louis Vuitton bag?

- RFM (recency, frequency, monetary) Analysis - When was the last time a customer bought anything from us? how often this customer return to make its purchase? And how much did a customer spend during this period?

Bargaining power of suppliers

The bargaining power of suppliers is also described as the market of inputs. Suppliers of raw materials, components, labor, and services (such as expertise) to the firm can be a source of power over the firm when there are few substitutes. If you are making biscuits and there is only one person who sells flour, you have no alternative but to buy it from them. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

Potential factors:

- Supplier switching costs relative to firm switching costs - Is the switching cost higher for the supplier than the firm resulting in a bargaining power tilted to the firm and it can be used to get lower prices from the supplier.

- Degree of differentiation - Inputs may differ significantly and affect the quality of the product therefore, it can be hard to change supplier and the supplier have a lot of bargaining power against the buying firm.

- Impact of inputs (costs and differentiation) - Cost and differentiation of inputs can determine the bargaining power of a supplier, as the buying firm is either a low-cost provider or have a niche product of high quality.

- Presence of substitute - Inputs can be substituted to solve the same need for the buying firm, resulting in a supplier's bargaining power being very low if they deliver a commodity input.

- Strength of distribution channel - The distribution channel can be a strong bargaining chip between suppliers and firms. For companies within the retail will, for example, companies such as Walmart and Costco have enormous bargaining power over their supplier due to the sheer size of their distribution network.

- Supplier concentration to firm concentration ratio - If the number of suppliers and firms to supply to are not in equilibrium or tilted to the firms’ favor, the supplier will have higher switching costs than the firm.

- Employee solidarity - One major input for companies is the employees, which is a very

important input of its product. If the labor market is out of balance, can, the employee raises the salary claims, and the personnel costs will increase. Labor unions will also be impacting this factor.

- Supplier competition - the ability to forward vertically integrate and cut out the buyer.

Applications and research

Porter’s model has been applied to several industries beyond the airline industry. For example, it has been used to study the competitiveness of U.S.-based firms in a globalized economy (Wilmot et al., 2002) and to analyze changes in labor costs over time (Mitchell & Neumann, 2005). The model has also been used as part of a research agenda on global strategy (Bryant & O'Reilly-Porter 2008).

Using Porter's Five Forces Analysis can help identify potential threats or opportunities for

an organization and factors that may affect its success at achieving its goals. Such analyses can provide insight into how competitive forces within an industry might affect competition between firms operating within that same industry; therefore allowing organizations to

understand better where they stand relative to others competing against them for them to achieve their objectives more successfully.

The Porter Diamond of National Advantage

The Porter Diamond of National Advantage is a way to visualize the five forces:

Quality, Price, Distribution channel (the “contraband”), Rivalry, and Threat.

The quality dimension is represented by the strength of competition in each industry. If there's low competition, you can expect that your competitors will have more inferior quality products or services than yours will be able to provide at competitive prices. On the other hand, if there are many competing firms in the industry but few of them are

profitable enough to survive over time (i.e., survive without being bought out by larger companies), then this can lead them down a path towards failure because they won't be able to keep up with their competition while also having enough customers left over after all their

competitors have disappeared from existence! In other words: no matter how hard we work at being efficient cleaners who provide high-quality service every time we wash our customers' windows -- even if our competitors do all sorts of things wrong like charging customers much more money than they should charge us ($$$) -- eventually someone

else comes along who offers better deals on chemicals used during cleaning services...

How to use it in investing analysis?

Porter’s Power Model serves as a good tool for where to look for moats. Moats as a definition produce long-term profits and protect the market share of the company. This is what the Power Model analyzes. How a company can protect its market share, and margins, and keep growing. Porter has laid out which five players matters for this analysis: Rivals, suppliers,

customers, new entrants, and substitutions. If you figure out a company can keep its advantage against these five players will probably your company have a wide moat. Would still be a pretty wide moat if the company can have an advantage over three of these players, but the advantage is not black or white as you can understand by the potential factors listed above.

Let’s look at a highly qualitative company that all know about Apple (we focus on the iPhone for simplicity's sake). Apple’s bargaining power against customers is very high, there are only one phone made with IOS and only a few models. Bargaining power against suppliers is another thing, quality is a very important part of the experience of the iPhone. So Apple can’t go anywhere to source its parts due to the quality aspects, meanwhile, Apple is a huge player in the smartphone so it would be very high volumes and a big deal for a supplier. Then look at the competition, all other phones are made with another operating system which is a huge competitive advantage as the customers get used to how the phone works creating switching costs to an android phone for example. Samsung and other players have tried to make the switch easier with apps that transfer info from iPhone.

The smartphone market has very low barriers of entry to keep new entrants out, as there are no regulations for permits or patents holding companies out. But there is quite substantial capital that is needed to start producing phones and significant volumes before making a profit.

Looking at OnePlus approached it in the beginning with a prepaid model, pay the phone first then they build it and ship it. Much like a Kickstarter campaign. Substitution to a smartphone is a little hard to narrow in on as the smartphone does so many things today. But many are the smartphone used for communication through regular phone services such as calls, text messages, messenger apps, social media, and so on. Today may the camera in the phone be very well included in the communication part, as nobody would want to send a bad picture. Is there any other product that could satisfy this need of the smartphone? Maybe the computer and tablet, but they are not as portable as a smartphone resulting in worse performance in terms of availability and ease of substitution.

Conclusion

Porter’s model has been applied to several industries beyond the airline industry. For example, it has been used in the automobile industry to analyze competitive forces and how they affect market share. It is usually used by business actors, meanwhile, an investor can use it to identify moats against these five forces which can hurt a company’s margins and market share. Being a very powerful tool, when searching for quality in companies.

Stay hungry and keep hunting!

If you like more posts like this, I post one every week on my substack. Feel free to join!

investacus.substack.com

Investacus | Douglas Forsling | Substack

Detta nyhetsbrev ger dig uppdateringar om techbolag, analyser och artiklar för att du ska bli en bättre investerare! Click to read Investacus, by Douglas Forsling, a Substack publication with hundreds of subscribers.

Already have an account?