Trending Assets

Top investors this month

Trending Assets

Top investors this month

Scorecard Update - New KPI

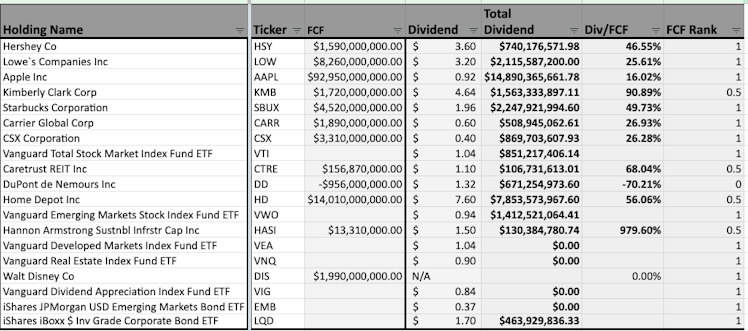

As I continue to learn, grow, and evolve as an investor, my decision making tools should do the same. I just finished adding a Free Cash Flow (FCF) metric to my Scorecard. This will provide deeper insight than earnings per share (EPS) and dividend yield. I have built a number of cases into my sheet to evaluate different combinations of FCF and Dividend Safety:

- FCF Negative Case: FCF Negative = 0

- "Safe" Dividend Case: FCF Positive & Total Dividend/FCF < 50% = 1

- "Unsafe" Dividend Case: FCF Positive & Total Dividend/FCF > 50% = 0.5

- ETF Case: Has Dividend, but no FCF = 1

- No Dividend Case: FCF Positive, but no Dividend = 1

Some insight into the "brains" of the operation - from my Roth IRA Sheet:

It took a number of days to try to work out all the IF statements and clean up some of the data inputs to make the Rank Score work...

FCF is the most manual metric that I am now tracking. My plan is to transpose FCF from Koyfin, quarterly. If anybody has a way to automate or live-source from a website, it would be much appreciated!

Have a great weekend!

Already have an account?