Trending Assets

Top investors this month

Trending Assets

Top investors this month

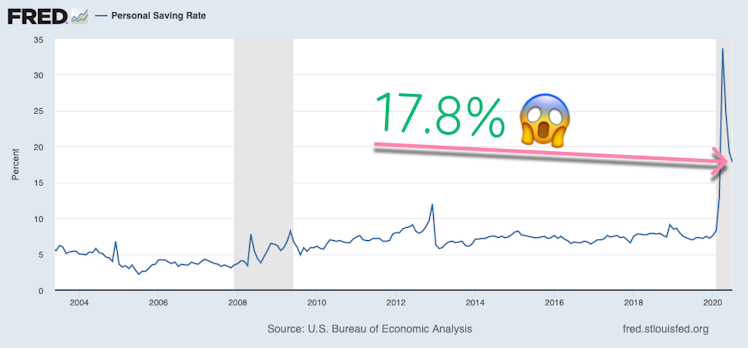

Savings Rate is High Despite Interest Rates Being Low

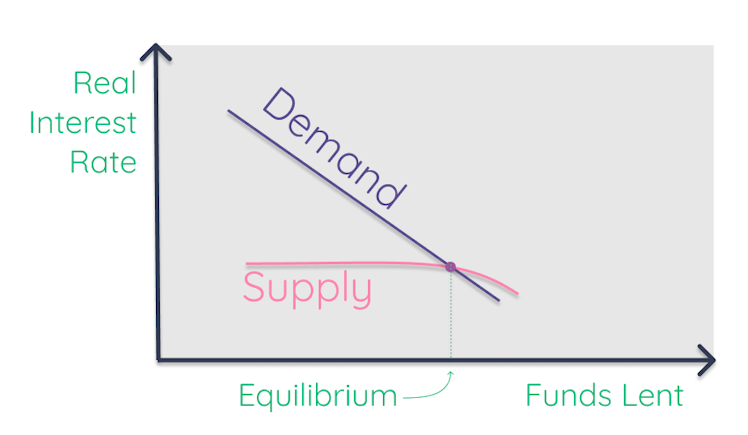

Yesterday we looked at the three basic factors that determine the real interest rate. One of these factors was funds from savers.

I mentioned that there is an assumption that the higher the real interest rates are, households will choose to postpone some current consumption and set aside or invest more of their disposable income for future use.

So let’s put that to the test in the Year of Our Lord 2020.

We know right now interest rates are historically low- that should also encourage households to be consuming a lot and saving very little, right?

Right?

Nope. Not right now at least.

Because of the pandemic, the personal savings rate is 17.8%!

As you can see from the graph-we are at record breaking levels. People don’t care that interest rates are low- they are worried about their jobs and their paychecks and so they are saving as much as they can in anticipation of tough times ahead.

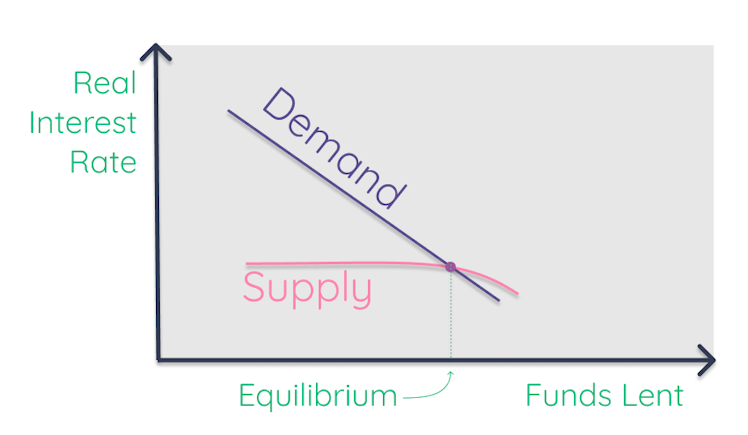

We need to update our mental modal from yesterday- not to what should happen when interest rates go down, but what is happening. And it looks like this:

What do we make of this dynamic? There is pent up demand in the system. Households are saving more than ever because they are scared, but also because there is less to buy and do in the middle of a pandemic. It has been hard to access services.

As services open back up, there will be plenty of demand for it.

There’s your bullish thought for the day.

Already have an account?